Insider Sell: Director Jane Sherburne Sells 2000 Shares of Teledyne Technologies Inc

On September 12, 2023, Director Jane Sherburne sold 2,000 shares of Teledyne Technologies Inc (NYSE:TDY). This move comes amidst a year where the insider has sold a total of 2,000 shares and purchased none.

Jane Sherburne is a prominent figure in the Teledyne Technologies Inc company, serving as a Director. Her decision to sell shares in the company is a significant event that could potentially impact the stock's performance.

Teledyne Technologies Inc is a leading provider of sophisticated electronic components, instruments, and communication products. They also provide engineering services and aerospace engines. The company's operations are primarily located in the United States, Canada, the United Kingdom, and Western and Northern Europe.

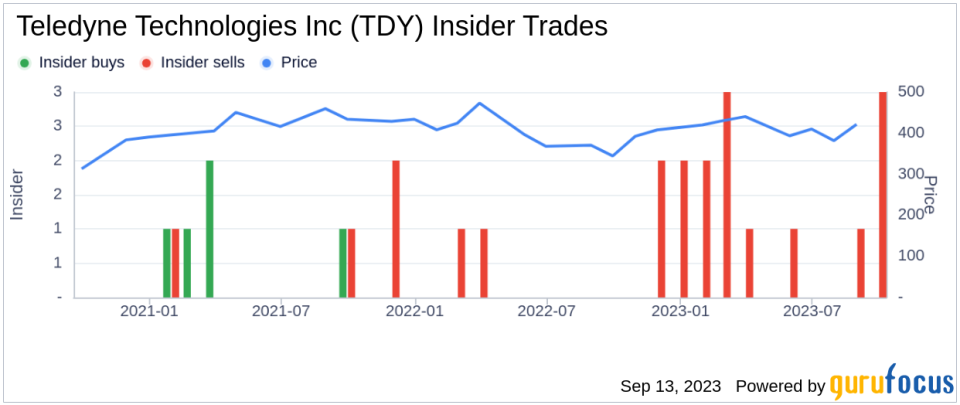

The insider transaction history for Teledyne Technologies Inc shows a trend of more sells than buys over the past year. There have been 15 insider sells and 0 insider buys in total. This could potentially indicate a bearish sentiment among insiders.

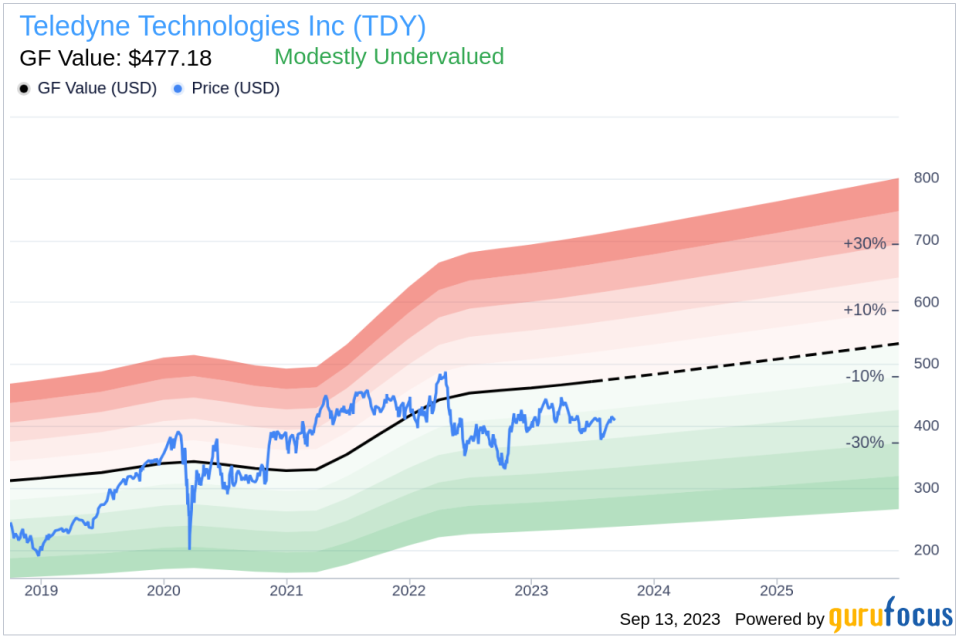

On the day of the insider's recent sell, shares of Teledyne Technologies Inc were trading for $406.77 apiece. This gives the stock a market cap of $19.27 billion. The price-earnings ratio is 25.46, which is higher than the industry median of 21.81 but lower than the companys historical median price-earnings ratio.

With a price of $406.77 and a GuruFocus Value of $477.18, Teledyne Technologies Inc has a price-to-GF-Value ratio of 0.85. This means the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's decision to sell shares could be influenced by a variety of factors. It could be a personal financial decision or it could be based on the insider's perception of the company's current valuation and future prospects. Regardless, investors should always consider the context of insider transactions when making investment decisions.

In conclusion, the recent insider sell by Director Jane Sherburne is a noteworthy event for investors and market watchers. It adds to the insider sell trend observed over the past year for Teledyne Technologies Inc. Despite this, the stock appears to be modestly undervalued based on its GF Value. Investors should keep a close eye on the company's performance and any future insider transactions.

This article first appeared on GuruFocus.