Insider Sell: Co-COO Joel Reiss Sells 3,000 Shares of TransDigm Group Inc

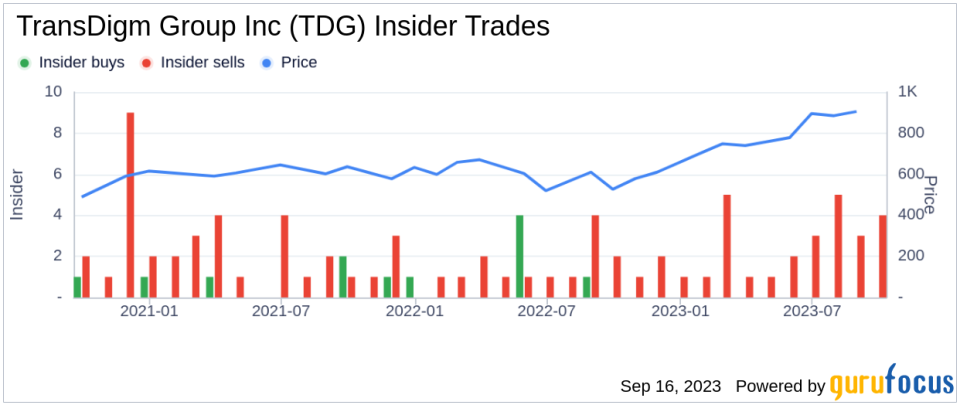

On September 15, 2023, Joel Reiss, Co-Chief Operating Officer of TransDigm Group Inc (NYSE:TDG), sold 3,000 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 12,000 shares and purchased none.

TransDigm Group Inc is a leading global producer, designer, and supplier of highly engineered aerospace components, systems, and subsystems. The company's products are used on nearly all commercial and military aircraft in service today. TransDigm Group's business model is to acquire and, when necessary, to restructure businesses involved in the design, production, and aftermarket supply of highly engineered aerospace components.

The insider transaction history for TransDigm Group Inc shows a clear trend: over the past year, there have been 29 insider sells and no insider buys. This could be a signal to investors about the company's future prospects.

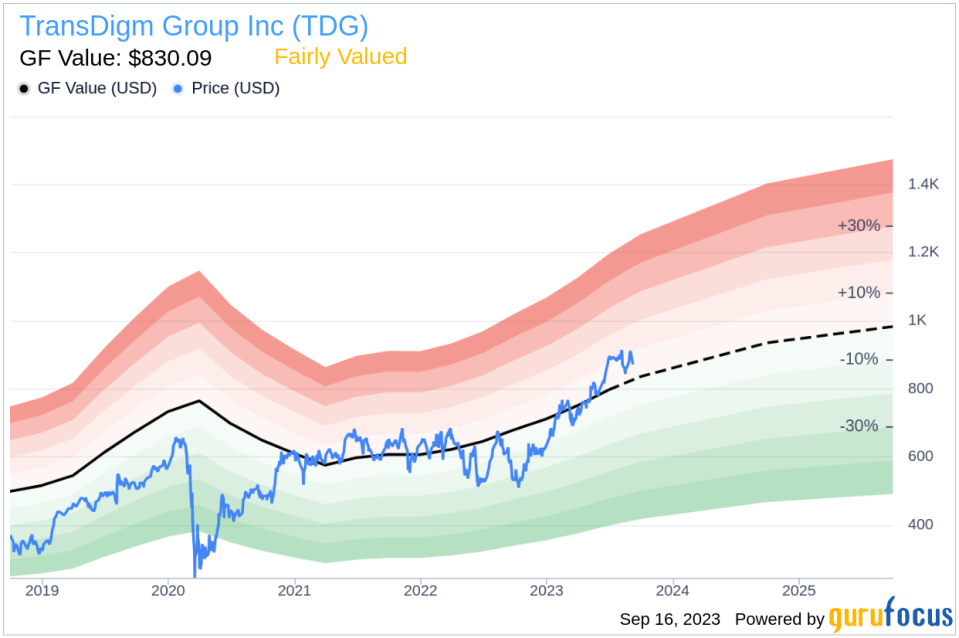

On the day of the insider's recent sell, shares of TransDigm Group Inc were trading for $872.68 apiece, giving the company a market cap of $47.72 billion. The price-earnings ratio is 46.07, which is higher than both the industry median of 33.45 and the companys historical median price-earnings ratio.

According to GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance, TransDigm Group Inc is fairly valued. With a price of $872.68 and a GuruFocus Value of $830.09, the stock has a price-to-GF-Value ratio of 1.05.

The insider's recent sell could be interpreted in several ways. It could be a personal financial decision or a lack of confidence in the company's future prospects. However, it's important to note that insider sells do not always indicate a negative outlook for the company. Investors should consider other factors such as the company's financial health, market conditions, and other relevant information before making investment decisions.

In conclusion, while the insider's recent sell of TransDigm Group Inc shares is noteworthy, it is just one piece of the puzzle when evaluating the company. Investors should also consider the company's valuation, financial health, and market conditions when making investment decisions.

This article first appeared on GuruFocus.