Insider Sell: COO Michael Bruen Sells 5,000 Shares of Bowman Consulting Group Ltd

On October 11, 2023, Michael Bruen, the Chief Operating Officer (COO) of Bowman Consulting Group Ltd (NASDAQ:BWMN), sold 5,000 shares of the company. This move is part of a series of insider sell transactions that have been taking place over the past year.

Michael Bruen is a seasoned executive with extensive experience in the consulting industry. As the COO of Bowman Consulting Group Ltd, he plays a crucial role in the company's strategic planning and operational execution. His insider trading activities provide valuable insights into the company's financial health and future prospects.

Bowman Consulting Group Ltd is a leading provider of professional services that include planning, engineering, construction management, and environmental consulting. The company's expertise spans both the public and private sectors, offering comprehensive solutions to complex infrastructure and development challenges.

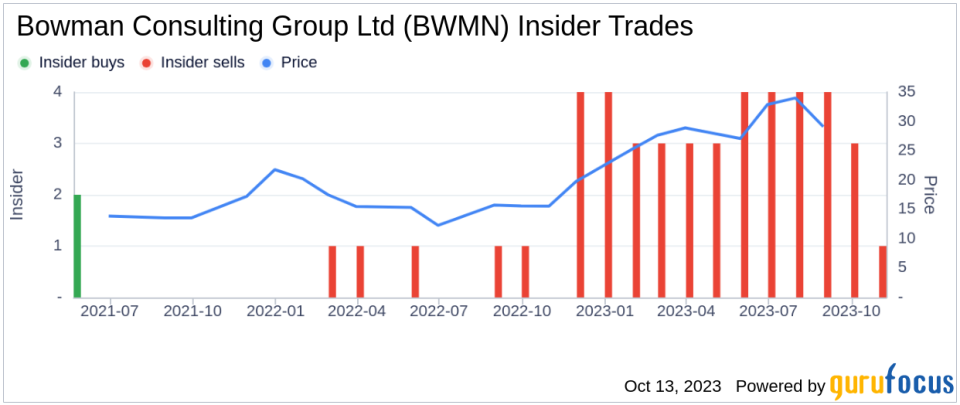

Over the past year, Michael Bruen has sold a total of 58,500 shares and has not made any purchases. This trend is consistent with the overall insider transaction history of Bowman Consulting Group Ltd, which shows zero insider buys and 40 insider sells over the same period.

The insider's recent sell transaction took place when the shares of Bowman Consulting Group Ltd were trading at $27.72 apiece. This gives the stock a market cap of $381.277 million. The price-earnings ratio stands at 100.44, which is higher than the industry median of 14.45 and lower than the companys historical median price-earnings ratio.

The insider's sell transactions and the absence of insider buys over the past year could be interpreted as a lack of confidence in the company's stock. However, it's important to note that insider selling does not necessarily indicate a negative outlook for the company. Insiders may sell shares for various reasons, including personal financial planning or portfolio diversification.

Despite the insider's sell transactions, Bowman Consulting Group Ltd's stock price has remained relatively stable. This suggests that the market has not reacted negatively to the insider's sell transactions. However, investors should keep a close eye on the company's financial performance and the insider's future trading activities for further clues about the company's prospects.

In conclusion, while the insider's sell transactions over the past year may raise some concerns, they do not necessarily indicate a negative outlook for Bowman Consulting Group Ltd. Investors should consider the company's financial performance, industry trends, and other relevant factors before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.