Insider Sell: COO & CFO Brittany Bagley Sells 10,000 Shares of Axon Enterprise Inc

In the realm of stock market movements, insider trading activity is often a significant indicator that investors keep a close eye on. Recently, Brittany Bagley, the Chief Operating Officer (COO) and Chief Financial Officer (CFO) of Axon Enterprise Inc (NASDAQ:AXON), sold 10,000 shares of the company on November 20, 2023. This transaction has caught the attention of market analysts and investors alike, as insider sells can provide insights into the company's future prospects and the confidence level of its top executives.

Who is Brittany Bagley?

Brittany Bagley holds a pivotal role at Axon Enterprise Inc, serving as both the COO and CFO. Her dual position places her at the core of the company's operational and financial strategies. Bagley's background and expertise in finance and operations make her transactions in the company's stock particularly noteworthy. Her decisions to buy or sell shares are often interpreted as informed by her deep understanding of Axon's financial health and operational direction.

Axon Enterprise Inc's Business Description

Axon Enterprise Inc is a company that operates in the public safety sector, providing a suite of products and services that include electrical weapons, body cameras, and a cloud-based digital evidence management system known as Evidence.com. The company's mission is to protect life and make the bullet obsolete, which it strives to achieve by innovating in the law enforcement and personal defense spaces. Axon's commitment to technology and innovation has positioned it as a leader in its industry, with a focus on enhancing the capabilities and safety of law enforcement agencies around the world.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving high-ranking executives like Brittany Bagley, can signal how insiders view the stock's valuation and future performance. Over the past year, Bagley has sold a total of 10,000 shares and purchased 250 shares. This pattern of more frequent selling than buying could suggest that the insider sees the current stock price as a good opportunity to realize gains.

When analyzing the broader insider transaction history for Axon Enterprise Inc, we observe that there have been 4 insider buys and 30 insider sells over the past year. This trend of more sells than buys among insiders might indicate a consensus that the stock's current price is relatively high compared to its intrinsic value or future growth prospects.

On the day of Bagley's recent sell, shares of Axon Enterprise Inc were trading at $224.7, giving the company a market cap of $17.117 billion. This valuation places the stock at a price-earnings ratio of 117.14, which is significantly higher than the industry median of 31.91 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could be a factor in the insider's decision to sell, as it may suggest that the stock is overvalued relative to its earnings.

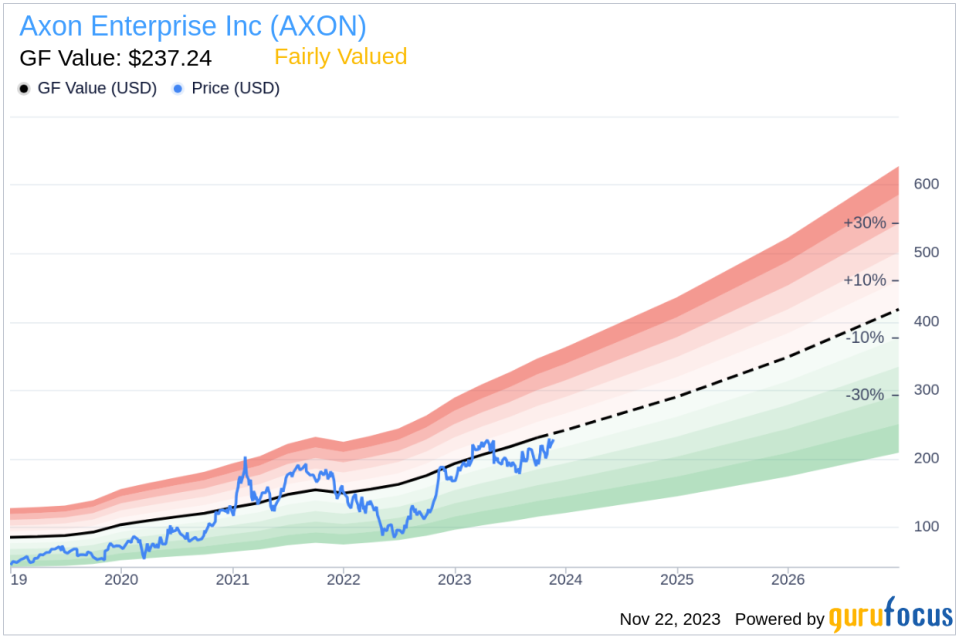

However, it's important to consider the stock's valuation in the context of the GuruFocus Value (GF Value). With a price of $224.7 and a GF Value of $237.24, Axon Enterprise Inc has a price-to-GF-Value ratio of 0.95, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the buying and selling patterns of Axon's insiders. The predominance of selling transactions could be interpreted as a lack of confidence in the stock's short-term growth potential or as a natural response to the stock's valuation reaching a level that insiders find appropriate for taking profits.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate. The close alignment of the stock price with the GF Value suggests that the market is pricing Axon's shares in a manner consistent with its fundamental worth, as estimated by GuruFocus.

Conclusion

The recent insider sell by Brittany Bagley, COO & CFO of Axon Enterprise Inc, provides investors with an opportunity to scrutinize the company's valuation and future outlook. While the insider's sell transactions over the past year have outnumbered buys, the stock's current price-to-GF-Value ratio suggests that it is fairly valued. Investors should consider both the insider trading trends and the company's valuation metrics when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a review of the company's financials, growth prospects, and market conditions.

It's important to note that insider trading activity is subject to various motivations and should not be the sole factor in investment decisions. Insiders may sell shares for personal financial planning, diversification, or other reasons unrelated to their outlook on the company's future performance. Therefore, while insider transactions can provide valuable insights, they should be considered alongside a wide range of financial analyses and market research.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.