Insider Sell: Director Malcolm Frank Sells Shares of FactSet Research Systems Inc (FDS)

FactSet Research Systems Inc (NYSE:FDS), a leading provider of integrated financial information and analytical applications to the global investment community, has witnessed a recent insider sell that has caught the attention of market watchers. On November 14, 2023, Director Malcolm Frank sold 1,208 shares of the company, a transaction that prompts a closer look into the insider's trading behavior and the potential implications for investors.

Who is Malcolm Frank?

Malcolm Frank is a seasoned executive with a deep understanding of the technology and financial services industries. His role as a Director at FactSet Research Systems Inc involves providing strategic guidance to the company, drawing from his extensive experience in leading technology-driven transformations. Frank's insights are particularly valuable given the increasing importance of data analytics and software solutions in the financial sector.

FactSet Research Systems Inc's Business Description

FactSet Research Systems Inc is a global provider of financial data and software solutions for investment professionals, including analysts, portfolio managers, and investment bankers. The company offers a wide array of products and services designed to streamline analysis, enhance productivity, and improve decision-making. FactSet's integrated platform delivers real-time news, quotes, analytics, and proprietary data across asset classes, enabling clients to stay ahead in a competitive market.

Analysis of Insider Buy/Sell and Relationship with Stock Price

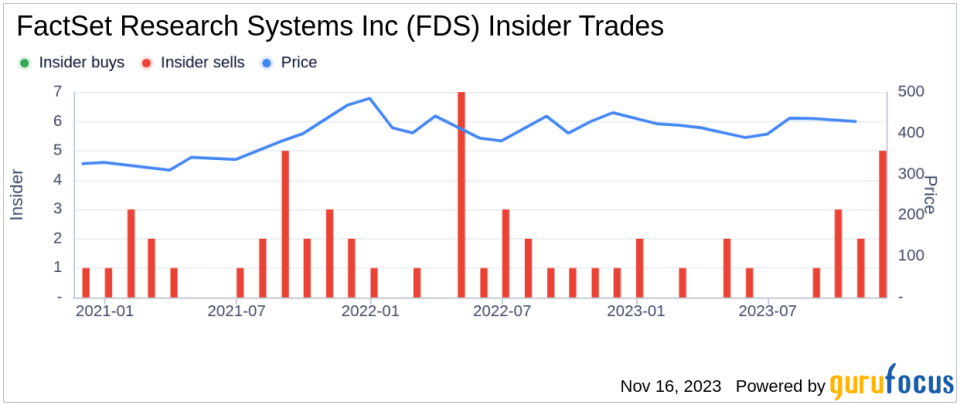

Insider trading activities, particularly sells, can provide valuable clues about a company's internal perspective on its stock's valuation. In the case of FactSet Research Systems Inc, the insider, Malcolm Frank, has not made any purchases over the past year but has sold 1,208 shares. This one-sided activity could suggest that insiders might perceive the stock as being fully valued or potentially overvalued at current levels.

However, it's important to note that insider sells can be motivated by various factors, such as personal financial planning or diversification, and may not always indicate a lack of confidence in the company's prospects. The absence of insider buys over the past year, combined with 17 insider sells, does warrant attention but should be considered within the broader context of the company's performance and market conditions.

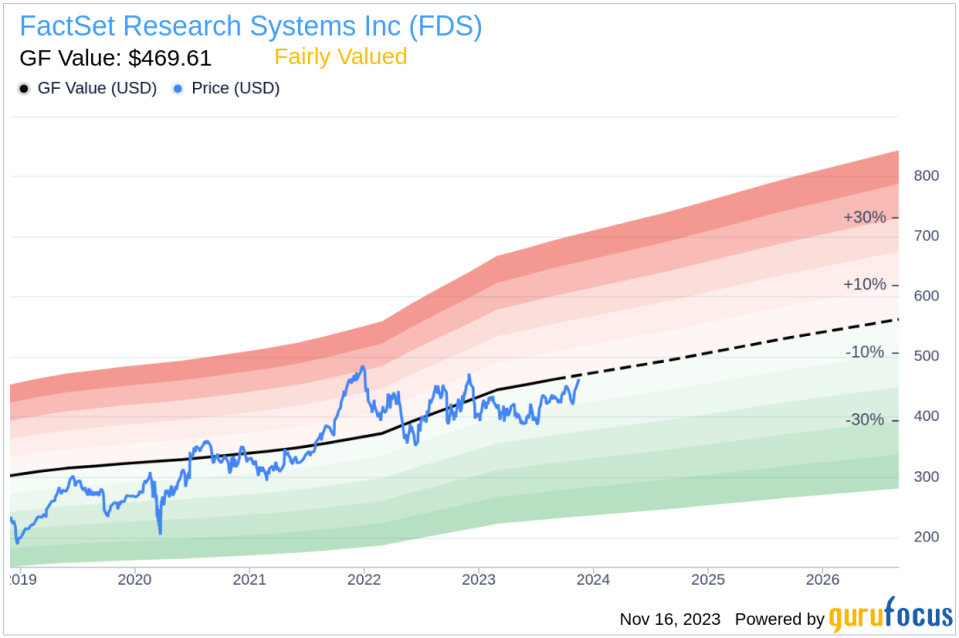

On the day of the insider's recent sell, FactSet Research Systems Inc's shares were trading at $459.08, giving the company a substantial market cap of $17.622 billion. The stock's price-earnings ratio stands at 38.53, which is higher than both the industry median of 18.2 and the company's historical median. This elevated P/E ratio could be a factor in the insider's decision to sell, as it may suggest a premium valuation compared to peers and historical norms.

Despite the high P/E ratio, the stock is considered Fairly Valued with a price-to-GF-Value ratio of 0.98, based on a GF Value of $469.61. The GF Value is a proprietary metric developed by GuruFocus, factoring in historical trading multiples, a GuruFocus adjustment for past performance, and future business estimates from analysts.

The insider trend image above illustrates the pattern of insider transactions over the past year. The absence of buys and the presence of multiple sells could be interpreted as a signal that insiders are taking advantage of the stock's current valuation to realize gains.

The GF Value image provides a visual representation of FactSet Research Systems Inc's stock price in relation to its intrinsic value estimate. The proximity of the current stock price to the GF Value suggests that the market is pricing the stock in line with its estimated fair value.

Conclusion

Director Malcolm Frank's recent sell transaction in FactSet Research Systems Inc shares may raise questions among investors about the stock's valuation and future prospects. While the insider's sell activity and the high P/E ratio could be seen as cautionary signals, the stock's Fairly Valued status according to the GF Value metric offers a counterbalance. Investors should consider the insider trading trends, valuation metrics, and the company's overall financial health and growth prospects when making investment decisions. As always, insider transactions are just one piece of the puzzle, and a comprehensive analysis should include a wide range of factors.

It's also crucial for investors to monitor any further insider transactions and company announcements that could provide additional context to the insider's recent sell activity. By staying informed and considering both the quantitative and qualitative aspects of FactSet Research Systems Inc, investors can better assess the potential impact of insider behaviors on their investment strategies.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.