Insider Sell: Director Clayton Trier Sells Shares of US Physical Therapy Inc (USPH)

Director Clayton Trier has recently made a significant stock transaction in US Physical Therapy Inc (NYSE:USPH), selling 1,170 shares on December 13, 2023. This move by an insider of the company has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Clayton Trier of US Physical Therapy Inc?

Clayton Trier serves as a Director at US Physical Therapy Inc, a national operator of outpatient physical therapy clinics. The company has a strong presence in the healthcare sector, providing services that include pre- and post-operative care for a variety of orthopedic-related disorders and sports-related injuries, rehabilitation of injured workers, and preventative care. Trier's role in the company involves oversight and strategic guidance, contributing to the company's growth and operational efficiency. His actions in the stock market, particularly his recent sale, are closely monitored as they may reflect his confidence in the company's future prospects.

US Physical Therapy Inc's Business Description

US Physical Therapy Inc is a prominent player in the outpatient physical therapy market. The company operates clinics that offer specialized treatment for orthopedic conditions, preventative care, rehabilitation of injured workers, and fitness services. With a focus on personalized therapy programs, US Physical Therapy Inc aims to improve the quality of life for patients and to facilitate their return to full functionality. The company's business model is built on a foundation of expert care, patient satisfaction, and operational excellence, making it a trusted name in the healthcare industry.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

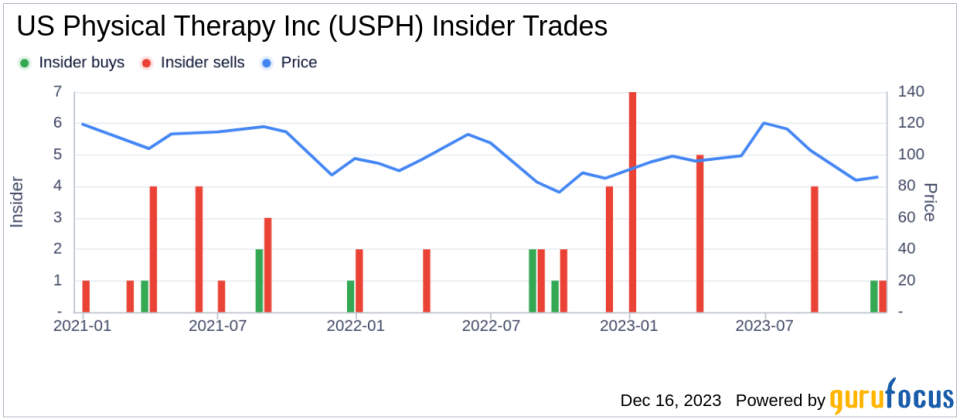

Insider transactions can provide valuable insights into a company's health and the sentiment of its executives and directors. Over the past year, Clayton Trier has sold a total of 1,540 shares and has not made any purchases. This pattern of selling without corresponding buys could be interpreted in various ways. It might indicate that the insider is taking profits, diversifying their investments, or that they have concerns about the company's future performance. However, without additional context, it is challenging to draw definitive conclusions.

The overall insider transaction history for US Physical Therapy Inc shows a trend of more insider sells (12) than buys (1) over the past year. This could suggest that insiders are more inclined to sell their shares than to acquire more, potentially signaling caution or a belief that the stock may be fully valued at current levels.

On the day of Trier's recent sale, shares of US Physical Therapy Inc were trading at $92.26, giving the company a market cap of $1.333 billion. The price-earnings ratio of 51.73 is higher than both the industry median of 25.575 and the company's historical median, indicating that the stock may be trading at a premium compared to its peers and its own past valuation.

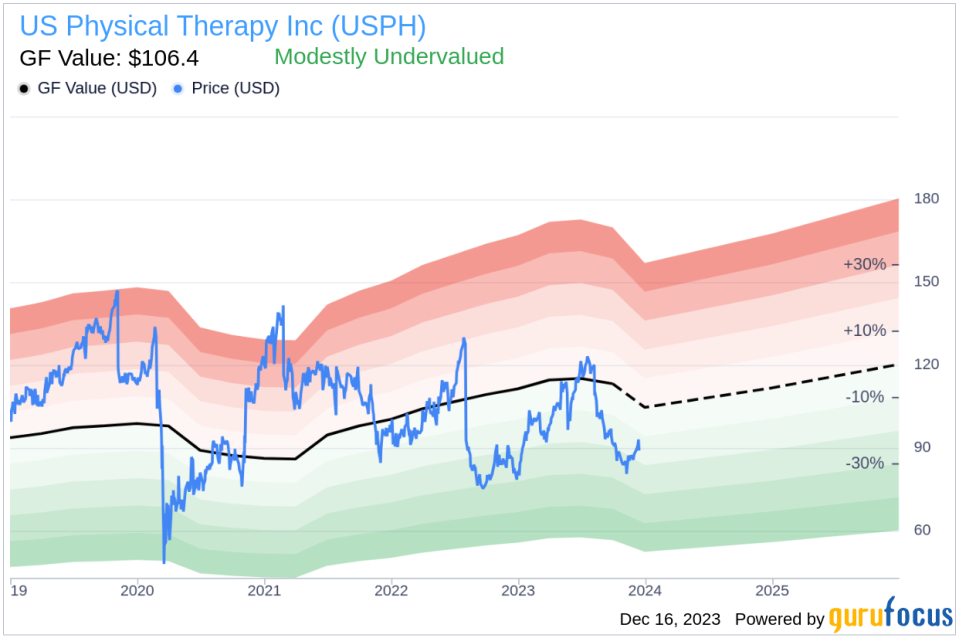

However, with a price of $92.26 and a GuruFocus Value of $106.40, US Physical Therapy Inc has a price-to-GF-Value ratio of 0.87, suggesting that the stock is modestly undervalued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

The insider trend image above provides a visual representation of the insider buying and selling activities over time, which can be a useful tool for investors when assessing the stock's potential.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value, offering another perspective for investors considering US Physical Therapy Inc's shares.

Conclusion

Director Clayton Trier's recent sale of shares in US Physical Therapy Inc may raise questions among investors about the insider's view of the company's valuation and future prospects. While the stock appears modestly undervalued based on the GF Value, the higher than average price-earnings ratio and the pattern of insider selling over the past year suggest a more complex picture. Investors should consider these insider transactions as part of a broader analysis, taking into account the company's performance, industry trends, and overall market conditions before making investment decisions.

As with any insider activity, it is important to remember that there can be many personal and financial reasons behind a director's decision to sell shares, and such transactions do not always reflect a lack of confidence in the company. Nonetheless, monitoring insider trends can provide valuable insights and should be one of the many factors considered in a comprehensive investment strategy.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.