Insider Sell: David Boyer Sells 1,437 Shares of Neurocrine Biosciences Inc (NBIX)

On October 2, 2023, David Boyer, Chief Corp. Affairs Officer of Neurocrine Biosciences Inc (NASDAQ:NBIX), sold 1,437 shares of the company. This move comes as part of a series of transactions by the insider over the past year, during which Boyer has sold a total of 33,407 shares and purchased none.

Neurocrine Biosciences Inc is a research-based pharmaceutical company primarily focused on discovering and developing innovative drugs for the treatment of neurological and endocrine-related diseases and disorders. The company's product portfolio includes treatments for Parkinson's disease, tardive dyskinesia, uterine fibroids, endometriosis, and congenital adrenal hyperplasia.

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider transactions. Over the past year, there have been 57 insider sells and no insider buys for Neurocrine Biosciences Inc.

The above image shows the trend of insider transactions for Neurocrine Biosciences Inc. It is evident that the insider sells have been consistent over the past year, with David Boyer being a significant contributor to this trend.

On the day of the insider's recent sell, shares of Neurocrine Biosciences Inc were trading at $112.68, giving the company a market cap of $10.82 billion. The price-earnings ratio stands at 63.98, which is higher than the industry median of 23.03 but lower than the company's historical median price-earnings ratio.

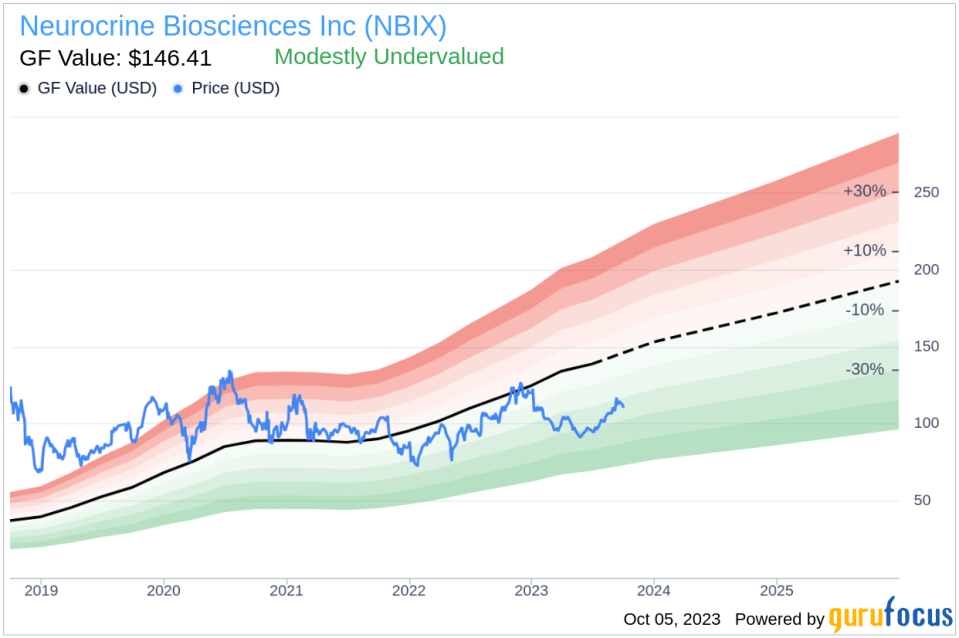

The GF Value image above indicates that Neurocrine Biosciences Inc is modestly undervalued, with a price-to-GF-Value ratio of 0.77. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

Despite the insider's sell-off, the company's modest undervaluation and its strong position in the pharmaceutical industry could make it an attractive investment opportunity. However, potential investors should closely monitor the company's insider transactions and other market indicators before making investment decisions.

As always, it's crucial to remember that insider transactions are just one piece of the puzzle when evaluating a company. They can provide valuable insights, but they should be considered alongside other factors such as the company's financial health, market conditions, and industry trends.

This article first appeared on GuruFocus.