Insider Sell: Crane Co's CEO Max Mitchell Divests 4,242 Shares

Crane Co (NYSE:CR), a diversified manufacturer of highly engineered industrial products, has recently witnessed a significant insider sell by its President and CEO, Max Mitchell. On November 29, 2023, Max Mitchell sold 4,242 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Max Mitchell?

Max Mitchell has been at the helm of Crane Co as the President and CEO, leading the company through various strategic initiatives and growth phases. Under Mitchell's leadership, Crane Co has continued to strengthen its market position in the diversified industrials sector, focusing on operational excellence and shareholder value creation.

Crane Co's Business Description

Crane Co, established in 1855, operates four business segments: Fluid Handling, Payment & Merchandising Technologies, Aerospace & Electronics, and Engineered Materials. The company's products are essential in various applications across industries, including chemical, oil & gas, commercial aerospace, defense, currency handling, and automotive. With a reputation for innovation and quality, Crane Co has built a robust portfolio of products and services that cater to a global customer base.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions are often scrutinized for insights into a company's financial health and future prospects. In the case of Crane Co, the insider transaction history reveals a pattern of sells rather than buys over the past year. Notably, Max Mitchell has sold a total of 98,970 shares and has not made any purchases. This could signal that insiders, including the CEO, may believe the stock is fully valued or potentially overvalued at current levels.

There have been 0 insider buys and 6 insider sells in the past year, indicating a possible lack of confidence from insiders in the stock's near-term appreciation potential. This trend is particularly important to consider in light of the company's stock performance.

On the day of the insider's recent sell, shares of Crane Co were trading at $104.09, giving the company a market cap of $6.004 billion. The price-earnings ratio stood at 19.36, lower than the industry median of 22.65 but higher than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a discount relative to its peers, it is priced higher than its historical average.

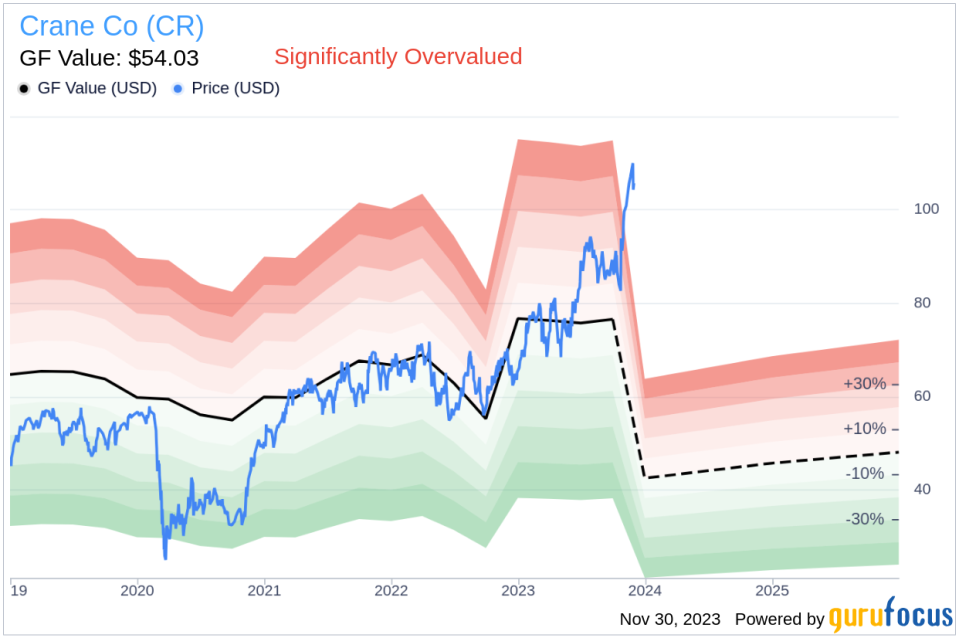

Moreover, with a price-to-GF-Value ratio of 1.93, Crane Co is considered Significantly Overvalued based on its GF Value. The GF Value, an intrinsic value estimate, suggests that the stock's current price is not supported by its historical trading multiples, adjusted factors based on past performance, and future business estimates.

The insider trend image above illustrates the recent insider sell transactions, which may raise questions among investors about the timing and rationale behind these sales.

The GF Value image provides a visual representation of the stock's valuation relative to its intrinsic value, further emphasizing the overvaluation concern.

Conclusion

The recent insider sell by Max Mitchell, along with the overall trend of insider sells at Crane Co, suggests that insiders may have reservations about the stock's current valuation. While insider sells are not always indicative of a stock's future performance, they can provide valuable context, especially when considered alongside other financial metrics and valuation models.

Investors should weigh these insider transactions against the backdrop of Crane Co's solid business fundamentals and market position. As always, a comprehensive analysis that includes both quantitative and qualitative factors is recommended before making any investment decisions.

It is also important to note that insider selling can be motivated by various factors, including personal financial planning, diversification of assets, or other reasons not directly related to the company's performance. Therefore, while insider trends are a piece of the puzzle, they should not be the sole basis for investment decisions.

As the market continues to digest the implications of insider activity at Crane Co, shareholders and potential investors should stay informed and consider the broader market conditions, company performance, and industry trends when evaluating their investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.