Insider Sell: COO Michael Bruen Sells 5,000 Shares of Bowman Consulting Group Ltd (BWMN)

Michael Bruen, the Chief Operating Officer of Bowman Consulting Group Ltd (NASDAQ:BWMN), has recently sold 5,000 shares of the company's stock on December 13, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is Michael Bruen of Bowman Consulting Group Ltd?

Michael Bruen serves as the Chief Operating Officer at Bowman Consulting Group Ltd, a company that specializes in professional engineering services. With a career spanning several years in the industry, Bruen has been instrumental in driving operational efficiency and strategic growth within the organization. His role involves overseeing the day-to-day operations and ensuring that the company's services meet the highest standards of quality and client satisfaction.

Bowman Consulting Group Ltd's Business Description

Bowman Consulting Group Ltd is a professional engineering services firm that provides solutions in civil engineering, planning, landscape architecture, surveying, environmental consulting, and other related services. The company caters to a diverse range of clients, including land developers, public agencies, and commercial enterprises. With a focus on innovation and sustainability, Bowman Consulting Group Ltd is committed to delivering projects that enhance communities and the environment.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

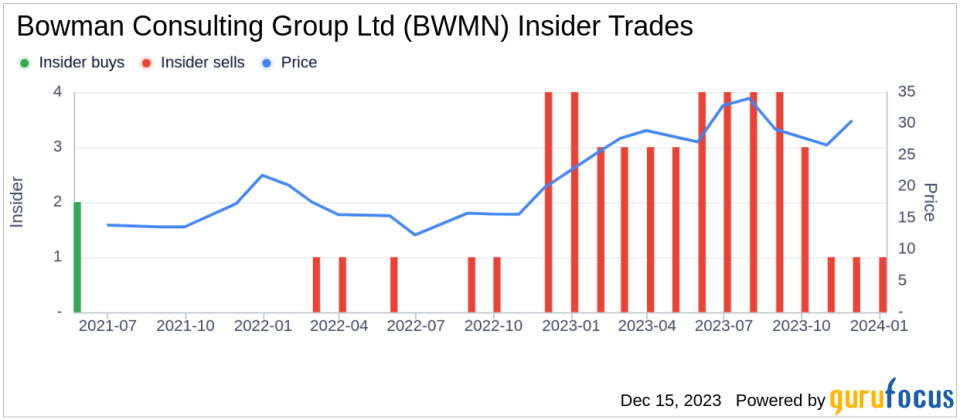

Insider transactions are closely monitored by investors as they can signal the confidence level of a company's executives and board members in the firm's future. In the case of Bowman Consulting Group Ltd, the insider transaction history over the past year shows a significant number of insider sells, with 36 recorded transactions and no insider buys. This trend could be interpreted in various ways, but it often suggests that insiders might believe the stock is fully valued or they are taking profits after a period of stock appreciation.

On the day of the insider's recent sale, shares of Bowman Consulting Group Ltd were trading at $31.64, giving the company a market cap of $473.589 million. This valuation places the stock at a price-earnings ratio of 323.30, which is substantially higher than the industry median of 14.64 and the company's historical median price-earnings ratio. Such a high price-earnings ratio could indicate that the stock is overvalued compared to its peers and historical performance, potentially justifying the insider's decision to sell shares.

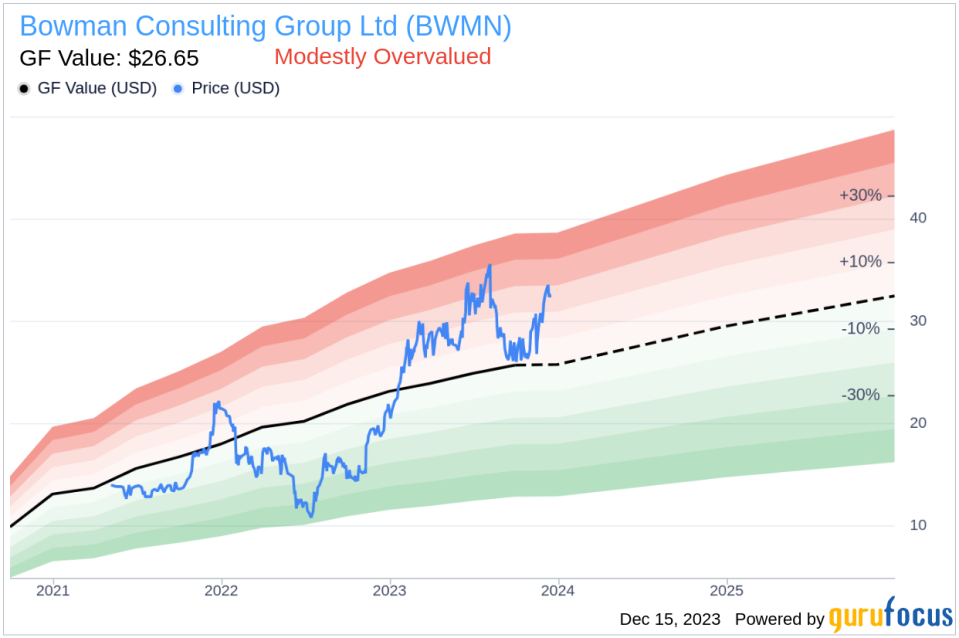

Moreover, with a price of $31.64 and a GuruFocus Value of $26.65, Bowman Consulting Group Ltd has a price-to-GF-Value ratio of 1.19. This suggests that the stock is modestly overvalued based on its GF Value, which is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider trend image above illustrates the recent selling pattern among the company's insiders, which could be a signal for investors to proceed with caution. While insider selling does not always imply negative prospects for a company, it is essential for investors to consider this information in the context of the company's overall financial health and market valuation.

The GF Value image provides a visual representation of the stock's current valuation in relation to its intrinsic value. As the stock is trading above its GF Value, it may be an indication that the market has priced in future growth expectations or that investor sentiment is particularly positive. However, it also raises the question of whether the stock's current price levels are sustainable in the long term, especially if the company does not meet these growth expectations.

Conclusion

Michael Bruen's recent sale of 5,000 shares of Bowman Consulting Group Ltd is a significant event that warrants attention from the investment community. While insider selling is not uncommon, the absence of insider buys over the past year, combined with the company's high price-earnings ratio and modest overvaluation based on the GF Value, suggests that investors should carefully evaluate the stock's current price levels and future growth potential. As always, it is recommended that investors conduct thorough research and consider a wide range of factors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.