Insider Sell: Craig Anderson Sells 15,000 Shares of ACV Auctions Inc (ACVA)

On September 12, 2023, Craig Anderson, an insider at ACV Auctions Inc (NASDAQ:ACVA), sold 15,000 shares of the company. This move comes amidst a trend of insider selling at ACV Auctions Inc, with 37 insider sells over the past year.

Craig Anderson is a key figure at ACV Auctions Inc, a company that operates an online platform for used car auctions. The platform provides detailed vehicle condition reports, which enable buyers to bid on and purchase vehicles without needing to be physically present at an auction site. This innovative approach to used car auctions has made ACV Auctions Inc a significant player in the industry.

Over the past year, the insider has sold a total of 115,000 shares and has not made any purchases. This trend of selling without any insider buying raises questions about the insider's confidence in the company's future prospects.

On the day of the insider's recent sell, shares of ACV Auctions Inc were trading for $16.21 apiece, giving the company a market cap of $2.52 billion.

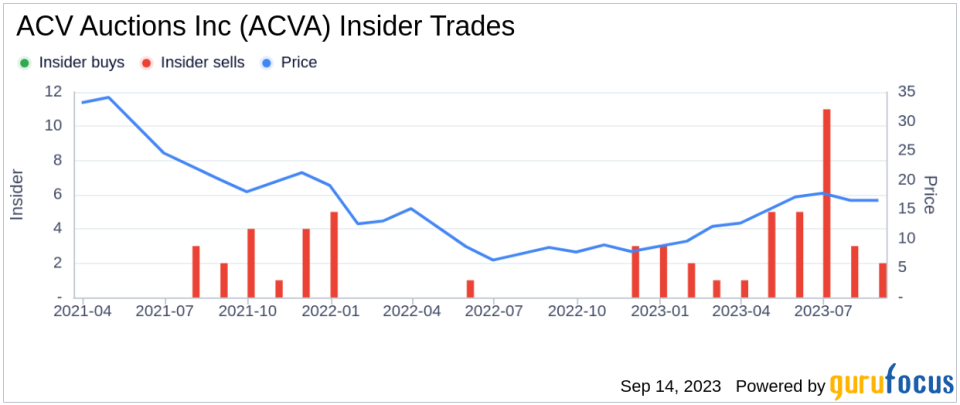

The above image shows the trend of insider transactions at ACV Auctions Inc. As can be seen, there have been no insider buys over the past year, while there have been 37 insider sells. This trend could be a signal to investors about the insider's sentiment towards the company's stock.

The relationship between insider transactions and stock price is often closely watched by investors. Insider selling can sometimes be seen as a negative signal, as it could indicate that insiders believe the company's stock is overvalued or that the company's future prospects are not as promising as the market believes. However, it's important to note that there can be many reasons for an insider to sell shares, and it does not necessarily indicate a lack of confidence in the company.

In the case of ACV Auctions Inc, the consistent insider selling over the past year, coupled with the lack of insider buying, could be a cause for concern for investors. However, it's also important to consider other factors, such as the company's financial performance, market conditions, and the insider's personal financial situation, before drawing any conclusions.

In conclusion, while the insider's recent sell of 15,000 shares of ACV Auctions Inc is noteworthy, it's just one piece of the puzzle. Investors should consider this information in the context of other factors when making investment decisions.

This article first appeared on GuruFocus.