Insider Sell: Coursera's CEO Jeffrey Maggioncalda Sells 58,499 Shares

In a notable insider transaction, Jeffrey Maggioncalda, the President & CEO of Coursera Inc (NYSE:COUR), sold 58,499 shares of the company on November 28, 2023. This move has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Jeffrey Maggioncalda?

Jeffrey Maggioncalda has been at the helm of Coursera Inc as the President & CEO, steering the company through the evolving landscape of online education. Under his leadership, Coursera has expanded its offerings and partnerships, aiming to provide accessible and high-quality education to learners around the globe. Maggioncalda's tenure has been marked by strategic initiatives that have shaped the company's growth trajectory and its position in the competitive online learning industry.

Coursera Inc's Business Description

Coursera Inc is a leading online learning platform that offers a wide range of courses, specializations, certificates, and degrees from top universities and companies. The company's mission is to provide universal access to world-class education, enabling individuals to learn new skills, advance their careers, and transform their lives. Coursera's platform caters to a diverse audience, including individual learners, enterprises, and government institutions, with a focus on high-demand fields such as data science, technology, and business.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving a company's top executives, can be a strong indicator of the insider's belief in the company's future performance. In the case of Coursera Inc, the insider transaction history over the past year shows a significant imbalance between sells and buys. Jeffrey Maggioncalda has sold a total of 968,500 shares and has not made any purchases. This pattern of selling could suggest that the insider may perceive the stock's current price as a favorable selling point or may be diversifying their personal investment portfolio.

It is important to consider the context of these transactions and their potential impact on the stock price. While a series of insider sells could be interpreted as a lack of confidence in the company's future growth, it is also possible that these transactions are part of pre-planned selling programs or personal financial planning. Investors should analyze these insider activities in conjunction with other financial data and market trends to make informed decisions.

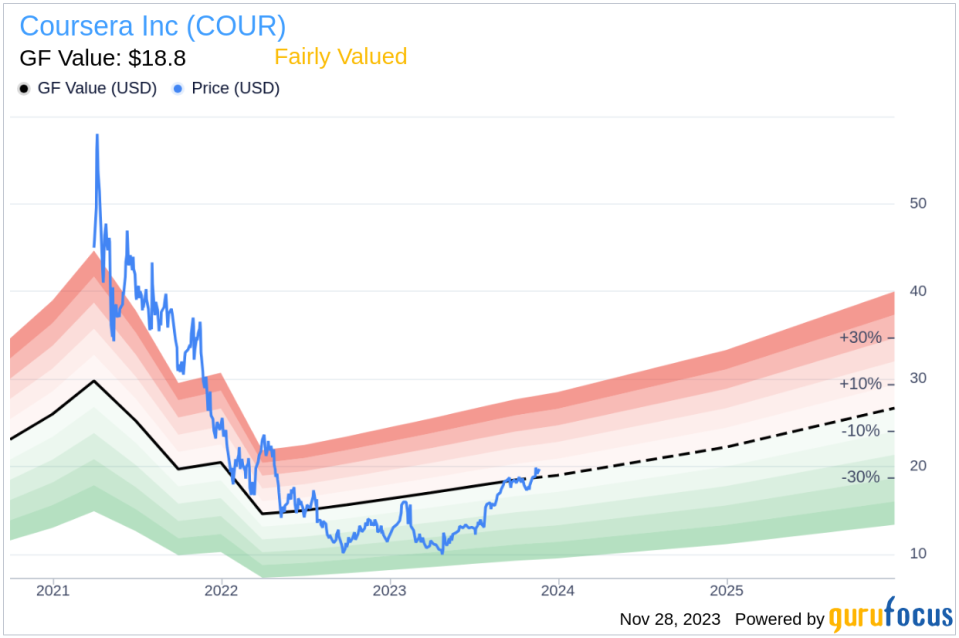

On the day of Maggioncalda's recent sell, Coursera Inc's shares were trading at $19.66, giving the company a market cap of $3.028 billion. This valuation places the stock within the range of what GuruFocus considers to be fairly valued, with a price-to-GF-Value ratio of 1.05.

The insider trend image above provides a visual representation of the selling pattern by Coursera's insiders. The absence of insider buys over the past year, coupled with a substantial number of sells, could be a signal for investors to watch closely for any changes in insider sentiment or company fundamentals that might explain this behavior.

The GF Value image illustrates Coursera Inc's valuation in relation to its intrinsic value as estimated by GuruFocus. The GF Value is determined by considering historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With the stock trading close to its GF Value, it appears to be fairly valued, suggesting that the market has efficiently priced in the company's current prospects and expected performance.

Conclusion

Jeffrey Maggioncalda's recent sale of 58,499 shares of Coursera Inc is a significant insider transaction that warrants attention. While the insider's selling activity over the past year has been notable, it is essential for investors to consider the broader context, including the company's valuation, market trends, and potential reasons behind the insider's decision to sell. As Coursera continues to navigate the dynamic online education sector, investors should stay informed of insider transactions and other key financial indicators to make well-rounded investment choices.

For those invested in or considering an investment in Coursera Inc, monitoring insider trends and understanding the relationship between insider activities and stock price movements will remain an important aspect of investment due diligence.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.