Insider Sell: Director Ajita Rajendra Sells 11,400 Shares of Donaldson Co Inc (DCI)

In a notable insider transaction, Director Ajita Rajendra sold 11,400 shares of Donaldson Co Inc (NYSE:DCI) on December 11, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its executives and directors.

Who is Ajita Rajendra?

Ajita Rajendra is a seasoned executive with a wealth of experience in the industrial sector. As a director of Donaldson Co Inc, Rajendra has been part of the company's board, contributing to its strategic direction and oversight. His background includes leadership roles in various companies, where he has honed his expertise in operations, management, and corporate governance.

About Donaldson Co Inc

Donaldson Co Inc is a global leader in the manufacturing of filtration systems and parts. Founded in 1915, the company provides innovative solutions to a wide range of industries, including aerospace, agriculture, construction, and transportation. Donaldson's products are essential in protecting engines, equipment, and the environment from harmful contaminants. With a commitment to quality and sustainability, Donaldson Co Inc continues to be at the forefront of filtration technology, serving customers around the world.

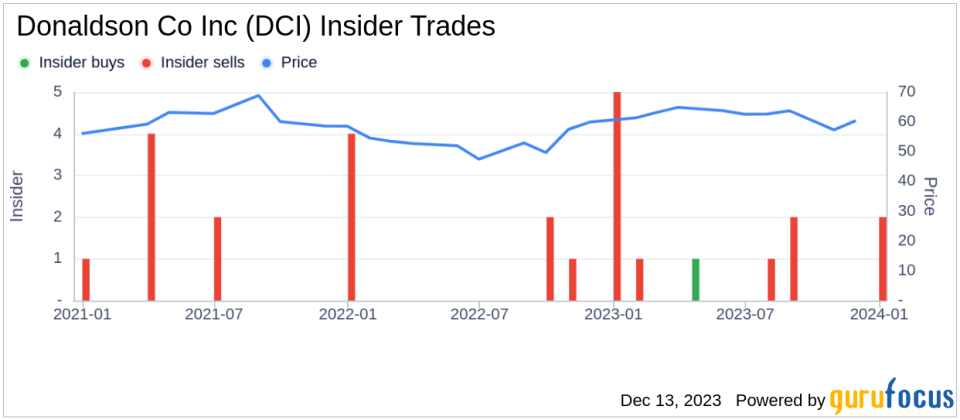

Analysis of Insider Buy/Sell and Relationship with Stock Price

The insider transaction history for Donaldson Co Inc reveals a pattern of more insider sells than buys over the past year. Specifically, there has been only 1 insider buy compared to 8 insider sells. This could indicate that insiders, including Ajita Rajendra, may perceive the stock's current price as a favorable selling point, possibly due to personal financial planning or valuation assessments.Ajita Rajendras trades over the past year show a total sale of 18,312 shares and no purchases. This consistent selling trend might raise questions among investors about the insider's long-term confidence in the company's stock performance.

The relationship between insider selling and stock price can be complex. While extensive selling by insiders might suggest a lack of confidence or a belief that the stock is overvalued, it is also important to consider that insiders may sell shares for various reasons unrelated to their outlook on the company, such as diversifying their investments or meeting personal financial obligations.

Valuation and Market Response

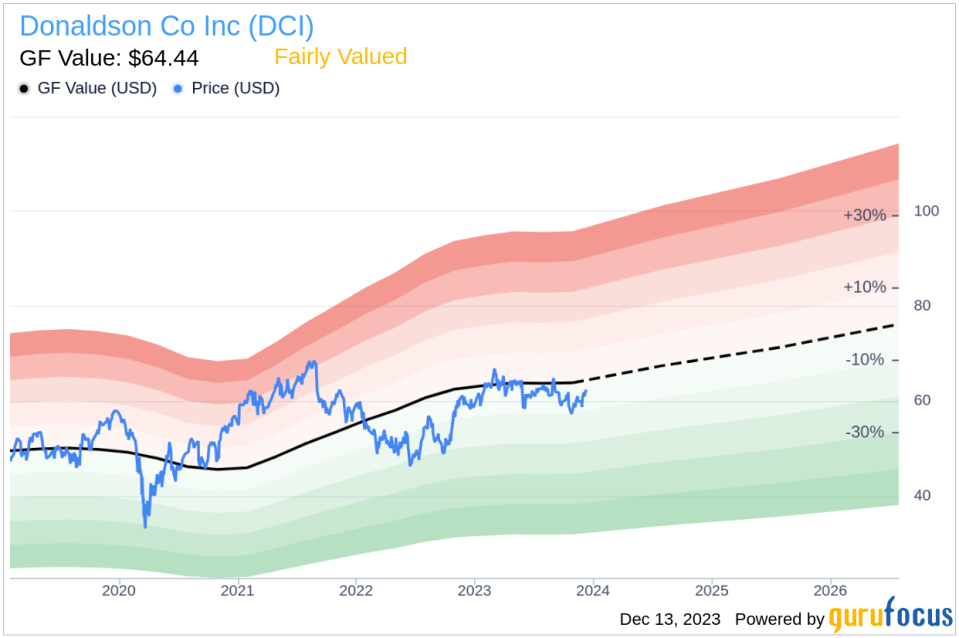

On the day of the insider's recent sale, shares of Donaldson Co Inc were trading at $62.24, giving the company a market cap of $7.501 billion. The price-earnings ratio of 21.09 is slightly lower than the industry median of 22.385 and also below the company's historical median price-earnings ratio. This could suggest that the stock is undervalued compared to its peers and its own historical valuation.With a price of $62.24 and a GuruFocus Value of $64.44, Donaldson Co Inc has a price-to-GF-Value ratio of 0.97, indicating that the stock is Fairly Valued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The close alignment of the current stock price with the GF Value suggests that the market has efficiently priced Donaldson Co Inc's shares, reflecting the company's fundamentals and growth prospects.

Conclusion

The recent insider sell by Director Ajita Rajendra of Donaldson Co Inc may prompt investors to scrutinize the company's valuation and future growth potential. While the insider's selling activity over the past year has been consistent, it is essential to consider the broader context of the company's financial health, industry position, and market valuation.Given the stock's Fairly Valued status according to the GF Value and its reasonable price-earnings ratio, investors may find Donaldson Co Inc an attractive investment for its stability and potential for steady growth. However, as with any investment decision, it is crucial to conduct thorough research and consider the implications of insider transactions within the larger scope of market conditions and individual investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.