Insider Sell: Dave Schaeffer Sells 45,000 Shares of Cogent Communications Holdings Inc

On September 11, 2023, Dave Schaeffer, Chairman, CEO, and President, and 10% Owner of Cogent Communications Holdings Inc (NASDAQ:CCOI), sold 45,000 shares of the company. This move is part of a series of transactions made by the insider over the past year, during which Schaeffer has sold a total of 155,000 shares and purchased none.

Dave Schaeffer is a key figure at Cogent Communications Holdings Inc, a multinational internet service provider based in the United States. The company specializes in providing businesses with high-speed internet access, Ethernet transport, and colocation services. With over 2,550 net-centric commercial buildings directly connected to its network, Cogent serves a broad range of industries.

The insider's recent sell-off comes at a time when Cogent Communications Holdings Inc's stock is trading at $67.68 per share, giving the company a market cap of $3.257 billion. The price-earnings ratio stands at 2.82, significantly lower than the industry median of 16.61 and the companys historical median price-earnings ratio. This suggests that the stock is currently undervalued.

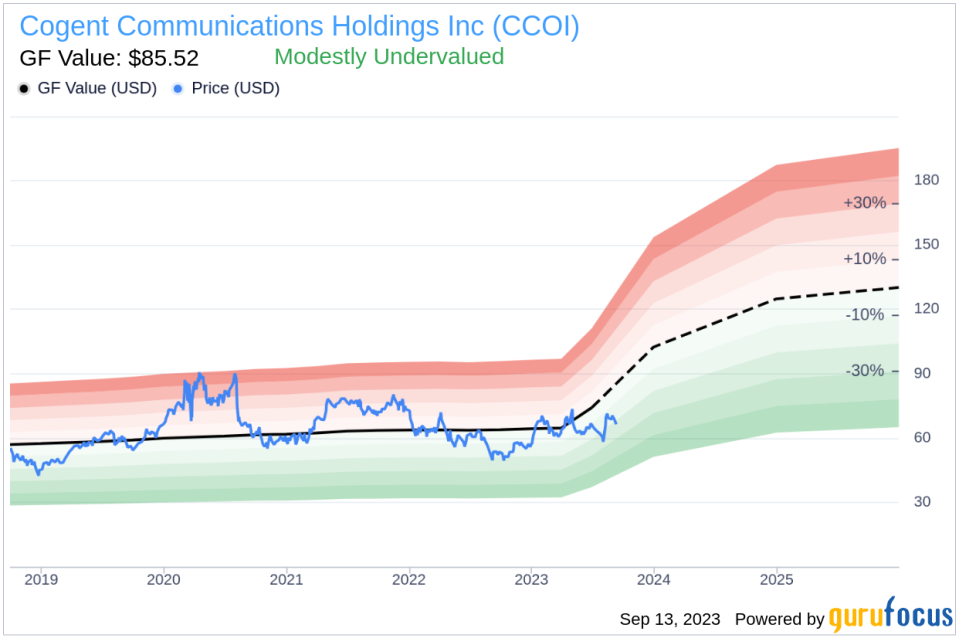

The GuruFocus Value of Cogent Communications Holdings Inc is $85.52, resulting in a price-to-GF-Value ratio of 0.79. This indicates that the stock is modestly undervalued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

Over the past year, the insider transaction history for Cogent Communications Holdings Inc shows a trend towards selling. There have been 34 insider sells and only 1 insider buy. This could be a signal that insiders believe the stock is overvalued, despite the current price-earnings ratio and GF Value suggesting otherwise.

However, it's important to note that insider selling does not necessarily indicate a negative outlook for the company. Insiders may sell shares for personal reasons or to diversify their investment portfolio. Therefore, while the insider's recent sell-off is worth noting, it should not be the sole factor considered when making investment decisions.

Investors should also consider the company's financial health, growth prospects, and the overall market condition. As always, it's recommended to conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.