Insider Sell: COO Wendy Diddell Sells 3,736 Shares of Richardson Electronics Ltd

On August 16, 2023, Wendy Diddell, the Chief Operating Officer (COO) of Richardson Electronics Ltd (NASDAQ:RELL), sold 3,736 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which Diddell has sold a total of 39,697 shares and made no purchases.

Richardson Electronics Ltd is a global provider of engineered solutions, power grid and microwave tubes, and related consumables. The company's products are used in power conversion, RF and microwave applications. With a market cap of $167.56 million, Richardson Electronics Ltd operates in a highly specialized industry.

The insider's recent sell has raised some eyebrows, especially considering the company's current valuation. On the day of the insider's recent sell, shares of Richardson Electronics Ltd were trading for $12.07 apiece. This gives the stock a price-earnings ratio of 7.59, which is lower than the industry median of 20.92 and lower than the companys historical median price-earnings ratio.

The insider transaction history for Richardson Electronics Ltd shows that there have been no insider buys over the past year. Meanwhile, there have been 11 insider sells over the same timeframe. This trend could be a signal that insiders believe the stock is overvalued, or it could simply be a result of personal financial planning on the part of the insiders.

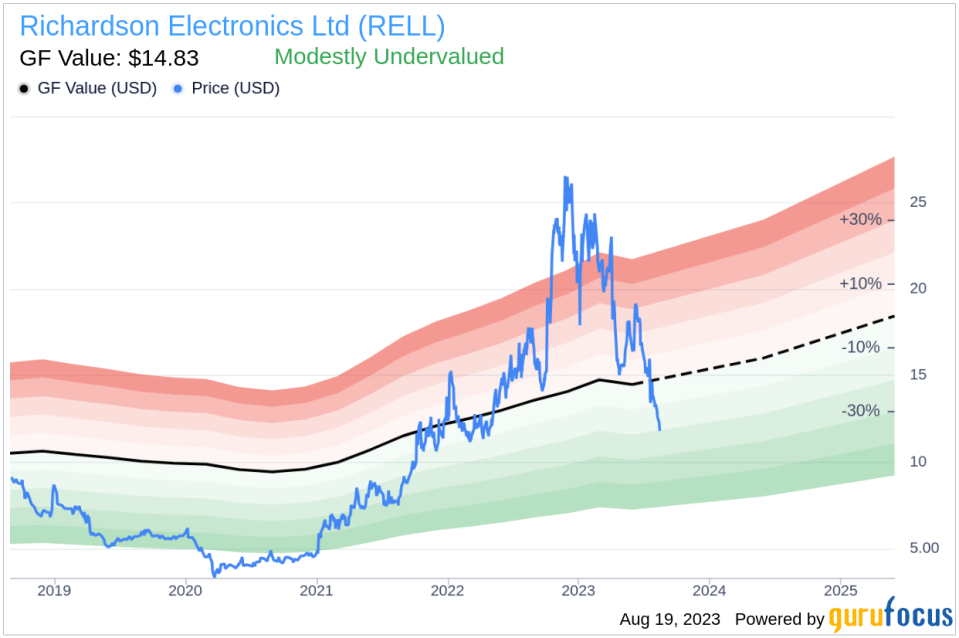

According to the GuruFocus Value, Richardson Electronics Ltd is modestly undervalued. With a price of $12.07 and a GuruFocus Value of $14.83, the stock has a price-to-GF-Value ratio of 0.81. The GF Value is an intrinsic value estimate developed by GuruFocus that is calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance.

While the insider's recent sell might raise some concerns, it's important to remember that insider transactions are not always indicative of a company's future performance. Investors should always consider a variety of factors, including the company's fundamentals, market conditions, and industry trends, before making investment decisions.

As always, it's crucial to continue monitoring insider transactions and other relevant market data. Stay tuned to GuruFocus for the latest updates on Richardson Electronics Ltd and other stocks of interest.

This article first appeared on GuruFocus.