Insider Sell: COO Mark Thurmond Sells 4,554 Shares of Tenable Holdings Inc (TENB)

Mark Thurmond, the Chief Operating Officer of Tenable Holdings Inc, has recently sold 4,554 shares of the company's stock, according to a Form 4 filed with the Securities and Exchange Commission. The transaction took place on November 20, 2023, and has caught the attention of investors and analysts who closely monitor insider activities as an indicator of a company's financial health and future performance.

Who is Mark Thurmond of Tenable Holdings Inc?

Mark Thurmond is a seasoned executive with a track record of driving growth and operational excellence in the cybersecurity industry. As the Chief Operating Officer of Tenable Holdings Inc, Thurmond is responsible for overseeing the company's global field operations, including sales, customer success, and partnerships. His role is pivotal in scaling Tenable's business and ensuring that the company meets its strategic objectives. Prior to joining Tenable, Thurmond held leadership positions at various technology and cybersecurity firms, where he demonstrated his ability to lead teams and execute business strategies effectively.

Tenable Holdings Inc's Business Description

Tenable Holdings Inc is a publicly traded cybersecurity company that specializes in vulnerability management. The company's flagship product, Tenable.io, provides a platform for comprehensive cyber exposure monitoring to help organizations understand and reduce their cybersecurity risk. Tenable's solutions are used by thousands of organizations around the globe, including more than 50% of the Fortune 500, to identify vulnerabilities, manage security risks, and ensure compliance with industry standards and regulations. With the ever-increasing threat landscape and the growing complexity of IT environments, Tenable's services are more relevant than ever, positioning the company as a key player in the cybersecurity space.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

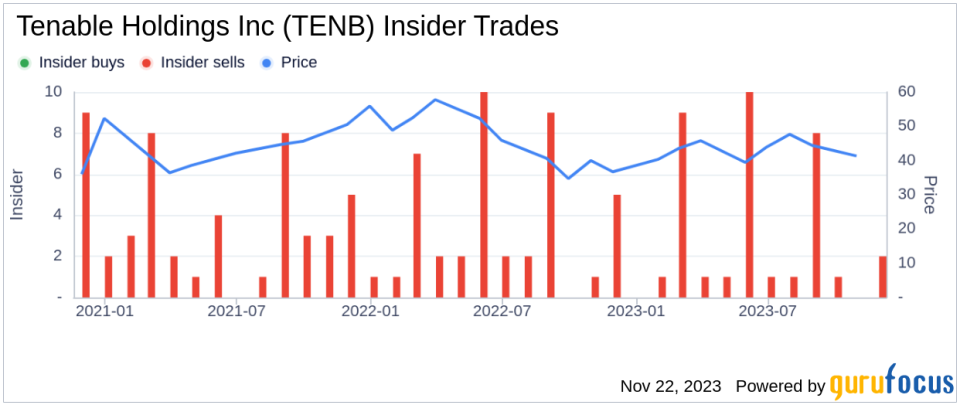

Insider transactions are often scrutinized by investors as they can provide insights into the confidence that management and key stakeholders have in the company's future. Over the past year, Mark Thurmond has sold a total of 59,655 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in several ways. It might suggest that the insider is adjusting personal investment holdings for reasons unrelated to the company's performance, such as diversifying their portfolio or financing personal expenditures.

However, when looking at the broader insider transaction history for Tenable Holdings Inc, we see that there have been no insider buys and 40 insider sells over the past year. This trend of insider selling could raise questions about the long-term value prospects of the company's stock, although it is not uncommon for insiders to sell shares for liquidity purposes or after vesting periods.

On the day of Thurmond's recent sale, shares of Tenable Holdings Inc were trading at $39.83, giving the company a market cap of $4.677 billion. This price point is significant when considering the company's valuation in relation to its intrinsic value.

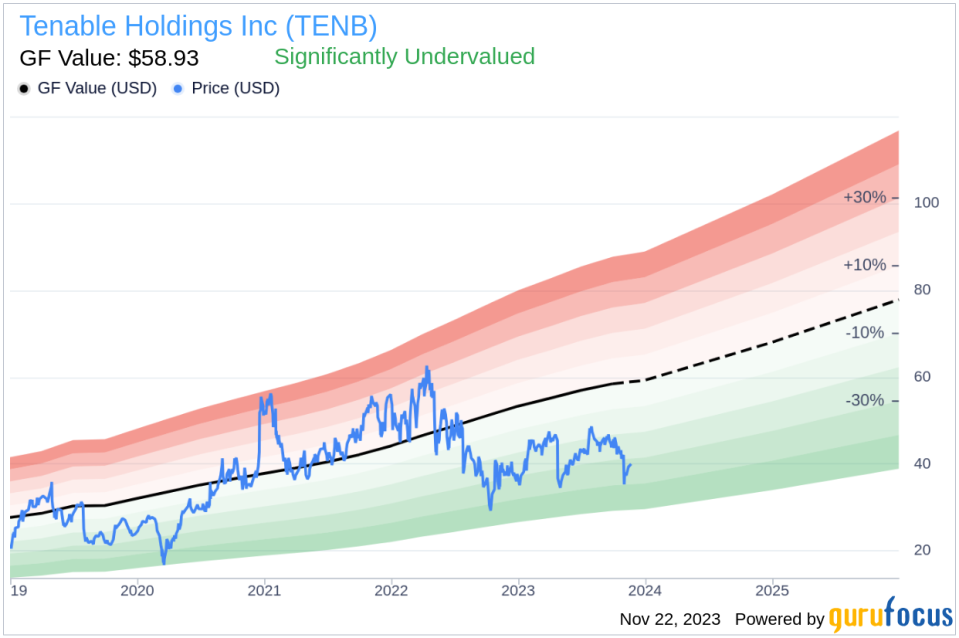

As per the GF Value, an intrinsic value estimate developed by GuruFocus, Tenable Holdings Inc has a GF Value of $58.93. With the stock trading at $39.83, the price-to-GF-Value ratio stands at 0.68, indicating that the stock is significantly undervalued. This discrepancy between market price and GF Value could suggest that the stock has considerable upside potential, assuming the company's future business performance aligns with the intrinsic value estimate.

The GF Value is calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts. These factors combine to provide a comprehensive valuation metric that can be used alongside other analysis tools.

Conclusion

The recent insider sell by COO Mark Thurmond may raise questions among investors, especially given the broader trend of insider selling at Tenable Holdings Inc. However, it is important to consider the context of these transactions and the individual circumstances of the insiders. Moreover, the current market valuation of Tenable Holdings Inc suggests that the stock is significantly undervalued based on the GF Value, which could indicate a buying opportunity for investors who believe in the company's long-term growth prospects.

Investors should also consider other factors such as the company's financial performance, competitive position, and the overall market environment when making investment decisions. While insider transactions can provide valuable insights, they are just one piece of the puzzle in the complex world of stock market investing.

As always, it is recommended that investors conduct their own due diligence and consult with financial advisors before making any investment decisions. The sale of shares by an insider like Mark Thurmond should be viewed within the larger context of Tenable Holdings Inc's financial health, market position, and future growth potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.