Insider Sell: Director Gilchrist Malcolm Ian Grant Sells Shares of Liberty SiriusXM Group

Recent filings with the SEC have revealed that Gilchrist Malcolm Ian Grant, a director of Liberty SiriusXM Group (NASDAQ:LSXMA), sold 3,258 shares of the company on November 28, 2023. This transaction has caught the attention of investors trying to understand the implications of insider activities on their investment decisions.

Who is Gilchrist Malcolm Ian Grant?

Gilchrist Malcolm Ian Grant is known to be a seasoned member of the board of directors at Liberty SiriusXM Group. Directors of a company are typically privy to the most intimate operational details and future prospects, making their trading activities a focal point for investors seeking insights into the company's health and potential.

Liberty SiriusXM Group's Business Description

Liberty SiriusXM Group is a subsidiary of Liberty Media Corporation, operating primarily through its ownership interest in Sirius XM Holdings Inc. Sirius XM is a leading audio entertainment company, known for its subscription-based satellite radio services. The company provides a platform for a wide array of radio channels featuring music, sports, talk shows, news, and entertainment, catering to a diverse audience across the United States. Liberty SiriusXM Group's business model capitalizes on the steady revenue stream from subscriptions and advertising, leveraging its extensive content library and exclusive media rights to attract and retain listeners.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider trading activities, such as the recent sale by the insider, can provide valuable clues about a company's future prospects. Over the past year, Gilchrist Malcolm Ian Grant has sold a total of 3,258 shares and has not made any purchases. This one-sided activity might raise questions about the insider's confidence in the company's future growth.

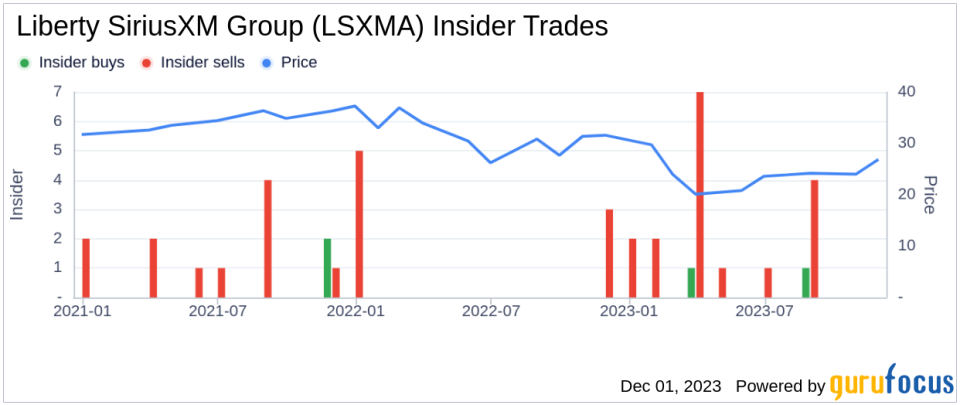

Comparing this to the broader insider transaction history for Liberty SiriusXM Group, there have been 2 insider buys and 18 insider sells over the past year. This trend suggests a general inclination towards selling among insiders, which could be interpreted in several ways. It might indicate that insiders believe the shares are fully valued or possibly overvalued, or it could simply reflect personal financial management decisions without any negative connotations for the company's outlook.

On the day of the insider's recent sale, shares of Liberty SiriusXM Group were trading at $65.07, giving the stock a market cap of $8.813 billion. This valuation places the company at a price-earnings ratio of 10.63, which is lower than the industry median of 17.44 and also below the company's historical median price-earnings ratio. This could suggest that the stock is undervalued based on earnings, potentially offering an attractive entry point for value investors.

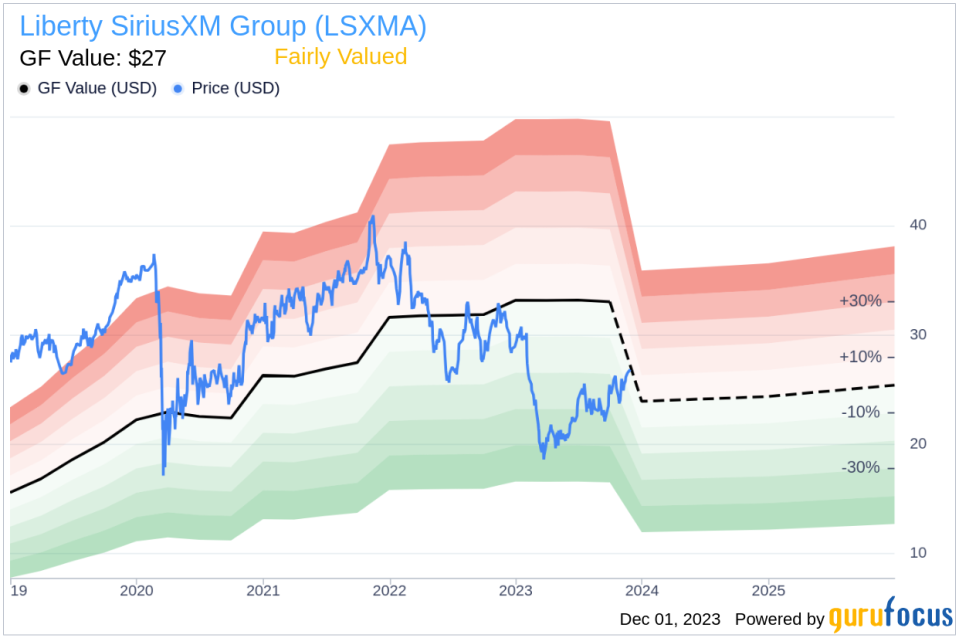

However, with a price-to-GF-Value ratio of 2.41, the stock is considered Fairly Valued according to the GuruFocus Value, which is at $27.00. The GF Value is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the insider trading activities, highlighting the recent transactions and the overall trend of buys and sells.

The GF Value image offers a perspective on the stock's valuation relative to its intrinsic value, suggesting that the current market price is in line with what might be expected based on fundamental analysis.

Conclusion

While the insider's recent sale might not be a definitive indicator of the company's future performance, it is one piece of the puzzle that investors should consider. The lower than average price-earnings ratio could be a sign of undervaluation, but the Fairly Valued status based on the GF Value suggests that the stock might be priced appropriately given its current fundamentals.

Investors should weigh this insider activity alongside other factors such as the company's financial health, competitive position, and market conditions. As always, insider trades should not be used in isolation but rather as part of a comprehensive investment analysis process.

For those invested in or considering an investment in Liberty SiriusXM Group, monitoring insider transactions, such as those by Gilchrist Malcolm Ian Grant, will continue to be an important aspect of understanding the stock's potential and aligning investment strategies with the insights these activities provide.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.