Insider Sell: Director James Courter Sells 12,725 Shares of Genie Energy Ltd (GNE)

James Courter, a notable director at Genie Energy Ltd (NYSE:GNE), has recently sold 12,725 shares of the company's stock. The transaction took place on November 27, 2023, and has caught the attention of investors and market analysts. This insider sell event is significant as it provides insights into the sentiment of company insiders regarding the stock's future performance.

Who is James Courter?

James Courter has been a key figure at Genie Energy Ltd, serving as a director. His role at the company involves overseeing corporate governance and strategic decisions, which gives him a deep understanding of the company's operations and market position. Courter's transactions in the company's stock are closely watched as they may reflect his confidence in the company's future prospects.

Genie Energy Ltd's Business Description

Genie Energy Ltd is an energy company that operates through various subsidiaries. The company is primarily involved in the provision of energy services, including the supply of electricity and natural gas to residential and small business customers. Genie Energy Ltd also has interests in oil and gas projects and alternative energy initiatives. The company's diverse portfolio of energy solutions positions it to capitalize on the dynamic energy market and the growing demand for sustainable energy sources.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions are often considered a barometer of a company's health and future performance. In the case of Genie Energy Ltd, the insider transaction history shows a pattern of more sells than buys over the past year. Specifically, James Courter has sold a total of 40,000 shares and has not made any purchases. This could signal a lack of confidence from the insider or simply a personal financial decision to diversify or liquidate assets.

On the day of the recent sell, shares of Genie Energy Ltd were trading at $24.45, giving the company a market cap of $661.048 million. The price-earnings ratio of 10.72 is lower than both the industry median of 15.1 and the company's historical median, suggesting that the stock may be undervalued based on earnings.

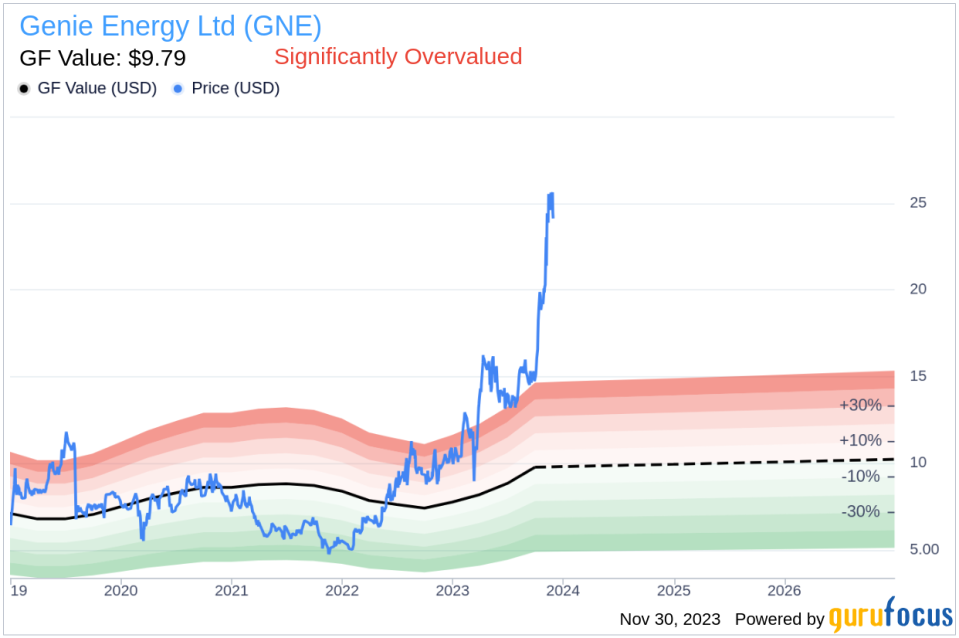

However, the price-to-GF-Value ratio tells a different story. With a stock price of $24.45 and a GuruFocus Value of $9.79, the price-to-GF-Value ratio stands at 2.5, indicating that the stock is significantly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The discrepancy between the price-earnings ratio and the GF Value suggests that while the company may be performing well currently, its stock price may not be sustainable in the long term.

The insider trend image above provides a visual representation of the insider selling pattern at Genie Energy Ltd. The absence of insider buys over the past year, coupled with the consistent sells, could be interpreted as a cautious or bearish stance from insiders regarding the stock's future.

The GF Value image further illustrates the overvaluation of the stock when compared to the intrinsic value calculated by GuruFocus. This disparity may be a contributing factor to the insider's decision to sell shares.

Conclusion

James Courter's recent sale of 12,725 shares of Genie Energy Ltd is a transaction that warrants attention from investors. While the company's low price-earnings ratio may suggest an undervalued stock based on current earnings, the significantly overvalued status according to the GF Value indicates that the stock price may not be justified by the company's intrinsic value. The insider's sell-off, in conjunction with the overall trend of more insider sells than buys, could suggest that those with intimate knowledge of the company anticipate a potential downturn or are simply taking profits during a period of overvaluation. Investors should consider these insider actions as part of their broader analysis when making investment decisions regarding Genie Energy Ltd.

As always, it is important for investors to conduct their own due diligence and consider multiple factors, including insider transactions, financial metrics, and market conditions, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.