Insider Sell: Director James Owens Sells 11,400 Shares of Donaldson Co Inc (DCI)

Director James Owens of Donaldson Co Inc (NYSE:DCI) has recently made a significant stock transaction, according to the latest SEC filings. On December 1, 2023, the insider sold 11,400 shares of the company, a move that has caught the attention of investors and market analysts. This article delves into the details of the transaction, the insider's history, the company's business description, and the potential implications of such insider activities on the stock's performance.

Who is James Owens?

James Owens is a notable figure within Donaldson Co Inc, serving as a director. Directors play a crucial role in shaping the strategic direction of a company and are often privy to in-depth knowledge about the company's operations and prospects. Owens's decision to sell a substantial number of shares may be interpreted in various ways, but it is essential to consider the context and the company's performance when evaluating the significance of this insider sell.

Donaldson Co Inc's Business Description

Donaldson Co Inc is a global leader in the industrial air filtration market, providing innovative filtration solutions for a wide range of industries, including aerospace, agriculture, construction, mining, and transportation. The company's products are designed to improve air quality, protect engines and equipment, and enhance performance. With a commitment to sustainability and technological advancement, Donaldson Co Inc has established a reputation for quality and reliability in the filtration industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

Insider transactions can provide valuable insights into a company's health and future prospects. Over the past year, James Owens has sold 11,400 shares in total and has not made any purchases. This one-sided activity might raise questions about the insider's confidence in the company's future performance.

When examining the broader insider transaction history for Donaldson Co Inc, we observe that there has been only 1 insider buy compared to 8 insider sells over the past year. This trend could suggest that insiders, on balance, are more inclined to sell their shares than to acquire more, which might be interpreted as a lack of confidence among those with intimate knowledge of the company.

However, it is crucial to consider these transactions in the context of the stock's valuation and market performance. On the day of Owens's recent sell, shares of Donaldson Co Inc were trading at $60.89, giving the company a market cap of $7,405.280 million. The price-earnings ratio stood at 20.75, lower than both the industry median of 22.77 and the company's historical median price-earnings ratio. This indicates that the stock was trading at a discount relative to its peers and its own historical valuation.

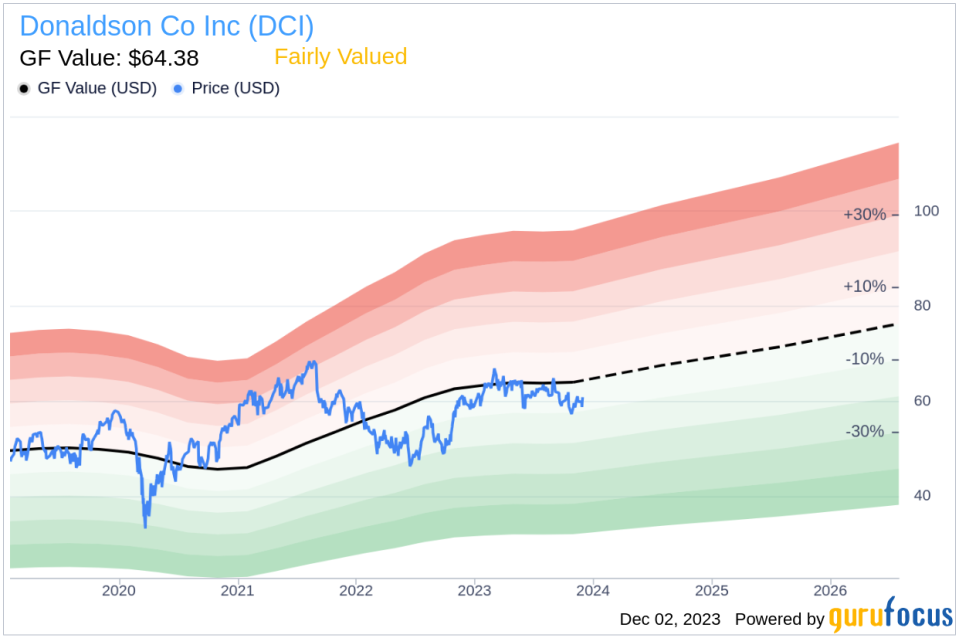

Furthermore, with a price of $60.89 and a GuruFocus Value of $64.38, Donaldson Co Inc had a price-to-GF-Value ratio of 0.95, suggesting that the stock was Fairly Valued based on its GF Value. The GF Value is an intrinsic value estimate that considers historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates.

Given this valuation context, Owens's decision to sell may not necessarily reflect a negative outlook on the company's value but could be motivated by personal financial planning or diversification strategies.

The insider trend image above provides a visual representation of the buying and selling patterns of insiders at Donaldson Co Inc. It is important to analyze such trends alongside other financial metrics and market indicators to gain a comprehensive understanding of the potential impact on the stock price.

The GF Value image further illustrates the stock's valuation relative to its intrinsic value estimate. When the stock price aligns closely with the GF Value, as it does in this case, it suggests that the market is pricing the stock in a manner consistent with its estimated true worth.

Conclusion

Director James Owens's recent sale of 11,400 shares of Donaldson Co Inc is a significant event that warrants attention. While insider sells can sometimes signal concerns about a company's future, the context of the stock's valuation and the overall insider transaction trend must be considered. In the case of Donaldson Co Inc, the stock appears to be fairly valued, and the insider selling activity may not necessarily indicate a bearish outlook. Investors should continue to monitor insider transactions and other key financial indicators to make informed decisions about their investments in Donaldson Co Inc.

It is also advisable for investors to consider the broader market conditions, the company's performance, and any recent news or developments that could influence the stock's price. As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock's potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.