Insider Sell: CTO Rajeev Rajan Sells 2,609 Shares of Atlassian Corp (TEAM)

Atlassian Corporation Plc (NASDAQ:TEAM), a leading provider of team collaboration and productivity software, has recently witnessed an insider sell that has caught the attention of investors and market analysts. Rajeev Rajan, the Chief Technology Officer of Atlassian, sold 2,609 shares of the company on November 29, 2023. This transaction has prompted a closer look into the insider's trading behavior and its potential implications for the stock's performance.

Who is Rajeev Rajan at Atlassian Corp?

Rajeev Rajan is known for his role as the Chief Technology Officer at Atlassian Corp. In his capacity as CTO, Rajan is responsible for overseeing the company's technological direction, ensuring that Atlassian's product offerings remain innovative and competitive in the fast-paced tech industry. His decisions and insights are crucial for the company's growth and adaptation to the ever-evolving demands of the market.

Atlassian Corp's Business Description

Atlassian Corp is a global software company that specializes in products for software developers, project managers, and content management. It is widely recognized for its flagship products such as Jira, Confluence, Bitbucket, and Trello, which help teams organize, discuss, and complete shared work. Atlassian serves a wide range of customers from small businesses to large enterprises, providing tools that facilitate collaboration, productivity, and the efficient management of workflows.

Analysis of Insider Buy/Sell and Relationship with Stock Price

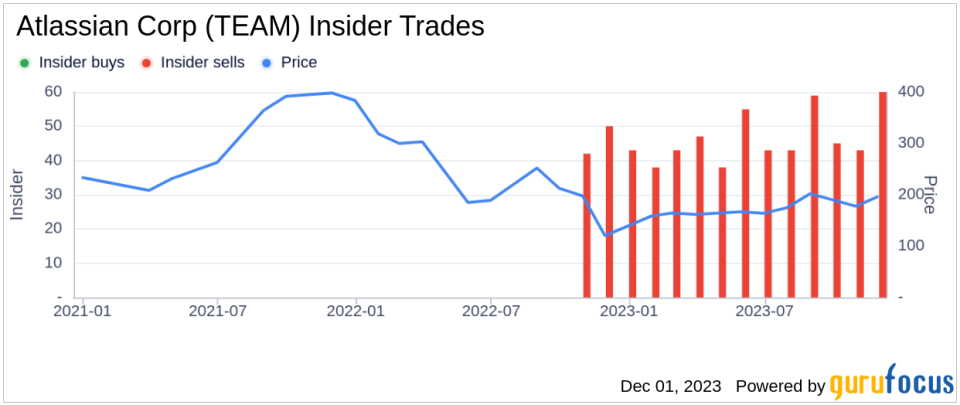

Insider trading activities, such as buys and sells, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Rajeev Rajan has sold a total of 24,908 shares and has not made any purchases. This one-sided activity could signal that the insider believes the stock may be fully valued or overvalued at current prices, or it may simply reflect personal financial planning decisions.

The broader insider transaction history for Atlassian Corp shows a significant imbalance with 0 insider buys and 557 insider sells over the past year. This trend could indicate that insiders, on the whole, are taking the opportunity to realize gains or redistribute their investment portfolios, rather than accumulating more shares.

On the day of Rajeev Rajan's recent sell, shares of Atlassian Corp were trading at $190.22, giving the company a market cap of $49.95 billion. This valuation places the company among the larger players in the software industry, reflecting its strong market position and robust product suite.

When analyzing the relationship between insider trading activities and stock price, it is important to consider the context of the transactions. While a pattern of insider selling can sometimes precede a decline in stock price, it is not a definitive indicator of future performance. Other factors, such as market conditions, company performance, and economic indicators, also play significant roles in determining stock price movements.

Valuation and GF Value Analysis

Atlassian Corp's stock price of $190.22, when compared to the GuruFocus Value (GF Value) of $353.91, suggests that the stock is Significantly Undervalued with a price-to-GF-Value ratio of 0.54. The GF Value is a proprietary metric developed by GuruFocus, designed to estimate the intrinsic value of a stock.

The GF Value takes into account historical trading multiples such as the price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow. Additionally, it includes a GuruFocus adjustment factor based on the company's past returns and growth, as well as future business performance estimates from Morningstar analysts.

Given that the stock is trading below its GF Value, it could be interpreted that the market is currently undervaluing Atlassian Corp's shares. This discrepancy between market price and intrinsic value could present a buying opportunity for investors who believe in the company's long-term growth prospects. However, it is also essential to consider why the market is pricing the stock at such a discount. Factors such as market sentiment, industry trends, and company-specific challenges must be evaluated to understand the full picture.

In conclusion, the recent insider sell by Atlassian Corp's CTO Rajeev Rajan may raise questions among investors regarding the stock's valuation and future performance. While the insider trading trend and the current price-to-GF-Value ratio suggest that the stock is undervalued, investors should conduct thorough due diligence, considering both the insider activity and the company's fundamentals before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.