Insider Sell: Director Constance Skidmore Sells 3,000 Shares of Comfort Systems USA Inc (FIX)

Comfort Systems USA Inc (NYSE:FIX), a leader in the provision of commercial, industrial, and institutional heating, ventilation, air conditioning, and electrical contracting services, has recently witnessed a notable insider sell by Director Constance Skidmore. On December 11, 2023, Constance Skidmore parted with 3,000 shares of the company, a transaction that has caught the attention of investors and market analysts alike.

Who is Constance Skidmore?

Constance Skidmore is known for her role as a director at Comfort Systems USA Inc. Her background includes extensive experience in financial and strategic planning, which she has brought to the table in her capacity as a board member. Skidmore's insights and decision-making skills have been valuable assets to the company, contributing to its strategic direction and governance.

Comfort Systems USA Inc's Business Description

Comfort Systems USA Inc is a company that specializes in providing comprehensive HVAC and electrical services. These services are critical for the construction and maintenance of commercial and industrial buildings, as well as large-scale residential developments. The company's expertise extends to designing, installing, maintaining, and repairing HVAC systems, which ensures that buildings are comfortable, energy-efficient, and compliant with various regulations. Comfort Systems USA Inc's commitment to quality service and customer satisfaction has established it as a trusted name in the industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

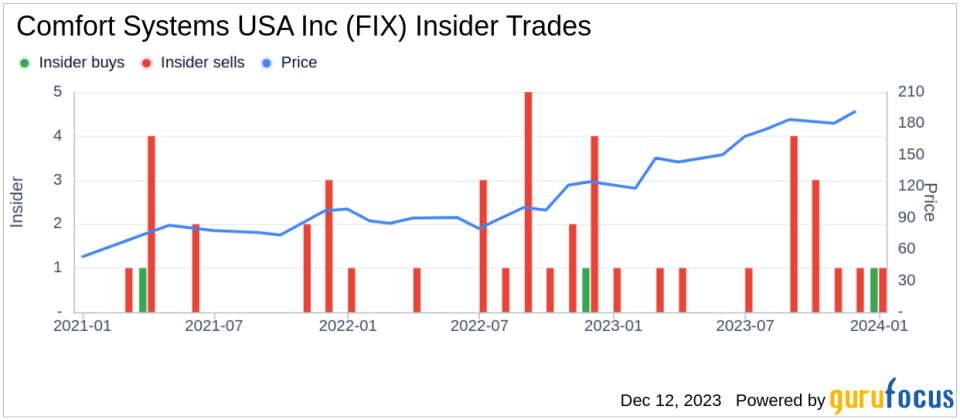

Insider transactions are often scrutinized by investors as they can provide insights into a company's internal perspective on its stock's value. In the case of Comfort Systems USA Inc, the past year has seen a total of 1 insider buy and 14 insider sells. This trend suggests that insiders may perceive the stock's current price as being on the higher side, prompting them to realize gains.

On the day of the insider's recent sell, shares of Comfort Systems USA Inc were trading at $193.4, valuing the company at a market cap of $7.107 billion. This price point is significantly higher than the industry median P/E ratio of 14.68 and above the company's historical median P/E ratio, indicating a premium valuation for FIX shares.

The relationship between insider selling and stock price can be complex. While a sell-off by insiders might initially signal a lack of confidence in the stock's future appreciation, it is also common for insiders to sell shares for personal financial planning reasons, unrelated to their outlook on the company's performance. Therefore, while insider sells can be a red flag, they must be interpreted within a broader context.

As seen in the insider trend image above, the pattern of insider transactions may provide additional context to the recent sell by Constance Skidmore. The image illustrates the balance of buys and sells over a period, which can help investors understand the sentiment of those with intimate knowledge of the company's operations.

Valuation and GF Value

Comfort Systems USA Inc's P/E ratio of 24.91 suggests a higher valuation compared to the industry median. This elevated ratio could be justified if the company is expected to have higher growth or profitability than its peers. However, investors should consider whether the current stock price adequately reflects the company's future prospects.

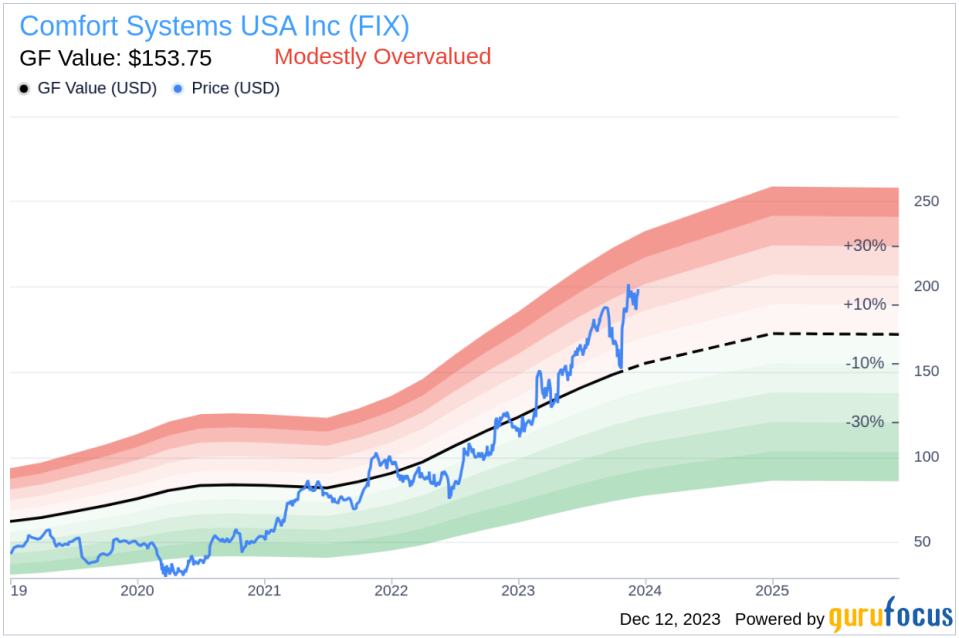

The price-to-GF-Value ratio of 1.26 indicates that the stock is modestly overvalued based on its GF Value of $153.75. The GF Value is a proprietary metric developed by GuruFocus, which factors in historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates provided by Morningstar analysts.

The GF Value image above provides a visual representation of Comfort Systems USA Inc's stock price in relation to its intrinsic value estimate. When the stock price exceeds the GF Value, as it does in this case, it suggests that the stock may be overpriced relative to the intrinsic value estimate.

Conclusion

The recent insider sell by Director Constance Skidmore, coupled with the overall trend of more insider sells than buys over the past year, may raise questions among investors about the stock's current valuation. While the company's market cap and P/E ratio reflect a strong market position, the price-to-GF-Value ratio indicates that the stock might be modestly overvalued. Investors should consider these factors, along with the company's growth prospects and industry trends, when making investment decisions regarding Comfort Systems USA Inc.

As always, it is important for investors to conduct their own due diligence and not rely solely on insider transaction patterns when evaluating a stock's potential. Insider sells can be influenced by a variety of factors, and a comprehensive analysis should include a review of the company's financial health, competitive position, and future outlook.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.