Insider Sell: Director Brian Ratzan Sells 8,180 Shares of The Simply Good Foods Co (SMPL)

Director Brian Ratzan of The Simply Good Foods Co has recently made a significant stock transaction, selling 8,180 shares of the company on December 7, 2023. This move has caught the attention of investors and market analysts, as insider transactions can often provide valuable insights into a company's financial health and future prospects.

Who is Brian Ratzan?

Brian Ratzan is a seasoned member of the board of directors at The Simply Good Foods Co. His role within the company involves oversight and strategic guidance, contributing to the company's direction and policies. Directors like Ratzan are privy to in-depth knowledge about the company's operations, financials, and strategic plans, making their trading activities a focal point for investors seeking clues about the company's performance.

About The Simply Good Foods Co

The Simply Good Foods Co, trading under the ticker symbol SMPL, is a consumer packaged goods company known for its focus on nutritional foods and snacking products. The company's portfolio includes a variety of well-known brands that cater to health-conscious consumers looking for convenient, nutritious options. With a commitment to quality and innovation, The Simply Good Foods Co has established a strong presence in the health and wellness sector, aiming to meet the evolving needs of today's consumers.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions, particularly those involving sales or purchases of a company's stock by its directors and executives, can be a powerful indicator of the company's internal perspective on its valuation and future prospects. In the case of The Simply Good Foods Co, the recent sale by Director Brian Ratzan of 8,180 shares has raised questions among investors about the potential reasons behind this decision.

Over the past year, Brian Ratzan has sold a total of 465,133 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider may perceive the stock's current price as being on the higher end of its value range, or it could be related to personal financial planning or diversification strategies.

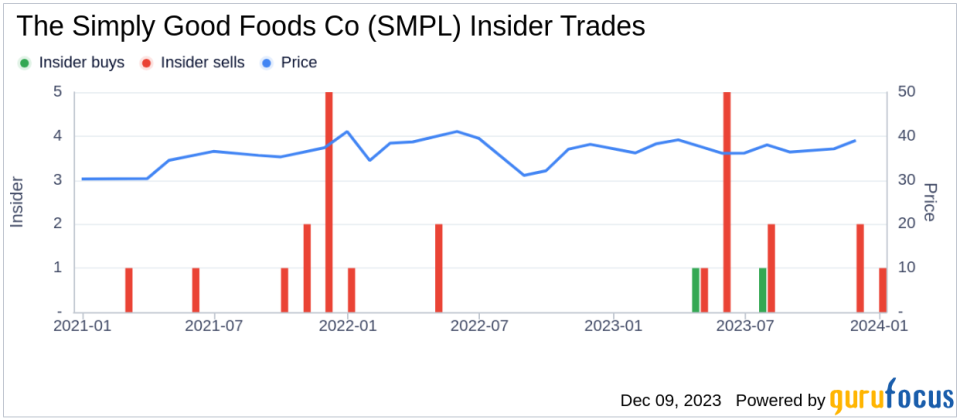

When examining the broader insider transaction history for The Simply Good Foods Co, we observe that there have been 2 insider buys and 12 insider sells over the past year. This trend of more frequent selling than buying by insiders might indicate a cautious or bearish sentiment within the company's leadership regarding the stock's future performance.

On the day of Ratzan's recent sale, shares of The Simply Good Foods Co were trading at $40.15, giving the company a market cap of $3.963 billion. The price-earnings ratio stood at 30.14, which is higher than the industry median of 18.43 but lower than the company's historical median price-earnings ratio. This suggests that while the stock may be trading at a premium compared to the industry, it is still within a reasonable range based on the company's own trading history.

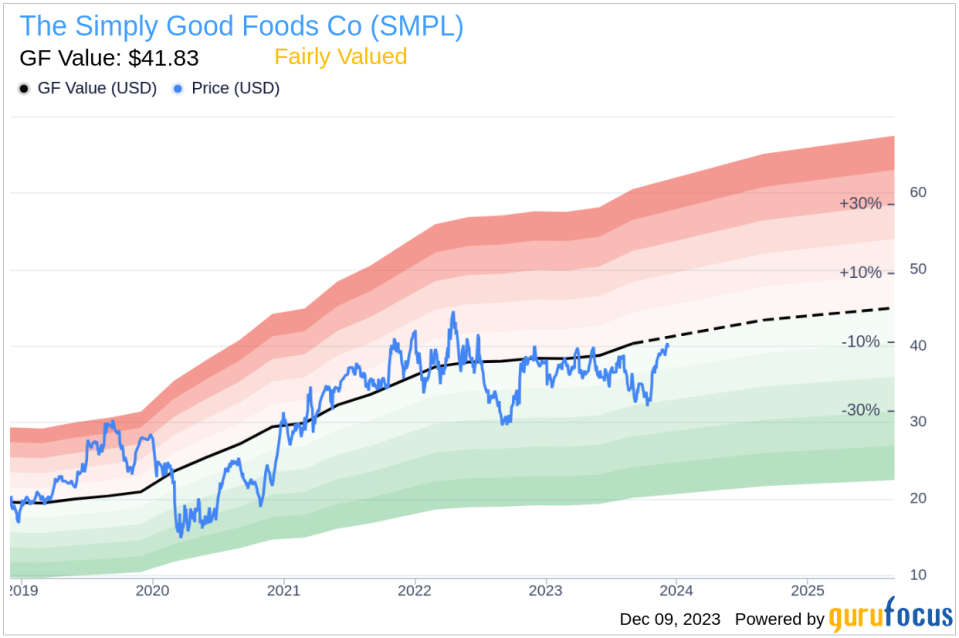

Considering the stock's valuation, with a price of $40.15 and a GuruFocus Value of $41.83, The Simply Good Foods Co has a price-to-GF-Value ratio of 0.96. This indicates that the stock is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the buying and selling activities of insiders over time. This can be a useful tool for investors trying to gauge the internal sentiment towards the stock.

The GF Value image offers a snapshot of the stock's valuation in relation to its intrinsic value, helping investors determine whether the stock is overvalued, undervalued, or fairly valued.

Conclusion

The sale of 8,180 shares by Director Brian Ratzan is a notable event for investors of The Simply Good Foods Co. While the reasons behind the insider's decision to sell are not publicly known, the transaction, along with the overall trend of more insider sells than buys, may prompt investors to take a closer look at the company's valuation and future prospects. With the stock currently deemed Fairly Valued based on the GF Value, investors should consider both the insider trading patterns and the company's fundamentals when making investment decisions.

As always, it is important for investors to conduct their own due diligence and consider multiple factors, including insider transactions, financial performance, industry trends, and broader market conditions, before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.