Insider Sell: Director John Schmieder Sells 3,000 Shares of Mesa Laboratories Inc

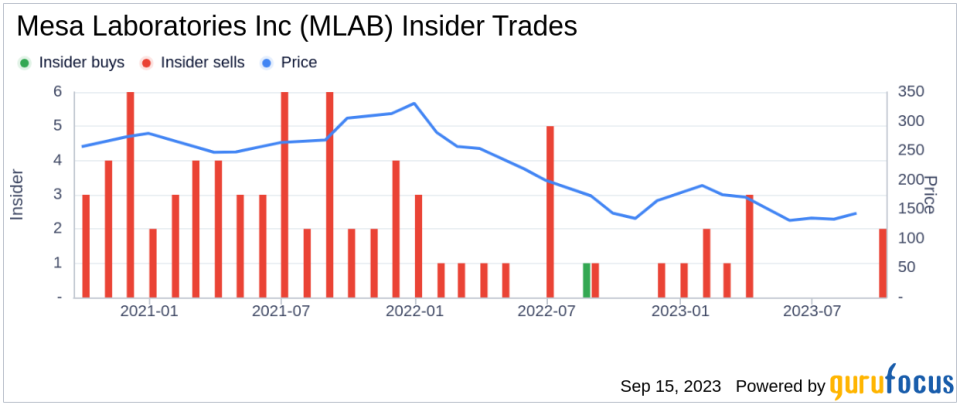

On September 13, 2023, John Schmieder, a director at Mesa Laboratories Inc (NASDAQ:MLAB), sold 3,000 shares of the company's stock. This move is part of a trend for the insider, who over the past year has sold a total of 7,071 shares and made no purchases.

Mesa Laboratories Inc is a multinational industrial technology and instrument manufacturer. The company specializes in the production of instruments and consumables for quality control applications, particularly in healthcare and pharmaceutical industries. Its products are used to assure product quality, control manufacturing processes, and to solve problems in niche markets in healthcare, industrial, pharmaceutical, food and beverage, and medical device industries.

The insider's recent sell has raised questions about the company's stock performance and its relationship with insider trading activities. Over the past year, there have been no insider buys and 10 insider sells at Mesa Laboratories Inc.

The stock was trading at $123.32 per share on the day of the insider's recent sell, giving the company a market cap of $676.213 million. The price-earnings ratio stands at 380.58, significantly higher than the industry median of 21.79 and the company's historical median price-earnings ratio.

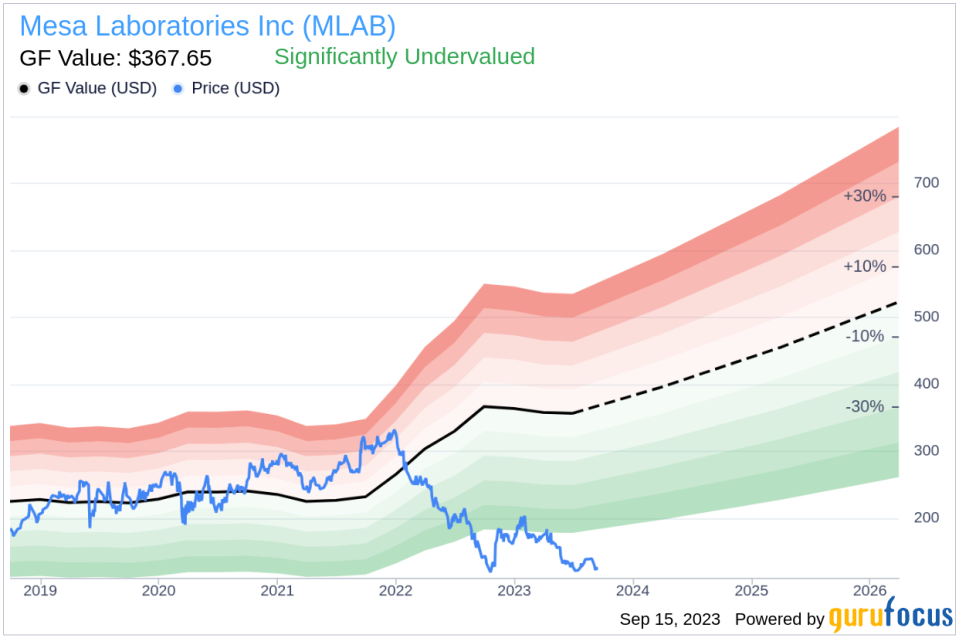

Despite the insider's sell, the stock appears to be significantly undervalued based on its GF Value. With a price of $123.32 and a GuruFocus Value of $367.65, the stock has a price-to-GF-Value ratio of 0.34.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples (price-earnings ratio, price-sales ratio, price-book ratio, and price-to-free cash flow) that the stock has traded at, a GuruFocus adjustment factor based on the company's past returns and growth, and future estimates of business performance from Morningstar analysts.

The insider's sell, coupled with the stock's undervaluation, may suggest that the insider believes the stock's current price does not reflect its intrinsic value. However, investors should conduct their own research and consider other factors before making investment decisions.

It's also worth noting that the insider's sell does not necessarily indicate a negative outlook for the company. Insiders may sell shares for various reasons, including personal financial needs or portfolio diversification. Therefore, while insider trading activities can provide valuable insights, they should not be the sole basis for investment decisions.

This article first appeared on GuruFocus.