Insider Sell: Coursera Inc's COO Shravan Goli Offloads 94,666 Shares

In a notable insider transaction, Shravan Goli, the Chief Operating Officer of Coursera Inc (COUR), sold 94,666 shares of the company on November 29, 2023. This move has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Shravan Goli is a seasoned executive with a track record of leading technology and education organizations. At Coursera Inc, Goli has been instrumental in driving the company's operational strategies and growth initiatives. His role involves overseeing key aspects of the business, including product development, content strategy, and customer experience.

Coursera Inc is a leading online learning platform that offers courses, specializations, and degrees across a wide range of subjects. The company partners with universities and other organizations to provide a world-class educational experience to learners globally. Coursera's mission is to empower individuals through learning and to provide access to high-quality education.

The insider's recent sale is part of a broader trend observed over the past year. According to the data, Shravan Goli has sold a total of 598,006 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways by investors.

When analyzing insider transactions, it's crucial to consider the context and potential motivations behind the trades. Insiders may sell shares for personal financial planning, diversification, or liquidity reasons that are not directly related to their outlook on the company's future performance. However, consistent selling by insiders, particularly without any buys, might raise questions about their confidence in the company's valuation or growth prospects.

Looking at the broader insider transaction history for Coursera Inc, there have been no insider buys over the past year, while there have been 93 insider sells. This trend suggests that insiders, on the whole, have been more inclined to sell shares rather than acquire more. This could be a signal to investors to monitor the company's performance and future guidance closely.

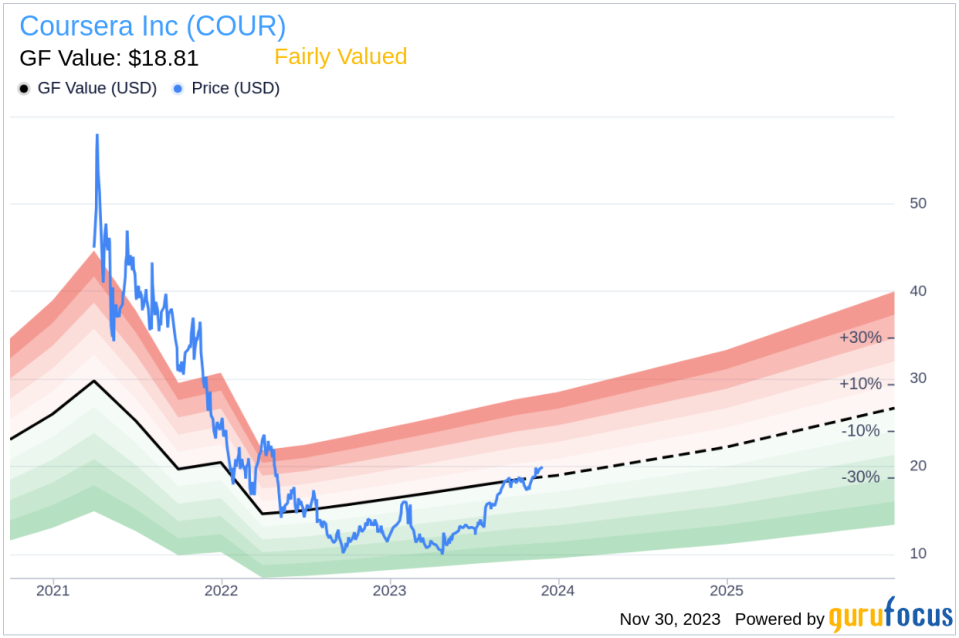

On the valuation front, shares of Coursera Inc were trading at $19.89 on the day of the insider's recent sale, giving the company a market cap of $3.040 billion. The stock's price relative to its intrinsic value, as estimated by GuruFocus's GF Value, is a key metric for investors. With a GF Value of $18.81, Coursera Inc's price-to-GF-Value ratio stands at 1.06, indicating that the stock is Fairly Valued.

The GF Value is a proprietary metric that takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business estimates provided by analysts. This comprehensive approach to valuation aims to provide a more nuanced view of a stock's worth than traditional metrics alone.

It's important to note that while the GF Value suggests Coursera Inc is fairly valued, the insider's decision to sell a significant number of shares could be seen as a lack of alignment with this assessment. Investors often look for insiders to hold or buy shares as a vote of confidence in the company's valuation and future prospects.

When considering the relationship between insider activity and stock price, it's essential to look at the broader market context and company-specific developments. Insider sales can sometimes precede periods of underperformance if they reflect concerns about the company's direction or market conditions. Conversely, they may simply reflect personal decisions by the insiders and have no bearing on the company's future performance.

As investors digest the news of Shravan Goli's share sale, they will be weighing the potential implications for Coursera Inc's stock. While the insider's actions provide one piece of the puzzle, a comprehensive analysis of the company's financials, competitive position, and growth strategy is necessary to form a complete investment thesis.

For those tracking insider trends, the visual representation of the selling pattern can be particularly telling. The following insider trend image illustrates the recent activity:

Additionally, the GF Value image below provides a visual guide to the stock's valuation in relation to its intrinsic value:

In conclusion, while the insider's sale of Coursera Inc shares is a significant event, it is just one factor that investors should consider. The company's fair valuation according to the GF Value, combined with the insider selling trend, suggests that investors should remain vigilant and continue to seek out comprehensive information to inform their investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.