Insider Sell: Director Laura Desmond Sells 11,003 Shares of DoubleVerify Holdings Inc

On September 12, 2023, Director Laura Desmond sold 11,003 shares of DoubleVerify Holdings Inc (NYSE:DV). This transaction is part of a series of insider sells by Desmond over the past year, totaling 644,548 shares sold and no shares purchased.

Laura Desmond is a key figure in DoubleVerify Holdings Inc, serving as a Director. Her insider trading activities provide valuable insights into the company's financial health and future prospects.

DoubleVerify Holdings Inc is a leading software platform that provides measurement and analytics that online advertisers and publishers use to eliminate waste and improve the performance of their digital advertising campaigns. The company's proprietary technology platform helps advertisers ensure their ads are viewable, fraud-free, in a brand-safe environment, and in compliance with the advertisers' privacy policies.

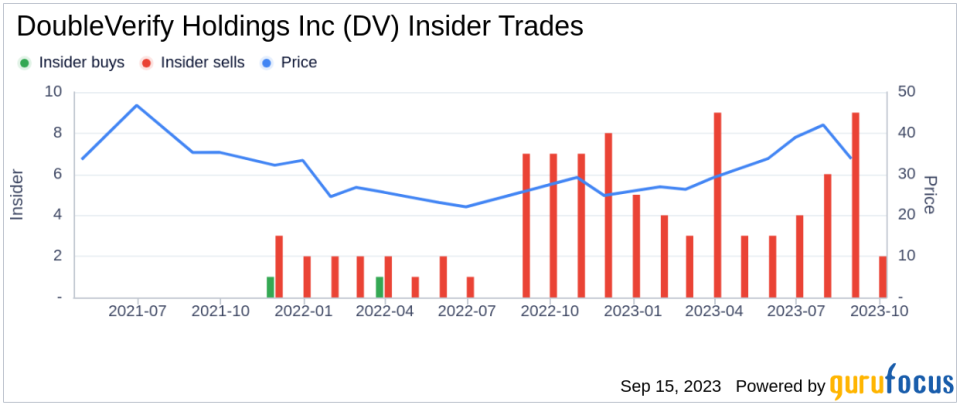

The insider transaction history for DoubleVerify Holdings Inc shows a trend of insider sells over the past year, with 67 insider sells and no insider buys. This trend is visualized in the following chart:

The insider's recent sell has raised questions about the company's current valuation. On the day of the insider's recent sell, shares of DoubleVerify Holdings Inc were trading for $30.75 apiece, giving the stock a market cap of $4.841 billion. The price-earnings ratio is 96.40, which is higher than the industry median of 27.3 and lower than the companys historical median price-earnings ratio.

The insider's sell-off could be interpreted as a lack of confidence in the company's current valuation. However, it's important to note that insider sells do not always indicate a bearish outlook. Insiders may sell shares for personal reasons unrelated to the company's performance or prospects. Therefore, investors should not solely rely on insider transactions when making investment decisions but should consider them as part of a broader analysis of the company's fundamentals and market conditions.

In conclusion, while the insider's recent sell-off may raise some concerns, it does not necessarily indicate a negative outlook for DoubleVerify Holdings Inc. Investors should continue to monitor the company's performance, insider transactions, and market conditions to make informed investment decisions.

This article first appeared on GuruFocus.