Insider Sell: Director Andrew Ng Sells 75,205 Shares of Coursera Inc (COUR)

In a notable insider transaction, Director Andrew Ng of Coursera Inc (NYSE:COUR) sold 75,205 shares of the company's stock on November 15, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Andrew Ng of Coursera Inc?

Andrew Ng is a co-founder of Coursera Inc, a leading online learning platform. He is a well-known figure in the field of artificial intelligence and has held positions at Stanford University and Google Brain. Ng's contributions to the field of online education and machine learning have been significant, and his involvement with Coursera has been instrumental in the company's growth and success.

Coursera Inc's Business Description

Coursera Inc is a global online learning platform that offers courses, specializations, certificates, and degrees across a wide range of subjects. The company partners with universities and organizations to provide a world-class educational experience to learners around the globe. Coursera's platform is designed to help individuals advance their careers, learn new skills, and pursue their interests through flexible, accessible, and affordable courses.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

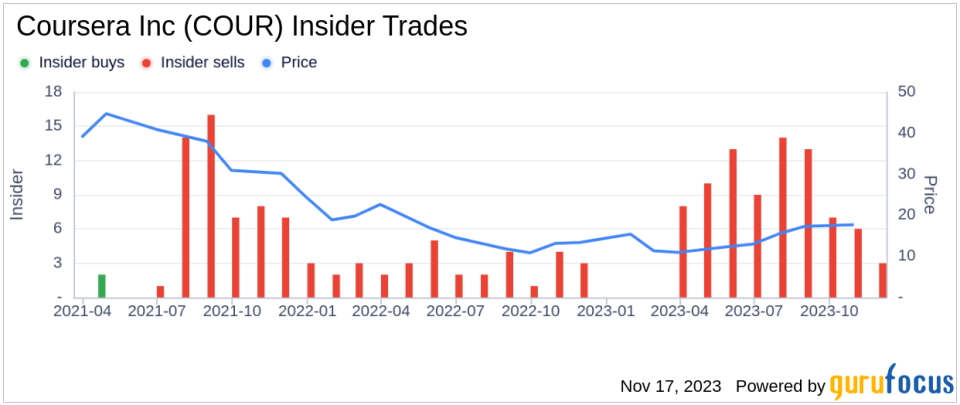

The insider transaction history for Coursera Inc shows a pattern of insider selling over the past year. Andrew Ng's recent sale of 75,205 shares is part of a larger trend, as he has sold a total of 675,205 shares and made no purchases in the same period. This consistent selling by Ng could be interpreted in several ways. It might suggest that the insider believes the stock is currently valued fairly or that they are diversifying their personal portfolio. However, without additional context, it is challenging to determine the exact motivation behind these sales.

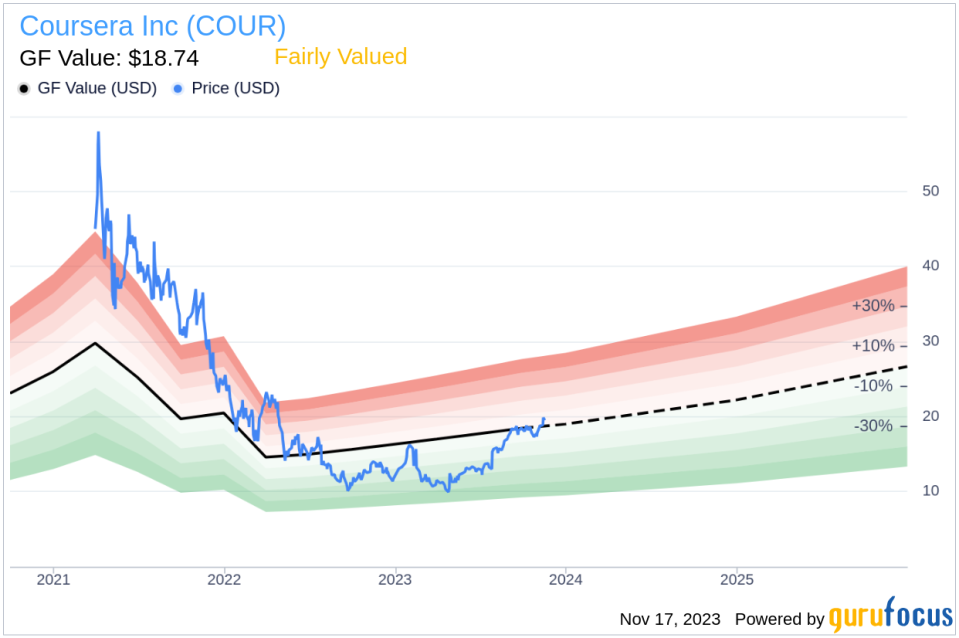

The relationship between insider transactions and stock prices is complex. While significant insider selling can sometimes lead to a decrease in investor confidence and a subsequent drop in stock price, this is not always the case. In the context of Coursera Inc, despite the insider selling, the stock has been trading around its GF Value, indicating that the market perceives the company as fairly valued.

Insider Trends

The overall insider trend for Coursera Inc has been towards selling, with 86 insider sells and no insider buys over the past year. This could be a signal to investors that insiders are taking profits or reallocating their investments, which might be a cause for concern if the trend continues. However, it is essential to consider the broader market conditions and the company's performance when interpreting these transactions.

Valuation

On the day of Andrew Ng's recent sale, shares of Coursera Inc were trading at $19.63, giving the company a market cap of $2.974 billion. This valuation places the stock in the mid-cap category, which can offer a balance between the growth potential of small-cap stocks and the stability of large-cap stocks.With a price of $19.63 and a GuruFocus Value of $18.74, Coursera Inc has a price-to-GF-Value ratio of 1.05. This suggests that the stock is fairly valued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, an adjustment factor based on the company's past performance, and future business performance estimates provided by analysts. Coursera Inc's close alignment with its GF Value indicates that the stock is priced appropriately in the market, considering its historical and expected future performance.

Conclusion

The recent insider sale by Director Andrew Ng of Coursera Inc is part of a broader trend of insider selling at the company. While such sales can raise questions about insiders' confidence in the company's future, the stock's fair valuation according to the GF Value suggests that the market has adequately priced in Coursera's prospects. Investors should continue to monitor insider activity and company performance for further insights, but as of now, Coursera Inc appears to be trading in line with its intrinsic value.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.