Insider Sell: Director Jeffrey Diehl Sells 125 Shares of Paylocity Holding Corp (PCTY)

On September 12, 2023, Jeffrey Diehl, a director at Paylocity Holding Corp (NASDAQ:PCTY), sold 125 shares of the company. This move comes as part of a series of transactions made by the insider over the past year.

Jeffrey Diehl is a significant figure at Paylocity Holding Corp, a leading provider of cloud-based payroll and human capital management (HCM) software solutions. Paylocity's comprehensive and easy-to-use solutions enable businesses to manage the complete employee lifecycle from recruitment to retirement.

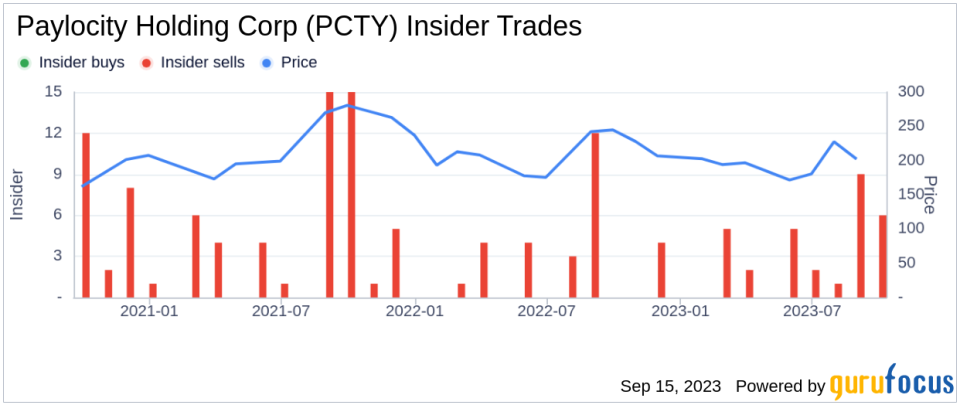

Over the past year, Diehl has sold a total of 24,788 shares and has not made any purchases. This recent sale is part of a broader trend at Paylocity, where there have been 34 insider sells and no insider buys over the past year.

The relationship between insider transactions and stock price can often provide valuable insights into the company's performance and the insiders' confidence in its future. In the case of Paylocity, the insider's consistent selling could be interpreted as a lack of confidence in the company's future performance. However, it's also important to consider other factors such as the insider's personal financial situation and the company's overall financial health.

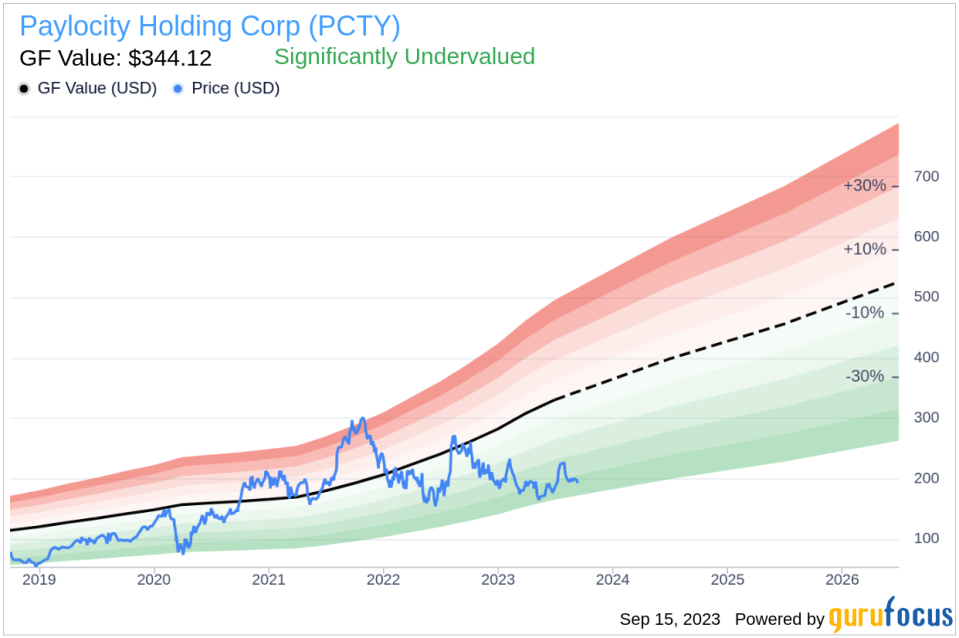

On the day of the insider's recent sale, Paylocity's shares were trading at $195.06, giving the company a market cap of $10.77 billion. The stock's price-earnings ratio stands at 77.05, higher than the industry median of 27.3 but lower than the company's historical median price-earnings ratio.

According to GuruFocus Value, which is an intrinsic value estimate based on historical multiples, a GuruFocus adjustment factor, and future business performance estimates, Paylocity is significantly undervalued. With a price of $195.06 and a GuruFocus Value of $344.12, the stock has a price-to-GF-Value ratio of 0.57.

In conclusion, while the insider's consistent selling of Paylocity shares might raise some eyebrows, the company's strong financials and the stock's undervalued status according to GuruFocus Value suggest that it could still be a good investment opportunity. As always, potential investors should conduct their own thorough research before making any investment decisions.

This article first appeared on GuruFocus.