Insider Sell: Director John Miller Sells 137,500 Shares of Denny's Corp (DENN)

Director John Miller has recently made a significant sale of shares in Denny's Corp (NASDAQ:DENN), a notable event for investors and market watchers alike. On November 15, 2023, John Miller sold 137,500 shares of the company, a transaction that warrants a closer look to understand its implications and the message it may send about the company's future prospects.

Who is John Miller of Denny's Corp?

John Miller is a seasoned executive with a wealth of experience in the restaurant industry. As a director of Denny's Corp, Miller has been involved in guiding the strategic direction of the company. His insights and decisions are informed by a deep understanding of the business, making his trading activities in the company's stock particularly noteworthy.

Denny's Corp's Business Description

Denny's Corp is a well-known full-service pancake house/coffee shop/fast casual family restaurant chain. It operates over 1,700 restaurants in the United States and several other countries. Denny's is known for being open 24/7 and serving breakfast, lunch, dinner, and dessert items. The company prides itself on its affordable prices and friendly service, aiming to be a favorite choice for family dining.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

Insider trading activities, such as the recent sale by John Miller, can provide valuable insights into a company's internal perspective. Over the past year, Miller has sold a total of 237,500 shares and has not made any purchases. This one-sided activity could suggest that insiders might believe the stock is fully valued or potentially overvalued at current levels.

When examining the relationship between insider trading and stock price, it's important to consider the context of these transactions. The insider's recent sale occurred with Denny's Corp shares trading at $9.26 each, giving the company a market cap of $516.471 million. This price is significantly lower than the industry median P/E ratio of 23.09 and also below the company's historical median P/E ratio, indicating that the stock might be undervalued based on earnings.

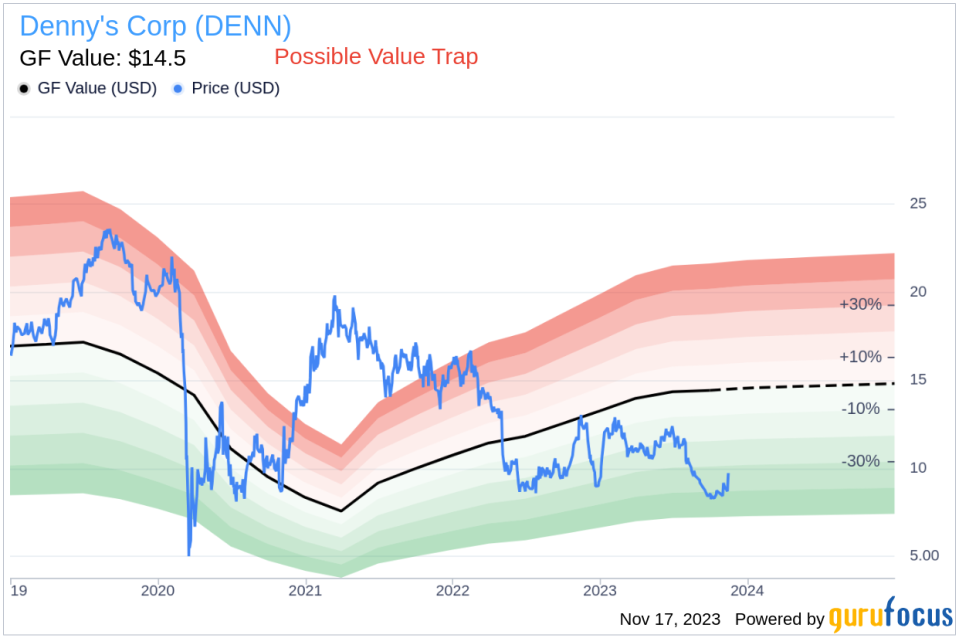

However, the price-to-GF-Value ratio stands at 0.64, with a GF Value of $14.50, suggesting that the stock is a possible value trap and investors should think twice. This discrepancy between traditional valuation metrics and the GF Value can create a complex picture for investors trying to interpret the insider's selling activity.

The insider trend image above shows a clear pattern of insider selling, with no insider buys over the past year. This trend could be interpreted as a lack of confidence among insiders about the company's future growth prospects or stock price appreciation.

Insider Trends

The insider transaction history for Denny's Corp reveals a lack of insider buying over the past year, with a total of 8 insider sells during the same period. This trend may raise questions about the insiders' long-term confidence in the company's stock performance.

Valuation

With a P/E ratio of 18.71, Denny's Corp trades below the industry median and its historical average, which could be seen as an indicator of undervaluation. However, the GF Value suggests a different story, labeling the stock as a possible value trap.

The GF Value, as shown above, is an intrinsic value estimate that takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The current price-to-GF-Value ratio indicates that the stock might not be as attractive as traditional valuation metrics suggest.

Conclusion

John Miller's recent sale of 137,500 shares of Denny's Corp is a significant insider move that investors should consider in the context of the company's valuation and insider trading trends. While traditional valuation metrics may suggest the stock is undervalued, the GF Value and the pattern of insider selling over the past year present a more cautious narrative. Investors should weigh these factors carefully and conduct further research to make informed decisions about their investment in Denny's Corp.

As always, insider trading is just one piece of the puzzle when it comes to evaluating a stock's potential. It's essential to look at a company's financial health, competitive position, and growth prospects in conjunction with insider activity to get a comprehensive view of its investment potential.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.