Insider Sell: Coursera's CEO Jeffrey Maggioncalda Offloads 161,304 Shares

In a significant insider sell transaction, Jeffrey Maggioncalda, the President & CEO of Coursera Inc (NYSE:COUR), sold 161,304 shares of the company on December 1, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's prospects and the confidence level of its top executives.

Who is Jeffrey Maggioncalda?

Jeffrey Maggioncalda has been at the helm of Coursera Inc as the President & CEO, steering the company through the evolving landscape of online education. Under his leadership, Coursera has expanded its offerings and partnerships, aiming to provide accessible and flexible learning opportunities to individuals around the globe. Maggioncalda's tenure has been marked by strategic initiatives that have shaped the company's growth trajectory and its position in the competitive online education sector.

About Coursera Inc

Coursera Inc is a leading online learning platform that offers a wide range of courses, specializations, certificates, and degrees from top universities and companies. The company's mission is to provide universal access to world-class education, enabling learners to acquire new skills and advance their careers. Coursera's platform caters to individuals looking to improve their knowledge base, as well as organizations seeking to upskill their workforce. With a diverse catalog of content across various disciplines, Coursera has become a go-to resource for millions of learners worldwide.

Analysis of Insider Buy/Sell and Relationship with Stock Price

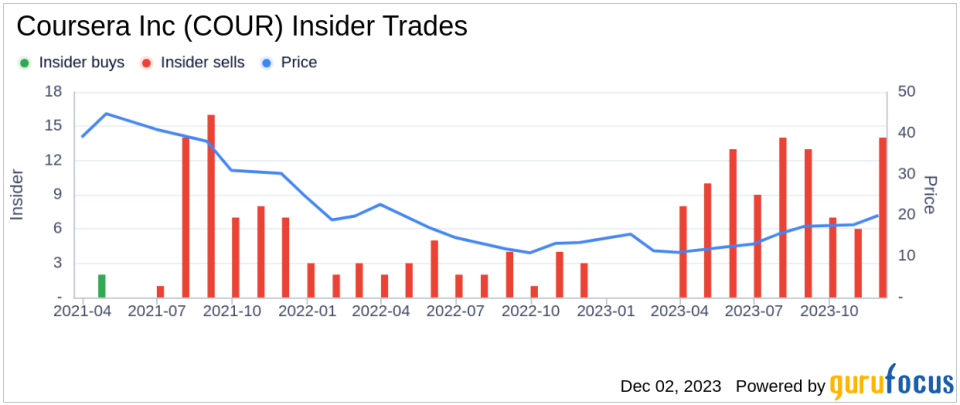

The insider transaction history for Coursera Inc reveals a pattern of insider sells over the past year, with no insider buys recorded during the same period. Jeffrey Maggioncalda himself has sold a total of 1,129,804 shares and has not made any purchases. This trend of insider selling could be interpreted in several ways. While it might suggest that insiders see the current stock price as favorable for liquidating some of their holdings, it could also raise questions about their long-term confidence in the company's stock performance.

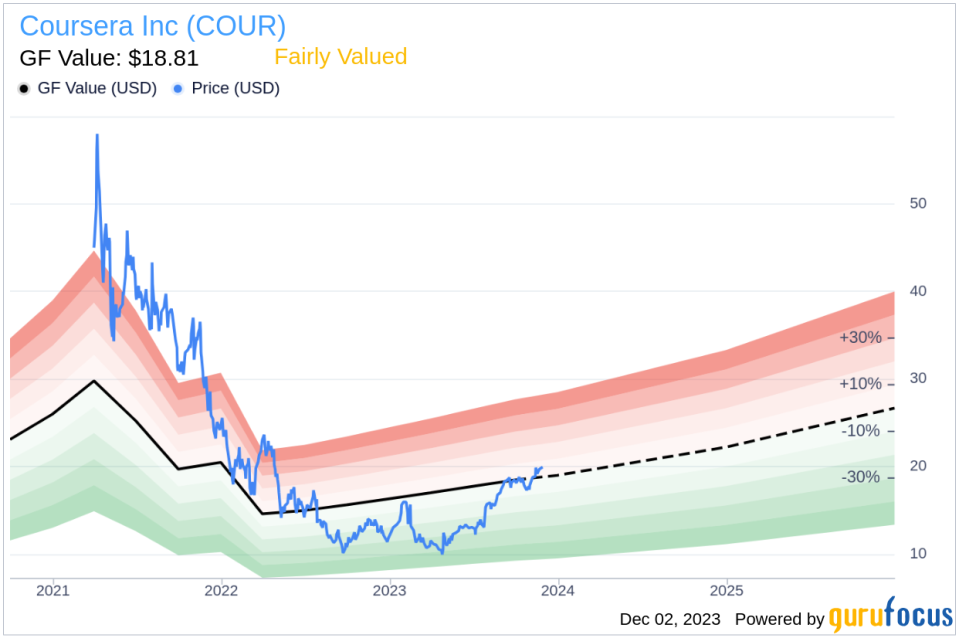

On the day of the insider's recent sell, Coursera's shares were trading at $20.13, giving the company a market cap of $3.082 billion. This price point is slightly above the GuruFocus Value (GF Value) of $18.81, indicating that the stock is Fairly Valued based on its intrinsic value estimate. The GF Value is a composite of historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

It is important to consider that insider sells can be motivated by a variety of factors unrelated to a company's health, such as personal financial planning or diversifying assets. However, consistent insider selling, especially in the absence of insider buying, may warrant closer scrutiny by investors.

The insider trend image above provides a visual representation of the selling pattern, which could influence investor sentiment and potentially impact the stock price. While the stock is currently deemed Fairly Valued, a continuation of this sell trend might lead to a reassessment of the stock's valuation by the market.

The GF Value image offers further context to the stock's valuation, showing the relationship between the current price and the estimated intrinsic value. A price-to-GF-Value ratio above 1 suggests that the stock is trading at a premium to its intrinsic value, which could limit the upside potential for investors buying at current levels.

Conclusion

Jeffrey Maggioncalda's recent insider sell of 161,304 shares of Coursera Inc is a notable event that warrants attention from the investment community. While the company's stock is currently Fairly Valued according to the GF Value, the ongoing pattern of insider sells could be a signal for investors to monitor closely. As always, it is essential for investors to conduct their own due diligence and consider a multitude of factors, including insider transactions, when making investment decisions.

Investors should also keep an eye on Coursera's strategic initiatives and performance metrics, as these will play a crucial role in the company's future growth and stock valuation. With the online education market continuing to evolve, Coursera's ability to innovate and adapt will be critical in maintaining its competitive edge and delivering value to shareholders.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.