Insider Sell: Director Frederic Simon Sells 35,000 Shares of JFrog Ltd (FROG)

In a notable insider transaction, Director Frederic Simon of JFrog Ltd (NASDAQ:FROG) parted with 35,000 shares of the company on November 21, 2023. This move has caught the attention of investors and analysts alike, as insider activity can often provide valuable insights into a company's prospects and the sentiment of its top executives.

Who is Frederic Simon of JFrog Ltd?

Frederic Simon is a key figure at JFrog Ltd, serving as one of its directors. His involvement with the company extends beyond mere oversight; he is deeply engaged with the strategic direction and operational performance of the firm. Simon's actions, particularly in the realm of stock transactions, are closely monitored for indications of his confidence in JFrog's future.

JFrog Ltd's Business Description

JFrog Ltd is a technology company that specializes in providing software development tools. The company's flagship product, the JFrog Platform, is a tool that streamlines the process of software updates and delivery by automating continuous integration and continuous delivery (CI/CD) pipelines. This platform is designed to support DevOps practices, allowing developers to release software faster and more efficiently. JFrog's solutions are widely used by software developers and IT professionals around the world, making it a significant player in the field of software development and delivery.

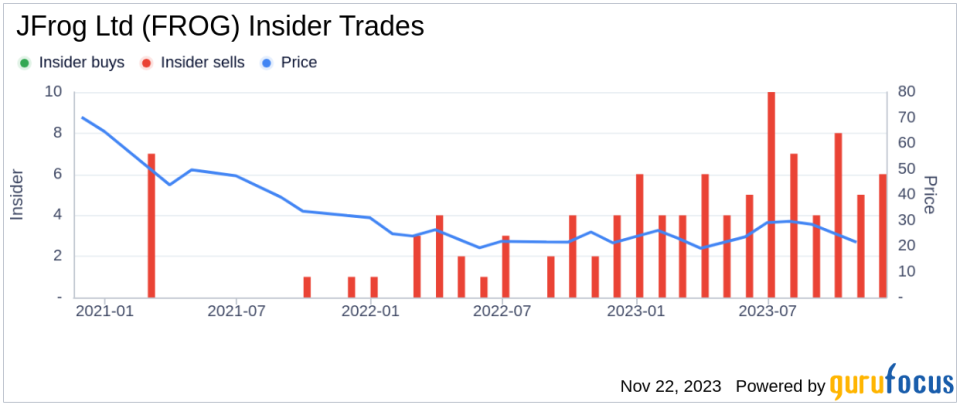

Analysis of Insider Buy/Sell and Relationship with Stock Price

The recent sale by Frederic Simon is part of a broader pattern of insider selling at JFrog Ltd. Over the past year, Simon has sold a total of 600,000 shares and has not made any purchases. This one-sided transaction history could be interpreted in several ways. On one hand, it might suggest that insiders see the current stock price as an opportune moment to realize gains. On the other hand, it could also raise questions about long-term confidence in the company's growth prospects.

The insider trend image above provides a visual representation of this selling pattern. It's important to note that while insider selling can be a red flag, it does not always indicate a problem with the company. Insiders might sell shares for personal reasons, such as diversifying their portfolio, funding personal expenses, or tax planning.When analyzing the relationship between insider transactions and stock price, it's crucial to consider the context. Shares of JFrog Ltd were trading at $26.63 on the day of Simon's recent sale, with a market cap of $2.819 billion. This price point is below the GuruFocus Value (GF Value) of $33.34, suggesting that the stock is modestly undervalued.

The GF Value, as shown in the image above, is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. With a price-to-GF-Value ratio of 0.8, JFrog Ltd appears to be trading at a discount to its intrinsic value, which could indicate an attractive entry point for investors.However, the insider selling trend might temper some of the enthusiasm for the stock. If insiders are selling while the stock is undervalued, it could suggest that they believe the market has not fully recognized the challenges the company may face, or they may have information that is not yet public.

Conclusion

The sale of 35,000 shares by Director Frederic Simon is a significant event for JFrog Ltd and its investors. While the company's stock appears to be undervalued based on the GF Value, the persistent insider selling raises questions about the stock's future trajectory. Investors should consider both the valuation metrics and insider activity when making investment decisions regarding JFrog Ltd. As always, it's recommended to look at the full picture, including the company's financial health, market position, and growth prospects, alongside insider trading patterns, before drawing any conclusions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.