Insider Sell: DermTech Inc CFO Kevin Sun Sells 9,616 Shares

On September 11, 2023, Kevin Sun, the Chief Financial Officer (CFO) of DermTech Inc (NASDAQ:DMTK), sold 9,616 shares of the company. This move is part of a larger trend of insider selling at DermTech Inc, which we will explore in this article.

Kevin Sun has been serving as the CFO of DermTech Inc, a company that specializes in genomics and dermatology. DermTech Inc is a pioneer in the field of precision dermatology, using genomics to create non-invasive skin tests that assist in the detection of skin cancers at their earliest stages. The company's innovative approach to dermatology has made it a significant player in the healthcare sector.

Over the past year, the insider has sold a total of 30,090 shares and has not made any purchases. This recent sale of 9,616 shares is a continuation of this trend. The insider's selling activities can often provide valuable insights into the company's financial health and future prospects.

The insider transaction history for DermTech Inc shows a clear trend of insider selling. Over the past year, there have been 25 insider sells and no insider buys. This could indicate that insiders believe the company's stock is currently overvalued, prompting them to sell their shares.

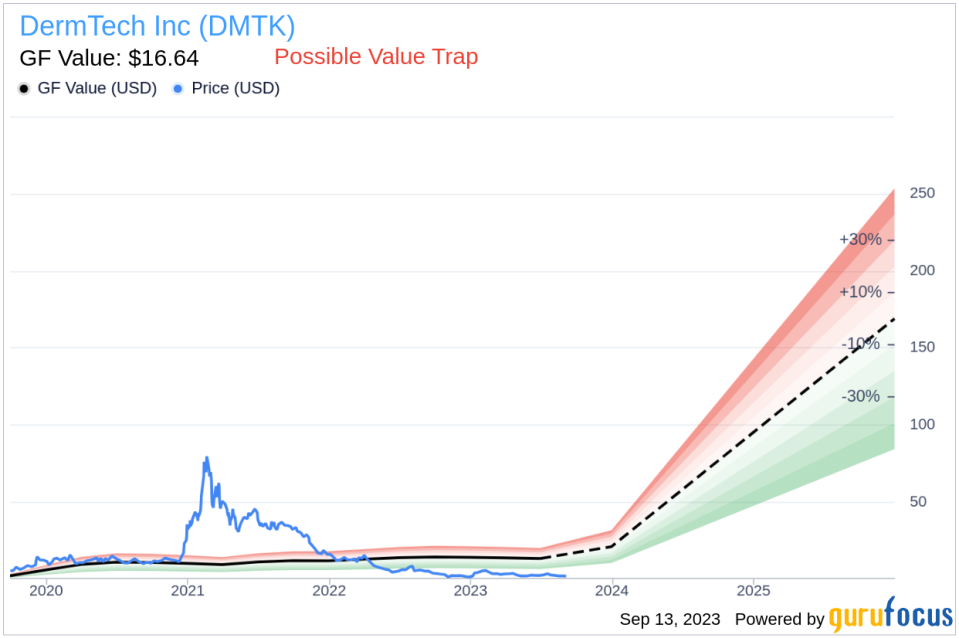

On the day of the insider's recent sale, DermTech Inc's shares were trading at $1.93, giving the company a market cap of $65.336 million. However, the GuruFocus Value of the stock stands at $16.64, indicating a price-to-GF-Value ratio of 0.12. This suggests that the stock is a possible value trap, and investors should think twice before investing.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts. In the case of DermTech Inc, the low price-to-GF-Value ratio suggests that the stock's current price does not reflect its intrinsic value, indicating a possible value trap.

In conclusion, the insider's recent sale of DermTech Inc shares, along with the company's low price-to-GF-Value ratio, suggests caution for potential investors. While DermTech Inc's innovative approach to dermatology makes it a significant player in the healthcare sector, the ongoing trend of insider selling could be a warning sign of overvaluation. As always, investors should conduct thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.