Insider Sell: Director John Miller Sells 25,000 Shares of Denny's Corp

On September 12, 2023, John Miller, a director at Denny's Corp (NASDAQ:DENN), sold 25,000 shares of the company. This recent transaction is part of a larger trend for the insider, who over the past year has sold a total of 435,000 shares and purchased none.

John Miller has been with Denny's Corp for several years, serving in various capacities. His deep understanding of the company's operations and strategic direction makes his stock transactions particularly noteworthy for investors and market watchers.

Denny's Corp is a well-known full-service restaurant chain. The company operates over 1,700 restaurants across the United States, Canada, and other countries. Denny's is known for its 24-hour service and its expansive menu featuring breakfast, lunch, dinner, and dessert items.

The insider transaction history for Denny's Corp shows a clear trend: over the past year, there have been no insider buys and nine insider sells. This could suggest that insiders believe the stock is currently overvalued, or it could simply reflect personal financial decisions by the insiders involved.

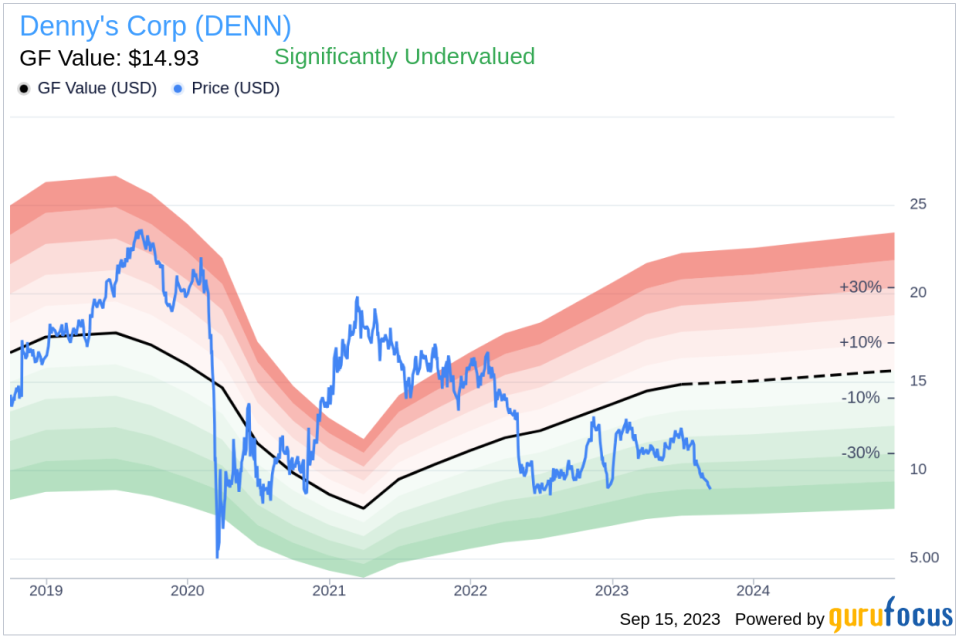

On the day of the insider's recent sell, shares of Denny's Corp were trading for $9.08 each, giving the company a market cap of $485.59 million. This is significantly lower than the company's GuruFocus Value of $14.93 per share, suggesting that the stock is significantly undervalued.

The price-earnings ratio of Denny's Corp is 13.07, lower than both the industry median of 24.28 and the company's historical median price-earnings ratio. This could indicate that the stock is undervalued compared to its earnings.

The GF Value, an intrinsic value estimate developed by GuruFocus, is calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance. With a price-to-GF-Value ratio of 0.61, Denny's Corp appears to be significantly undervalued.

However, the insider's recent sell could suggest a different perspective. It's possible that the insider believes the stock's current price accurately reflects its value, or even that it's overvalued. As always, investors should consider a variety of factors, including insider transactions, when making investment decisions.

This article first appeared on GuruFocus.