Insider Sell: CommVault Systems Inc's Chief Revenue Officer Blasio Di Sells Company Shares

CommVault Systems Inc (NASDAQ:CVLT), a global leader in enterprise data protection and information management, has recently witnessed an insider sell that has caught the attention of investors and market analysts. The company's Chief Revenue Officer, Blasio Di, sold 2,420 shares of CommVault Systems on November 20, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock's performance.

Who is Blasio Di?

Blasio Di serves as the Chief Revenue Officer of CommVault Systems Inc. In this role, Di is responsible for overseeing the company's global sales and revenue generation strategies. With a deep understanding of the data management industry and a track record of driving growth, Blasio Di plays a crucial role in CommVault's mission to help organizations protect, manage, and use their data more effectively.

CommVault Systems Inc's Business Description

CommVault Systems Inc is a software company that specializes in data protection and information management. The company offers solutions that enable mid- and large-sized enterprises to protect, manage, and access their data across complex IT environments. CommVault's products include data backup and recovery, cloud and infrastructure management, retention and compliance, and other related services. With a focus on innovation and customer satisfaction, CommVault aims to provide comprehensive data management solutions that meet the evolving needs of businesses in a data-driven world.

Analysis of Insider Buy/Sell and Relationship with Stock Price

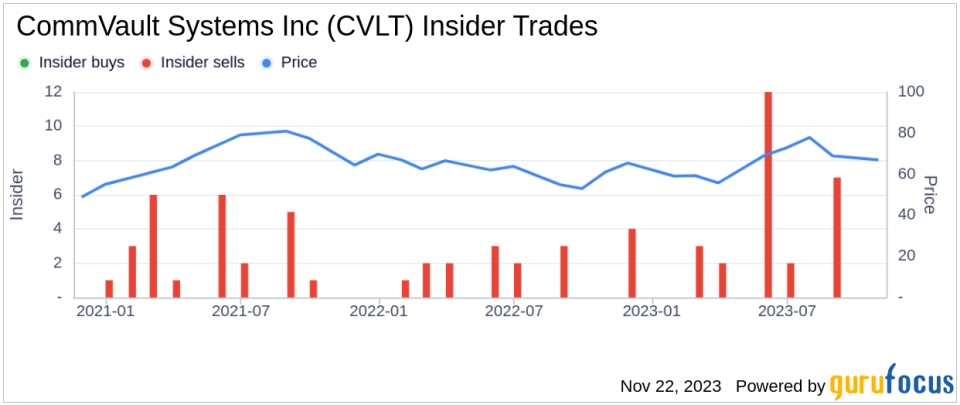

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's valuation. In the case of CommVault Systems Inc, Blasio Di's recent sell of 2,420 shares follows a pattern of insider selling over the past year. According to the data, Blasio Di has sold a total of 40,191 shares and has not made any purchases during the same period. This consistent selling could be interpreted as a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider.

When examining the relationship between insider trading and stock price, it is important to consider the overall trend of insider transactions. CommVault Systems Inc has seen 30 insider sells and no insider buys over the past year. This trend of insider selling could suggest that insiders believe the stock is fully valued or potentially overvalued at current levels.

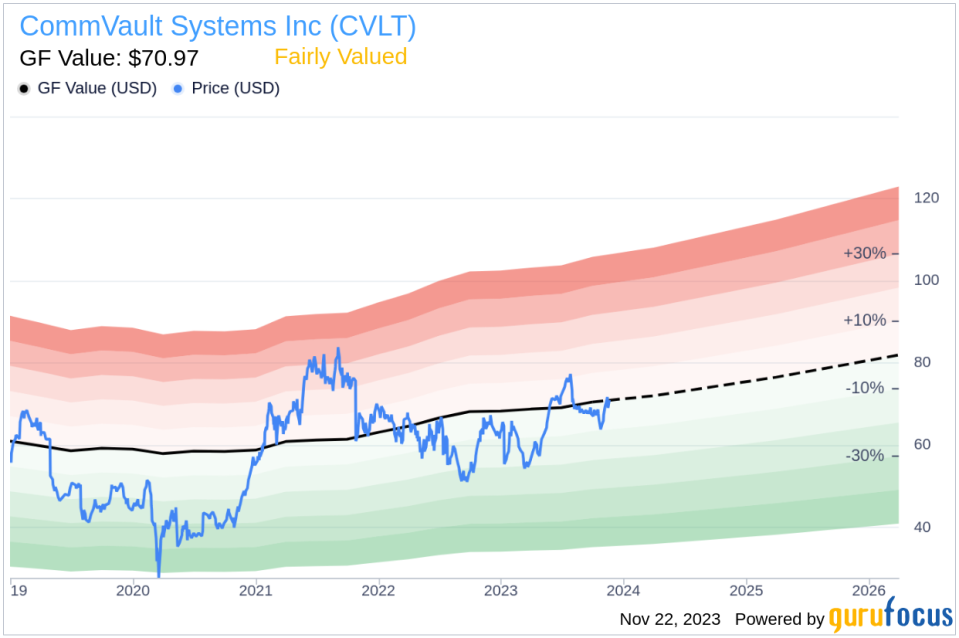

On the day of Blasio Di's recent sell, CommVault Systems Inc's shares were trading at $69.52, giving the company a market cap of $3.127 billion. This price point is close to the GuruFocus Value (GF Value) of $70.97, indicating that the stock is Fairly Valued based on its intrinsic value estimate.

The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. With a price-to-GF-Value ratio of 0.98, CommVault Systems Inc's stock appears to be trading at a fair value, neither significantly undervalued nor overvalued.

The insider trend image above provides a visual representation of the selling and buying activities of insiders at CommVault Systems Inc. The absence of buys and the prevalence of sells could be a signal for investors to monitor the company's performance and future growth expectations closely.

The GF Value image further supports the notion that CommVault Systems Inc's stock is currently trading around its fair value. This assessment aligns with the stock's current market price and suggests that investors may not expect significant price appreciation or depreciation in the near term, barring any unforeseen company developments or market conditions.

Conclusion

The recent insider sell by Blasio Di, the Chief Revenue Officer of CommVault Systems Inc, is part of a broader trend of insider selling at the company. While insider sells are not always indicative of a company's future performance, they can provide context for investors when evaluating their investment decisions. With CommVault Systems Inc's stock trading close to its GF Value, the market seems to agree with the insiders' assessment that the stock is fairly valued at its current price. Investors should continue to monitor insider trading activities, company performance, and market conditions to make informed investment decisions.

It is also important to note that insider trading is just one of many factors that can affect a stock's price. Other considerations, such as earnings reports, industry trends, and macroeconomic factors, should also be taken into account when analyzing a company's stock. As always, investors are encouraged to conduct their own due diligence and consult with financial advisors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.