Insider Sell: Director Andy Fang Offloads 134,000 Shares of DoorDash Inc (DASH)

DoorDash Inc (NASDAQ:DASH), a leading food delivery service company, has recently witnessed a significant insider sell by one of its top executives. Director Andy Fang, a key figure in the company, sold 134,000 shares of DoorDash Inc on November 17, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Andy Fang of DoorDash Inc?

Andy Fang is one of the co-founders of DoorDash Inc and has been instrumental in the company's growth and success. As a director, Fang has been involved in strategic decision-making and has played a crucial role in shaping the company's direction. His insider knowledge of the company's operations and market position makes his trading activities particularly noteworthy for investors.

DoorDash Inc's Business Description

DoorDash Inc operates an online food ordering and delivery platform that connects people with their favorite local and national restaurants. The company has expanded rapidly since its inception, offering a convenient and reliable service for customers to order meals and have them delivered to their doorstep. DoorDash has leveraged technology to streamline the delivery process and has established a strong brand presence in the competitive food delivery industry.

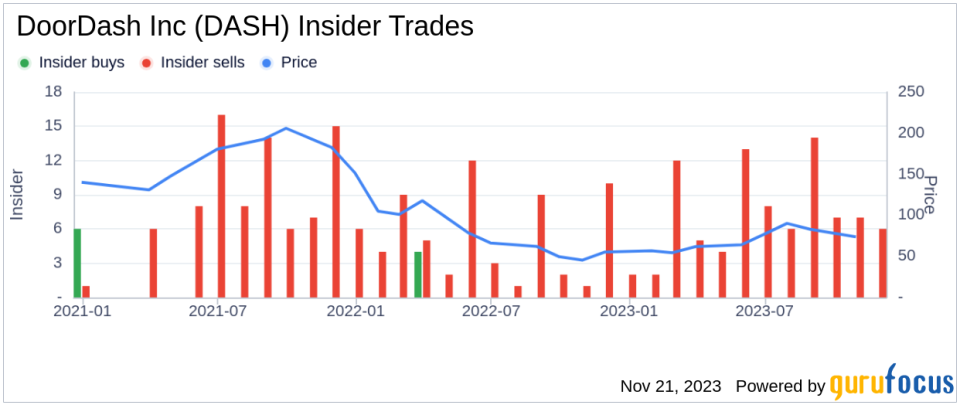

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

The insider transaction history for DoorDash Inc reveals a pattern that could be of interest to investors. Over the past year, Andy Fang has sold a total of 1,348,703 shares and has not made any purchases. This one-sided activity suggests that the insider may perceive the stock's current price as a favorable selling point or may be diversifying his personal portfolio.In the broader context, there have been 93 insider sells and no insider buys over the same timeframe. This trend could indicate that insiders collectively believe the stock is fully valued or overvalued, or they may have personal financial reasons for selling their shares.

On the day of the insider's recent sell, shares of DoorDash Inc were trading at $94.76, giving the company a market cap of $38.13 billion. This valuation places DoorDash among the larger players in the market, reflecting its significant growth and market share in the food delivery sector.

Valuation and GF Value Analysis

The price-to-GF-Value ratio is a metric used to determine whether a stock is trading at a fair value. With a trading price of $94.76 and a GuruFocus Value of $107.19, DoorDash Inc has a price-to-GF-Value ratio of 0.88, indicating that the stock is modestly undervalued based on its GF Value.The GF Value is calculated considering historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This intrinsic value estimate provides a benchmark for investors to assess whether a stock is trading above or below its fair value.

Conclusion

The recent insider sell by Director Andy Fang at DoorDash Inc is a significant event that warrants attention from the investment community. While insider sells are not always indicative of a company's decline, they can provide valuable context when analyzed alongside other financial metrics and market trends.Investors should consider the insider trends, the company's valuation, and the GF Value analysis when making investment decisions. Although DoorDash Inc appears to be modestly undervalued based on the GF Value, the consistent pattern of insider selling could suggest that those with the most intimate knowledge of the company's prospects are choosing to realize their gains at the current stock price levels.As always, it is essential for investors to conduct their due diligence and consider a wide range of factors before making any investment decisions. The actions of insiders like Andy Fang are just one piece of the puzzle in the complex and ever-changing landscape of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.