Insider Sell: Coherent Corp's CTO Julie Eng Divests 9,901 Shares

In a notable insider transaction, Julie Eng, the Chief Technology Officer of Coherent Corp (NYSE:COHR), sold 9,901 shares of the company on December 6, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the confidence level of its senior executives.

Julie Eng has been an integral part of Coherent Corp, a company that specializes in lasers and laser-based technology for scientific, commercial, and industrial customers. With a background in technology and innovation, Eng's role as CTO involves overseeing the development and strategy of the company's product offerings. Her decision to sell a significant number of shares may raise questions about her outlook on the company's future performance.

Coherent Corp operates in a highly specialized sector, providing photonics solutions that are critical in applications ranging from materials processing to microelectronics and life sciences. The company's expertise in lasers and optical components has positioned it as a leader in its field, catering to a diverse clientele that relies on precision and quality.

Over the past year, Julie Eng has sold a total of 12,867 shares and has not made any purchases of Coherent Corp stock. This pattern of selling without corresponding buys could be interpreted in various ways, but it is essential to consider the broader context of insider transactions at the company.

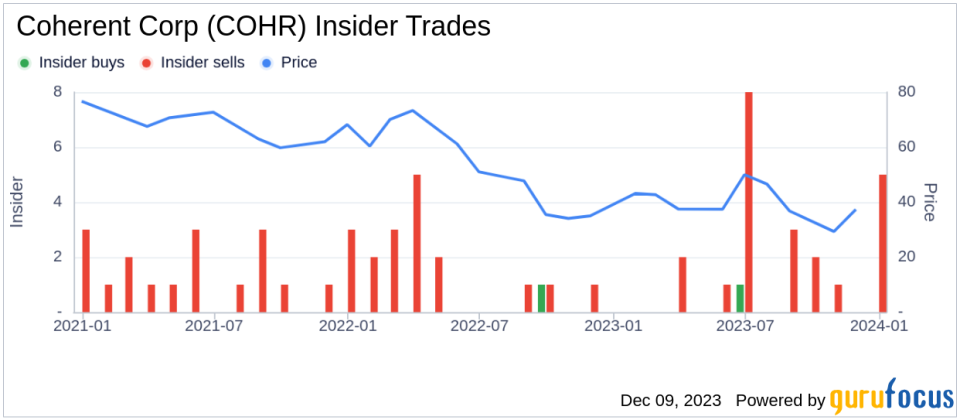

The insider transaction history for Coherent Corp shows a trend that leans more towards selling than buying. In the past year, there has been only 1 insider buy compared to 22 insider sells. This trend could suggest that insiders, on balance, are taking the opportunity to liquidate some of their holdings rather than increase their positions.

On the day of Eng's recent sale, Coherent Corp shares were trading at $40.01, giving the company a market capitalization of $6.268 billion. This valuation is significant, as it reflects the market's current assessment of the company's worth.

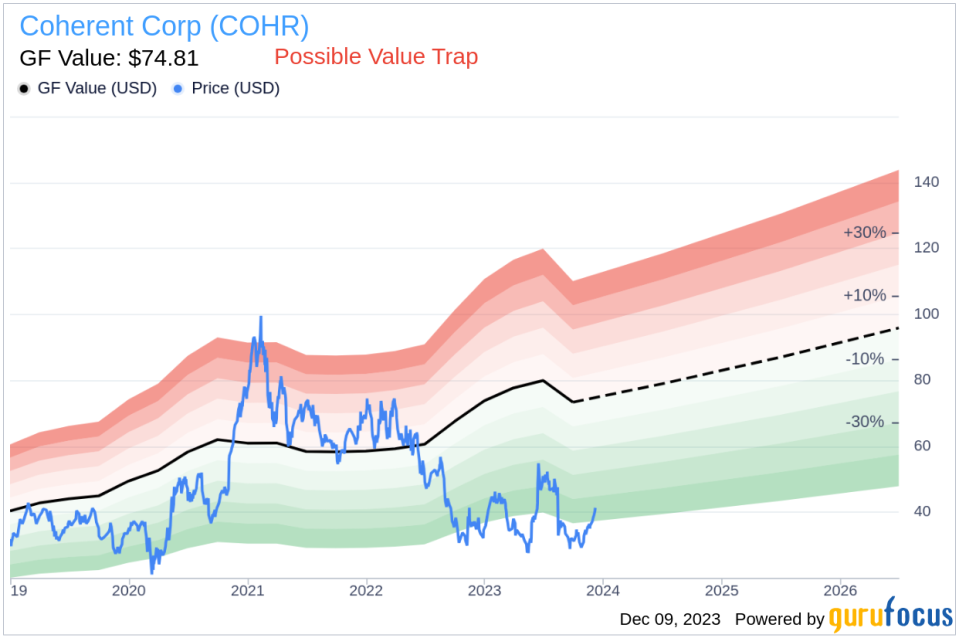

However, when we look at the stock's price relative to the GuruFocus Value (GF Value), we see a different picture. With a GF Value of $74.81, Coherent Corp's price-to-GF-Value ratio stands at 0.53, indicating that the stock may be a Possible Value Trap, and investors should Think Twice before making an investment decision. This assessment is based on the GF Value, which considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The GF Value is a proprietary metric developed by GuruFocus, taking into account:

Historical multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow.

An adjustment factor based on the company's historical returns and growth.

Analyst estimates of the company's future business performance.

Given this context, Julie Eng's decision to sell shares could be influenced by a variety of factors, including personal financial planning or a belief that the stock's current price does not fully reflect the company's long-term potential. It is also possible that the insider is simply diversifying her investment portfolio.

When analyzing insider transactions, it is crucial to consider the overall trend rather than a single event. While Eng's sale is significant, it is part of a broader pattern of insider selling at Coherent Corp. This trend could be a signal to investors to conduct a more thorough analysis of the company's financial health and future prospects.

Moreover, the relationship between insider selling and stock price can be complex. While extensive insider selling can sometimes precede a decline in stock price, it is not a definitive indicator of future performance. Other market factors, industry trends, and company-specific developments must also be taken into account.

Investors should also consider the company's current valuation in light of its GF Value. The fact that the stock is trading below its GF Value could suggest that it is undervalued, but the label of a Possible Value Trap warrants caution. It is essential to delve deeper into the company's financials, growth prospects, and competitive position before drawing conclusions.

In summary, the recent insider sell by Coherent Corp's CTO Julie Eng is a development that investors should monitor closely. While it may raise questions about the insider's confidence in the company's future, it is just one piece of the puzzle. A comprehensive analysis of Coherent Corp's valuation, business model, and market position is necessary to understand the implications of insider transactions on the stock's potential.

As always, investors are encouraged to conduct their due diligence and consider the broader market context when evaluating insider trading activity and its impact on stock prices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.