Insider Sell: Director Lisa Wardell Offloads Shares of Adtalem Global Education Inc

In a notable insider transaction, Director Lisa Wardell sold a substantial number of shares of Adtalem Global Education Inc (NYSE:ATGE), a leading provider of educational services. On November 10, 2023, the insider executed a sale of 173,671 shares, a move that has caught the attention of investors and market analysts alike.

Who is Lisa Wardell of Adtalem Global Education Inc?

Lisa Wardell is a prominent figure in the world of education and business. As a director of Adtalem Global Education Inc, she has been instrumental in shaping the strategic direction of the company. Her background includes a wealth of experience in leadership roles, and she has been recognized for her contributions to the industry. Wardell's decision to sell a significant portion of her holdings in the company is therefore of particular interest to those following Adtalem's stock.

About Adtalem Global Education Inc

Adtalem Global Education Inc is a global education provider that empowers students to achieve their goals, find success, and make inspiring contributions to the global community. The company offers a wide range of educational programs across the medical and healthcare, financial services, and business and law sectors, among others. Adtalem is committed to providing quality education that enables learners to reach their full potential and meet the evolving needs of the workforce.

Analysis of Insider Buy/Sell and Relationship with Stock Price

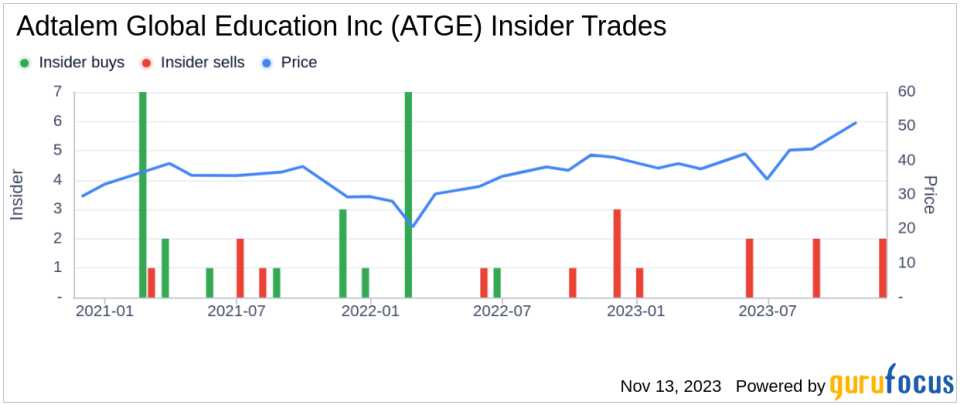

The recent sale by Lisa Wardell is part of a broader pattern of insider activity at Adtalem Global Education Inc. Over the past year, Wardell has sold a total of 398,232 shares and has not made any purchases. This trend is consistent with the overall insider transaction history for the company, which shows zero insider buys and eight insider sells over the same timeframe.

The relationship between insider transactions and stock price is often scrutinized by investors. Insider sales can sometimes signal a lack of confidence in the company's future prospects or a belief that the stock is overvalued. However, it is also important to consider that insiders may sell shares for a variety of reasons unrelated to their outlook on the company, such as diversifying their personal portfolio or meeting financial obligations.

Valuation and Market Response

On the day of the insider's recent sale, shares of Adtalem Global Education Inc were trading at $55.35, giving the company a market cap of $2.197 billion. The price-earnings ratio stood at 24.20, higher than both the industry median of 18.95 and the company's historical median price-earnings ratio. This suggests that the stock may be trading at a premium compared to its peers and its own historical valuation.

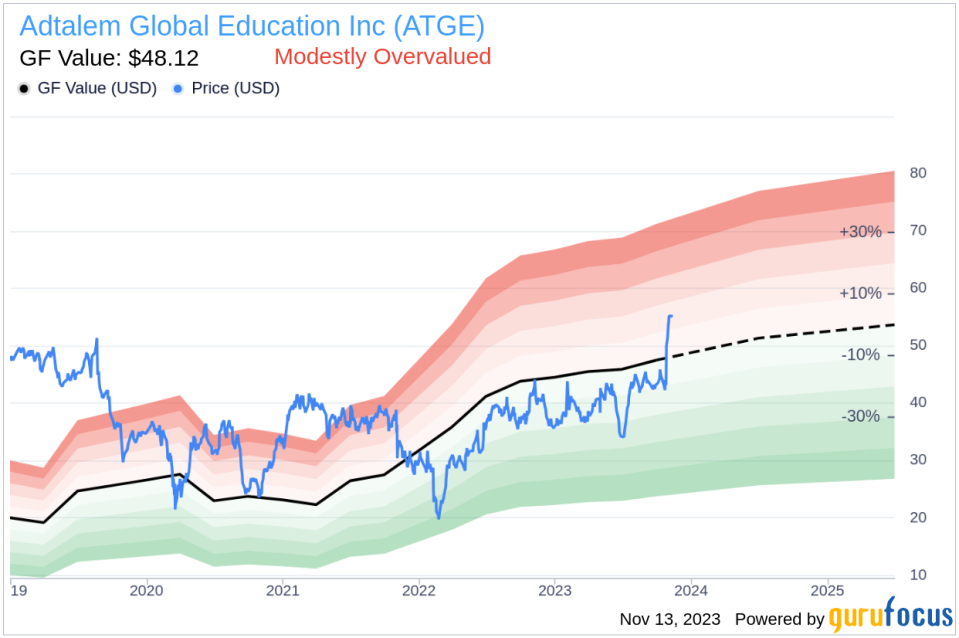

Moreover, with a price of $55.35 and a GuruFocus Value of $48.12, Adtalem Global Education Inc has a price-to-GF-Value ratio of 1.15, indicating that the stock is modestly overvalued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts.The insider's decision to sell at a time when the stock appears to be modestly overvalued according to the GF Value could be interpreted as an alignment with the valuation analysis, suggesting that the insider believes the current market price may not be sustainable.

Conclusion

The sale of shares by Director Lisa Wardell is a significant event for Adtalem Global Education Inc and its investors. While the insider's actions may raise questions about the stock's valuation and future performance, it is essential to consider the broader context of the company's financial health and market position. As with any insider transaction, investors should use this information as one of many factors in their overall analysis of the company's potential as an investment.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.