Insider Sell: Director Jack Henry Sells Shares of Grand Canyon Education Inc (LOPE)

Director Jack Henry of Grand Canyon Education Inc (NASDAQ:LOPE) has recently made a significant change to his holdings in the company. On November 17, 2023, the insider sold 1,450 shares of the education services provider. This transaction has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is Jack Henry of Grand Canyon Education Inc?

Jack Henry is a notable figure within Grand Canyon Education Inc, serving as a director. Directors are responsible for overseeing the company's management and ensuring that shareholder interests are represented. Henry's actions, particularly in the realm of stock transactions, are closely monitored for indications of his confidence in the company's future performance.

Grand Canyon Education Inc's Business Description

Grand Canyon Education Inc is a leading provider of higher education services, specializing in offering graduate and undergraduate degree programs in a wide range of disciplines. The company operates through its subsidiary, Grand Canyon University, which delivers education both online and on-campus. Grand Canyon Education Inc prides itself on providing accessible and high-quality education that meets the needs of a diverse student population, including working professionals seeking to advance their careers.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider transactions are often considered a barometer of a company's internal perspective. When insiders buy shares, it is generally seen as a sign of confidence in the company's future. Conversely, when insiders sell, it can raise questions about the company's outlook or an insider's view of the stock's valuation.

Over the past year, Jack Henry has sold a total of 3,950 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider sees the current stock price as a good opportunity to realize gains or reallocate assets.

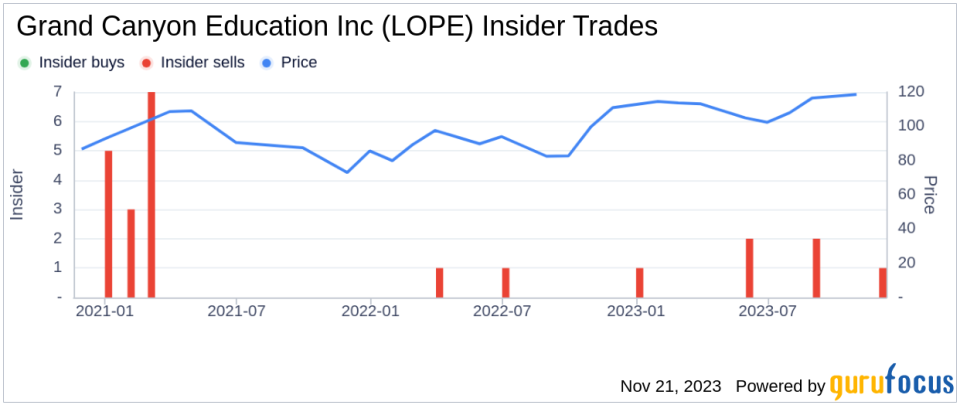

The insider transaction history for Grand Canyon Education Inc shows a lack of insider buying over the past year, with 0 total buys. However, there have been 6 insider sells in the same timeframe. This trend of more frequent selling could indicate that insiders, including Jack Henry, may believe the stock is fully valued or possibly overvalued at current levels.

On the day of Jack Henry's recent sale, shares of Grand Canyon Education Inc were trading at $137.92, giving the company a market cap of $4,052.548 million. This valuation places the stock at a price-earnings ratio of 21.15, which is higher than both the industry median of 18.62 and the company's historical median price-earnings ratio. This elevated P/E ratio could be a contributing factor to the insider's decision to sell shares.

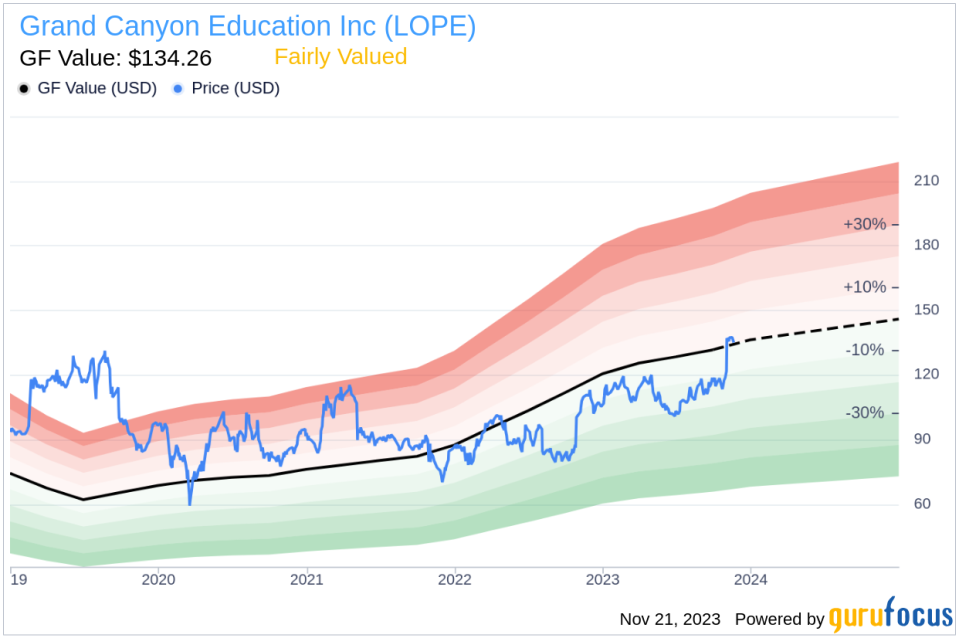

When considering the stock's valuation in relation to the GuruFocus Value (GF Value), Grand Canyon Education Inc has a price-to-GF-Value ratio of 1.03, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is calculated using historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates from Morningstar analysts.

The insider trend image above provides a visual representation of the selling pattern over the past year. This consistent selling activity could be interpreted as a cautious stance by insiders, possibly anticipating a plateau or decline in stock performance.

The GF Value image further illustrates the stock's current valuation in relation to its intrinsic value estimate. While the stock is deemed Fairly Valued, the proximity of the price to the GF Value suggests that there is limited upside potential, which may have influenced the insider's decision to sell.

Conclusion

Director Jack Henry's recent sale of 1,450 shares of Grand Canyon Education Inc is a transaction that warrants attention. While the company's stock is considered Fairly Valued based on the GF Value, the higher price-earnings ratio compared to the industry median and the pattern of insider selling over the past year could suggest that insiders like Jack Henry are taking a more conservative approach to their investment in the company. Investors should consider these insider trends alongside broader market analysis when making investment decisions regarding Grand Canyon Education Inc.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.