Insider Sell: Director Carmen Romeo Sells 5,000 Shares of SEI Investments Co (SEIC)

SEI Investments Co (NASDAQ:SEIC), a leading provider of investment processing, management, and operations solutions, has recently witnessed an insider sell that has caught the attention of market analysts and investors. On December 1, 2023, Director Carmen Romeo parted with 5,000 shares of the company, a transaction that has sparked discussions regarding insider activity and its implications for the stock's future.

Who is Carmen Romeo of SEI Investments Co?

Carmen Romeo is a notable figure within SEI Investments Co, serving as a Director. Directors at publicly traded companies like SEI Investments Co are responsible for overseeing the company's management and ensuring that shareholder interests are represented. They play a crucial role in shaping the strategic direction of the company and are privy to in-depth knowledge about the firm's operations and prospects. Romeo's decision to sell shares is therefore of particular interest to those following the company's insider activity.

SEI Investments Co's Business Description

SEI Investments Co is a global provider of investment processing, investment management, and investment operations solutions. The company helps corporations, financial institutions, financial advisors, and ultra-high-net-worth families create and manage wealth by providing innovative and comprehensive solutions that enable their clients to achieve their investment objectives. With a history of innovation, SEI Investments Co has been a pioneer in many areas of the investment services industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are closely monitored by investors as they can provide insights into a company's internal perspective on the stock's valuation. Over the past year, Carmen Romeo has sold a total of 5,000 shares and has not made any purchases. This one-sided activity raises questions about the insider's confidence in the company's future performance.

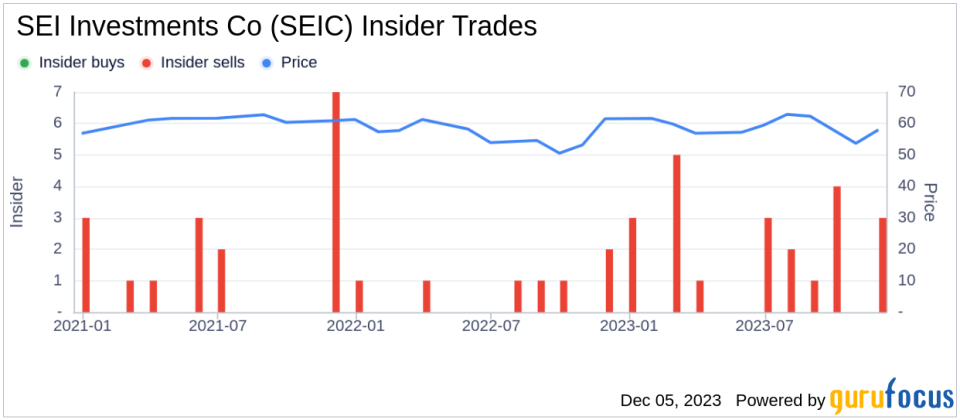

The insider transaction history for SEI Investments Co shows a trend of more insider sells than buys over the past year, with 23 insider sells and no insider buys. This could suggest that insiders, on the whole, believe the stock may be fully valued or that they are taking profits after a period of performance.

On the day of the insider's recent sell, shares of SEI Investments Co were trading at $59, giving the company a market cap of $7.911 billion. The price-earnings ratio of 17.79 is higher than the industry median of 13.18 but lower than the company's historical median price-earnings ratio, indicating a potentially fair valuation relative to its peers and its own trading history.

With a price of $59 and a GuruFocus Value of $62.87, SEI Investments Co has a price-to-GF-Value ratio of 0.94, suggesting that the stock is Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the selling and buying patterns of insiders at SEI Investments Co. The absence of buys and the prevalence of sells could be interpreted in various ways, but it often indicates that insiders might perceive the stock's current price as an opportune time to realize gains.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value. A price-to-GF-Value ratio below 1 suggests that the stock is not overvalued, which could reassure investors that the insider's sell is not necessarily a sign of an impending downturn.

Conclusion

Director Carmen Romeo's recent sale of 5,000 shares of SEI Investments Co has provided the market with valuable information regarding insider sentiment. While the insider's actions alone should not be used as a sole indicator of the stock's future movement, they do offer a piece of the puzzle when assessing the company's valuation and prospects. With SEI Investments Co's stock being fairly valued according to the GF Value and the insider trend showing a clear preference for selling over buying, investors should keep a close watch on further insider activity and company performance to inform their investment decisions.

As always, it is important for investors to consider the broader market context, the company's fundamentals, and their own investment strategy when interpreting insider transactions and making investment choices.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.