Insider Sell: Director Austin Shanfelter Sells 30,000 Shares of Orion Group Holdings Inc (ORN)

Orion Group Holdings Inc (NYSE:ORN) has recently witnessed a significant insider sell that has caught the attention of investors and market analysts. On November 27, 2023, Director Austin Shanfelter sold 30,000 shares of the company, a move that prompts a closer look into the insider's trading behavior and the potential implications for the stock's future performance.

Who is Austin Shanfelter?

Austin Shanfelter is a notable figure within Orion Group Holdings Inc, serving as a director of the company. His role in the company's leadership provides him with an intimate understanding of the firm's operations, strategic direction, and financial health. Shanfelter's decisions to buy or sell shares are often considered a reflection of his confidence in the company's prospects, making his recent sell a point of interest for those following ORN's stock.

Orion Group Holdings Inc's Business Description

Orion Group Holdings Inc is a leading construction and marine services company that provides solutions in the infrastructure, industrial, and building sectors. The company operates through two segments: Marine and Concrete. Orion's Marine segment offers a range of services including marine transportation facility construction, marine pipeline construction, and dredging of waterways, channels, and ports. The Concrete segment focuses on turnkey concrete construction, providing project management, construction, and placement for large-scale commercial and light industrial projects. With a strong presence in the construction and marine sectors, Orion Group Holdings Inc is well-positioned to capitalize on the growing demand for infrastructure development and maintenance.

Analysis of Insider Buy/Sell and Relationship with Stock Price

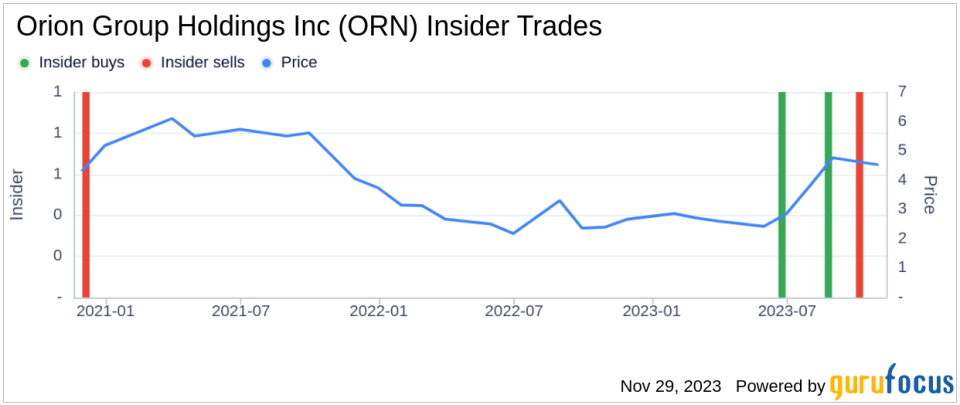

Insider trading activities, such as the recent sell by Austin Shanfelter, can provide valuable insights into a company's internal perspective on its stock's valuation. Over the past year, Shanfelter has sold a total of 60,000 shares and has not made any purchases. This could signal a lack of confidence in the company's short-term growth prospects or simply a personal financial decision by the insider.

Comparatively, the overall insider transaction history for Orion Group Holdings Inc shows a balanced picture with 2 insider buys and 2 insider sells over the past year. This mixed activity suggests that while some insiders may see value at current prices, others may believe the stock is fairly valued or overvalued.

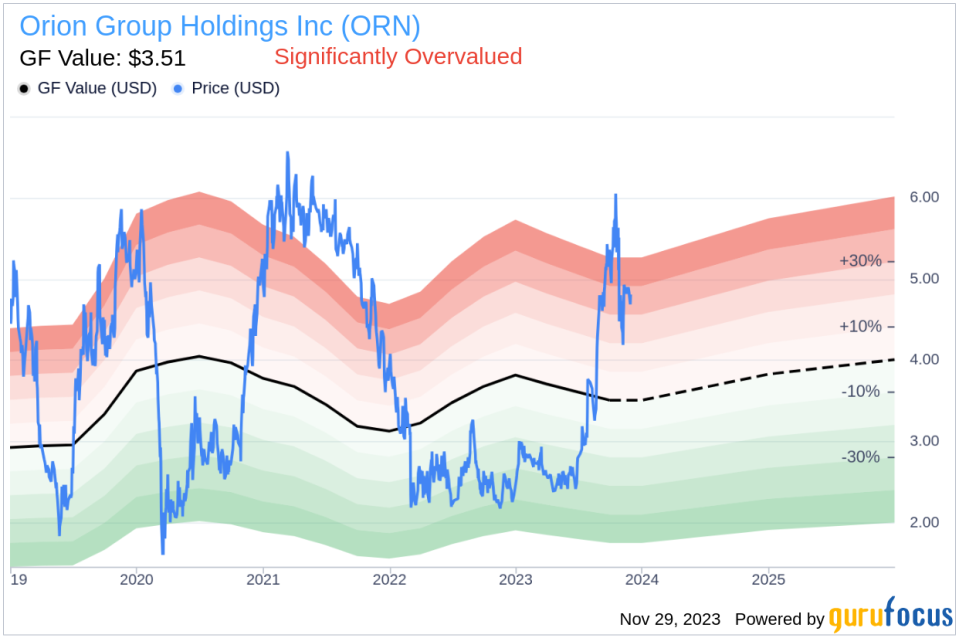

On the day of Shanfelter's recent sell, shares of Orion Group Holdings Inc were trading at $4.86, giving the company a market cap of $158.13 million. This price point is particularly interesting when considering the company's valuation in relation to the GuruFocus Value (GF Value).

With a GF Value of $3.51, Orion Group Holdings Inc's stock is currently trading at a price-to-GF-Value ratio of 1.38, indicating that the stock is significantly overvalued based on its intrinsic value estimate. The GF Value is a proprietary metric developed by GuruFocus, taking into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from analysts.

The insider's decision to sell at a price above the GF Value could be interpreted as an agreement with the assessment that the stock is overvalued. However, it is important to note that insider trading is influenced by many factors, and a sell does not necessarily indicate a negative outlook for the company. Insiders may sell shares for reasons unrelated to their view of the company's financial health, such as diversifying their portfolio, tax planning, or personal financial needs.

Conclusion

The recent insider sell by Director Austin Shanfelter at Orion Group Holdings Inc raises questions about the stock's current valuation and future performance. While the insider's sell could be seen as a lack of confidence in the stock's potential to rise further, it is essential to consider the broader context of insider trading patterns and the company's fundamentals. Investors should weigh the insider's actions alongside other financial data and market trends before making investment decisions. As always, insider trades are just one piece of the puzzle when it comes to evaluating a stock's attractiveness and potential for growth.

For those interested in Orion Group Holdings Inc, it is advisable to keep an eye on insider trading activities, as they can provide early signals about the company's internal expectations. Additionally, understanding the company's business model, industry trends, and financial performance is crucial in forming a comprehensive investment thesis. With careful analysis and consideration of all relevant factors, investors can make informed decisions about their involvement with ORN stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.