Insider Sell: Dave Schaeffer Sells 18,191 Shares of Cogent Communications Holdings Inc

On September 15, 2023, Dave Schaeffer, Chairman, CEO, and President, and 10% Owner of Cogent Communications Holdings Inc (NASDAQ:CCOI), sold 18,191 shares of the company. This move is part of a series of insider transactions that have taken place over the past year.

Dave Schaeffer is a key figure at Cogent Communications Holdings Inc, a multinational internet service provider based in the United States. The company specializes in providing businesses with high-speed internet access, Ethernet transport, and colocation services. Cogent's network stretches over 190 markets throughout 43 countries in North America, Europe, and Asia.

Over the past year, the insider has sold a total of 218,191 shares and has not made any purchases. This trend is reflected in the company's overall insider transactions, with 1 insider buy and 36 insider sells over the same period.

The relationship between insider transactions and stock price is often closely watched by investors. In this case, the consistent selling by the insider could be interpreted as a lack of confidence in the company's future performance. However, it's important to note that insider selling can occur for a variety of reasons, not all of which are indicative of a company's health or future prospects.

On the day of the insider's recent sell, shares of Cogent Communications Holdings Inc were trading at $65.82, giving the company a market cap of $3.198 billion. The price-earnings ratio stands at 2.80, significantly lower than the industry median of 16.13 and the companys historical median price-earnings ratio. This could suggest that the stock is undervalued.

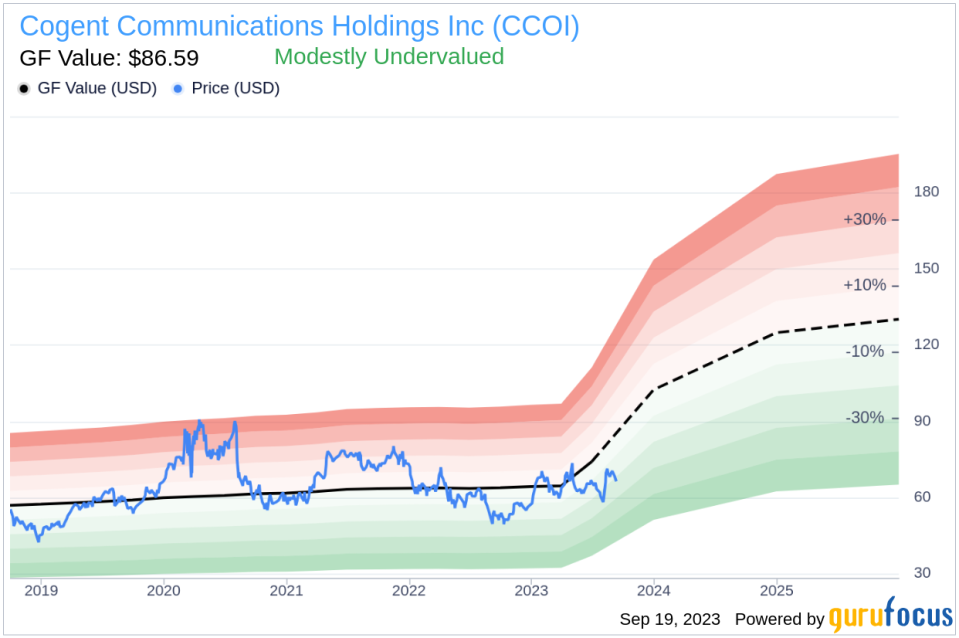

According to the GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, the stock is modestly undervalued. With a price of $65.82 and a GuruFocus Value of $86.59, the price-to-GF-Value ratio stands at 0.76.

In conclusion, while the insider's recent sell might raise some eyebrows, the company's valuation metrics suggest that the stock could be a good value buy. As always, investors should conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.