Insider Sell: Director Ekta Singh-Bushell Sells 5,976 Shares of Huron Consulting Group Inc (HURN)

In a notable insider transaction, Director Ekta Singh-Bushell has parted with 5,976 shares of Huron Consulting Group Inc (NASDAQ:HURN), a global professional services firm, on November 27, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's financial health and future prospects.

Who is Ekta Singh-Bushell?

Ekta Singh-Bushell serves on the board of directors at Huron Consulting Group Inc. With a background that spans technology, finance, and operational leadership, Singh-Bushell brings a wealth of experience to the table. Her insights and strategic guidance are instrumental in steering the company towards its objectives. Prior to her tenure at Huron, Singh-Bushell has held significant roles in other organizations, which have equipped her with a keen understanding of the consulting industry and corporate governance.

About Huron Consulting Group Inc

Huron Consulting Group Inc is a global professional services firm that assists clients in diverse industries to improve performance, comply with complex regulations, reduce costs, recover from distress, leverage technology, and stimulate growth. The company offers services including strategy, operations, advisory, technology, and analytics across healthcare, higher education, life sciences, and commercial sectors. Huron's expertise in these areas has made it a trusted advisor and consultant for organizations looking to navigate the complexities of their respective markets.

Analysis of Insider Buy/Sell and Relationship with Stock Price

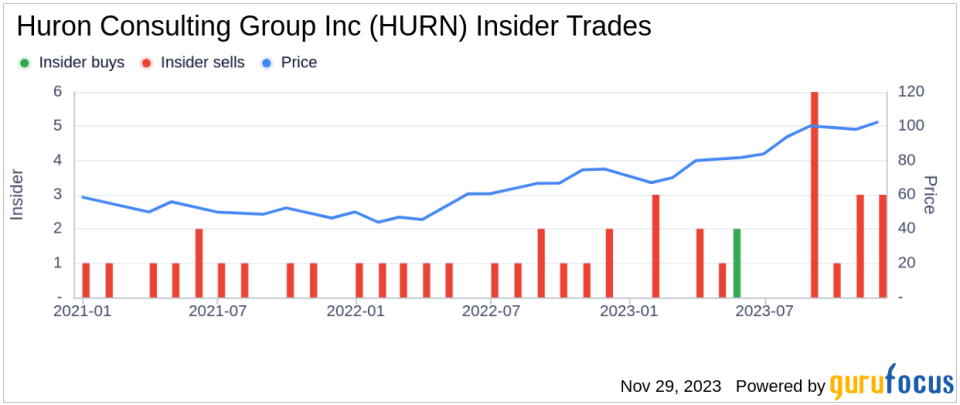

Insider transactions, particularly those involving a sale or purchase of a company's stock by its directors, executives, or other key personnel, can be a strong indicator of the company's internal perspective on its valuation. In the case of Huron Consulting Group Inc, the insider transaction history over the past year shows a pattern that leans more towards selling than buying, with 19 insider sells and only 2 insider buys.

Ekta Singh-Bushell's recent sale of 5,976 shares is part of a larger trend of her transactions over the past year, totaling 6,360 shares sold. The absence of any purchases in the same period may suggest that insiders, including Singh-Bushell, perceive the stock's current price as being on the higher end of its value spectrum, potentially signaling a belief that the stock is fully valued or even overvalued at current levels.

On the day of the insider's recent sale, shares of Huron Consulting Group Inc were trading at $105.95, giving the company a market capitalization of $1.924 billion. This price reflects a price-earnings ratio of 26.32, which is above both the industry median of 16.96 and Huron's historical median price-earnings ratio. Such a high price-earnings ratio could be indicative of the market's high expectations for future earnings growth or a premium placed on the stock due to perceived quality or stability.

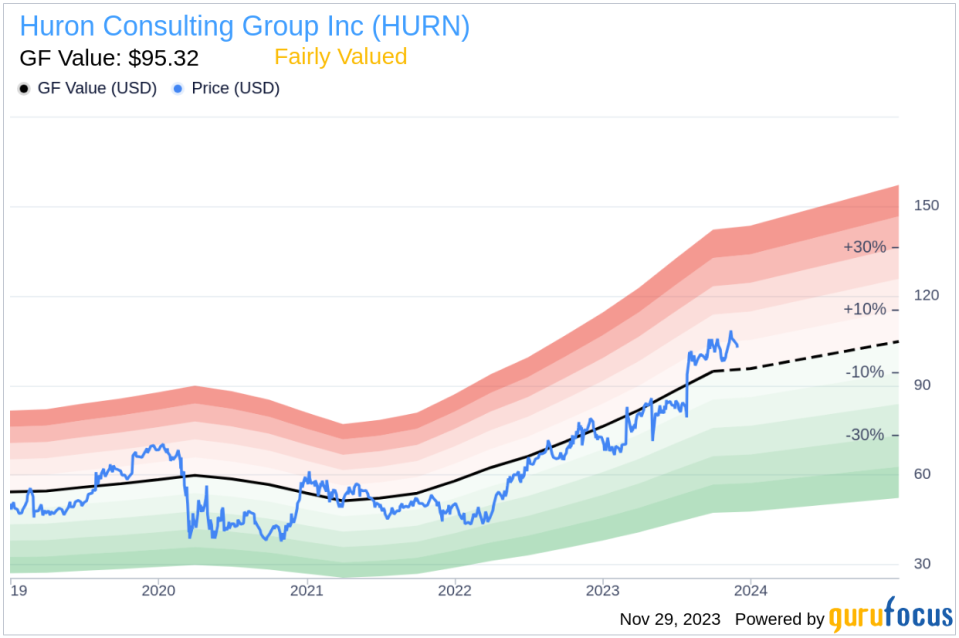

When considering the price-to-GF-Value ratio of 1.11, Huron Consulting Group Inc appears to be Fairly Valued based on its GF Value of $95.32. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above illustrates the recent insider selling and buying patterns, providing a visual representation of the transactions over the past year. The predominance of selling transactions could be interpreted as insiders taking advantage of the current stock price to realize gains.

The GF Value image provides a snapshot of how the stock is valued in relation to the GuruFocus estimate of its intrinsic value. A ratio greater than 1 suggests that the stock is trading at a premium to its GF Value, which aligns with the current market pricing and the insider's decision to sell.

Conclusion

Insider transactions, such as the recent sale by Director Ekta Singh-Bushell, offer valuable clues about the internal assessment of a company's valuation. In the case of Huron Consulting Group Inc, the pattern of insider selling over the past year, coupled with a high price-earnings ratio and a price-to-GF-Value ratio that indicates fair valuation, suggests that insiders might believe the stock's growth potential is adequately reflected in its current price. Investors and analysts will continue to monitor insider activity and company performance to gauge the future direction of the stock's price.

It is important for investors to consider not only insider transactions but also the broader market conditions, the company's fundamentals, and industry trends when making investment decisions. While insider selling can be a red flag in some cases, it must be weighed against other factors to form a comprehensive view of the investment landscape.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.