Insider Sell: Coursera Inc's Leah Belsky Offloads 38,107 Shares

In a notable insider transaction, Leah Belsky, the Chief Revenue Officer of Coursera Inc (NYSE:COUR), sold 38,107 shares of the company on November 17, 2023. This sale is part of a series of transactions over the past year, where Belsky has sold a total of 361,372 shares, without any recorded purchases. Such insider activity often garners the attention of investors, as it may signal executive sentiment about the company's future prospects.

Who is Leah Belsky of Coursera Inc?

Leah Belsky is a significant figure at Coursera Inc, holding the position of Chief Revenue Officer. In her role, Belsky is responsible for driving revenue growth and overseeing the company's global sales strategy. Her actions and decisions are critical to Coursera's success, especially as the company navigates the competitive landscape of online education and professional training.

Coursera Inc's Business Description

Coursera Inc is a leading online learning platform that offers courses, specializations, certificates, and degree programs. The company partners with universities and other organizations to provide a wide range of learning opportunities to individuals around the world. Coursera's offerings span various disciplines, including data science, technology, business, and personal development, making education more accessible and flexible for learners globally.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

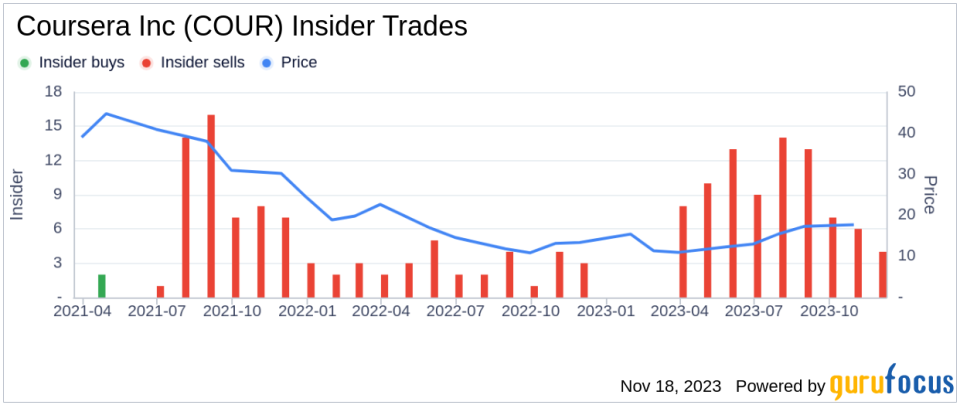

The insider transaction history for Coursera Inc reveals a pattern of insider selling, with 86 insider sells and no insider buys over the past year. This trend could be interpreted in several ways. On one hand, insiders might sell shares for personal financial planning reasons that are not directly related to their outlook on the company's future. On the other hand, consistent selling by insiders, particularly without any offsetting buys, might raise concerns among investors about the insiders' confidence in the company's valuation or growth prospects.

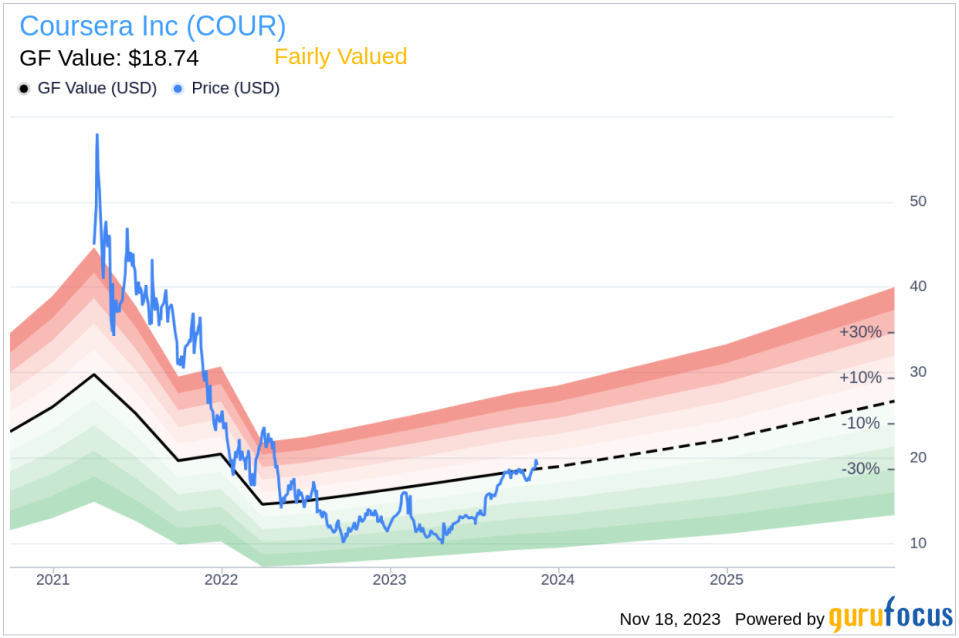

The recent sale by Leah Belsky occurred with Coursera Inc's shares trading at $19.3 each, giving the company a market cap of $2.925 billion. This price point is slightly above the GuruFocus Value (GF Value) of $18.74, suggesting that the stock is Fairly Valued.

The GF Value is a proprietary metric used to estimate the intrinsic value of a stock. For Coursera Inc, the GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 1.03, Coursera Inc's stock appears to be trading in line with its estimated fair value, which might indicate that the insider believes the stock is not undervalued at current levels.

Conclusion

The insider selling activity at Coursera Inc, particularly by Chief Revenue Officer Leah Belsky, is a data point that investors may want to consider as part of their overall analysis of the company. While the stock is currently deemed Fairly Valued based on the GF Value, the lack of insider buying could suggest that insiders do not see an attractive buying opportunity at current prices. As always, investors should look at a comprehensive set of factors, including company performance, market conditions, and broader economic indicators, when making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.