Insider Sell: CTO David Matthews Sells 5,475 Shares of Power Integrations Inc (POWI)

Power Integrations Inc (NASDAQ:POWI), a leader in high-performance integrated circuits used in power conversion, has recently witnessed a significant insider sell by its Chief Technical Officer (CTO), David Matthews. On November 14, 2023, David Matthews sold 5,475 shares of the company, a move that has caught the attention of investors and market analysts alike.

Who is David Matthews?

David Matthews has been an integral part of Power Integrations Inc, serving as the company's CTO. His role involves overseeing the technological advancements and innovation strategies of the company. Matthews's expertise in the field of power conversion technology has been pivotal in maintaining Power Integrations' position as a market leader. His insider transactions are closely monitored as they can provide insights into the company's performance and future prospects.

Power Integrations Inc's Business Description

Power Integrations Inc specializes in the design, development, and marketing of integrated circuits for energy-efficient power conversion. The company's products are used in a variety of electronic devices and equipment, including chargers for portable devices, LED lights, smart utility meters, and industrial controls. Power Integrations prides itself on its EcoSmart energy-efficiency technology, which significantly reduces energy waste and contributes to a greener environment.

Analysis of Insider Buy/Sell and Relationship with Stock Price

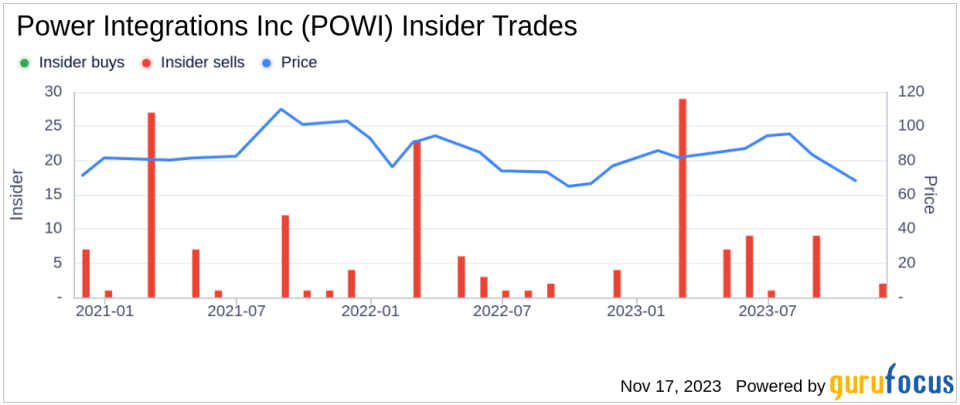

Insider transactions, particularly sells, can provide valuable clues about a company's health and the sentiment of its executives. Over the past year, David Matthews has sold a total of 42,530 shares and has not made any purchases. This pattern of selling could suggest that the insider may perceive the stock's current price as being on the higher side, or it could be part of a personal financial planning strategy.

It is important to note that there have been 59 insider sells and no insider buys over the past year for Power Integrations Inc. This trend could indicate that insiders are taking profits or reallocating their investments, which might raise questions about their confidence in the company's near-term growth potential.

On the day of Matthews's recent sell, shares of Power Integrations Inc were trading at $76.14, giving the company a market cap of $4.361 billion. This price reflects a price-earnings ratio of 68.49, which is significantly higher than the industry median of 25.1 and above the company's historical median price-earnings ratio. Such a high price-earnings ratio could suggest that the stock is overvalued compared to its peers, potentially justifying the insider's decision to sell.

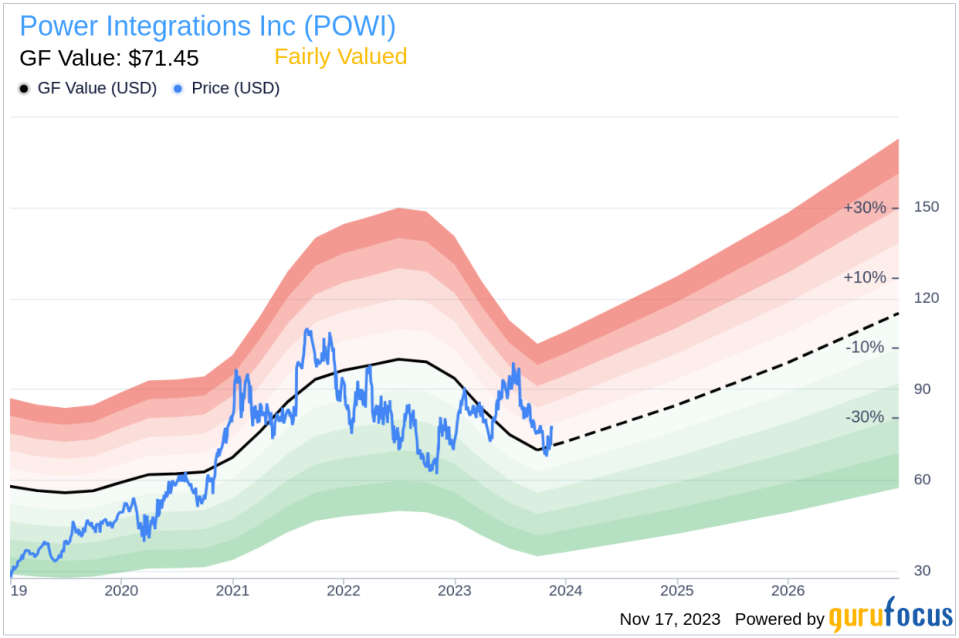

However, when considering the GuruFocus Value (GF Value) of $71.45, Power Integrations Inc appears to be Fairly Valued with a price-to-GF-Value ratio of 1.07. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The GF Value suggests that the stock is not significantly overpriced, which could mean that the insider's sell is not necessarily a bearish signal for the stock. It is also possible that the insider is diversifying their portfolio or addressing personal financial needs unrelated to their outlook on the company.

Insider Trend Image Analysis

The insider trend image above shows a clear pattern of insider selling over the past year. While this could be a point of concern for potential investors, it is essential to consider the broader context. Insider sells can occur for various reasons, including tax planning, estate planning, or liquidity needs. Therefore, while the trend is worth noting, it should not be the sole factor in making investment decisions.

Conclusion

David Matthews's recent sell of 5,475 shares of Power Integrations Inc is a significant transaction that warrants attention. While the insider sell trend and the high price-earnings ratio might raise some flags, the GF Value indicates that the stock is fairly valued. Investors should consider the insider trading patterns alongside other financial metrics and market analyses before making investment decisions. As always, a diversified investment approach is recommended to mitigate risks associated with reliance on insider transaction signals.

For those interested in Power Integrations Inc, it is advisable to keep an eye on future insider transactions and to stay updated with the company's performance and industry trends. Insider sells, while informative, are just one piece of the puzzle in the complex financial markets.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.