Insider Sell: Director Marc McMorris Sells Shares of Fair Isaac Corp (FICO)

Fair Isaac Corporation, commonly known as FICO, is a data analytics company based in San Jose, California focused on credit scoring services. It is best known for its FICO score, a credit score model it developed which is used by financial institutions. These scores are designed to predict consumer behavior and are used extensively in the banking industry to assess credit risk. The company also provides software and services used for managing credit accounts, identifying and minimizing the impact of fraud, and automating lending processes.

On November 14, 2023, Marc McMorris, a seasoned director of Fair Isaac Corp, made a significant move in the stock market by selling 2,561 shares of the company. This transaction has caught the attention of investors and analysts alike, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

But who is Marc McMorris? McMorris has been a member of the board of directors at Fair Isaac Corp, bringing with him a wealth of experience and knowledge. His background and expertise in the financial sector have been assets to the company, guiding strategic decisions and contributing to its growth trajectory. His recent sale of shares may be interpreted in various ways, but it is essential to consider the broader context of insider trading patterns and the company's valuation metrics to understand the potential implications of his actions.

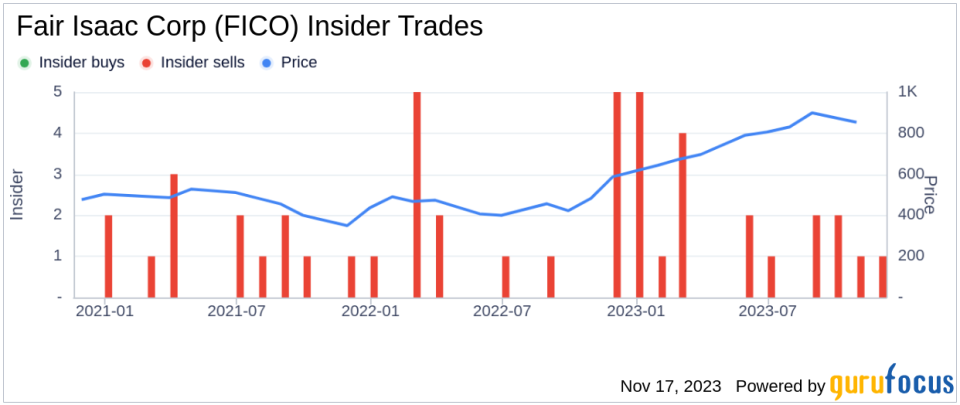

The insider transaction history for Fair Isaac Corp shows a pattern that leans heavily towards selling. Over the past year, Marc McMorris has sold a total of 9,293 shares and has not made any purchases. This could be indicative of several things, including personal financial management or a belief that the stock may be currently overvalued. When looking at the broader insider activity, there have been 20 insider sells and no insider buys over the same timeframe, suggesting that insiders may have similar sentiments about the stock's valuation.

On the day of the insider's recent sale, shares of Fair Isaac Corp were trading at $1,024.33, giving the company a substantial market cap of $25.555 billion. This price point is particularly interesting when we consider the company's valuation metrics. The price-earnings ratio stands at 61.08, significantly higher than the industry median of 26.58 and above the company's historical median price-earnings ratio. This elevated P/E ratio could be a signal that the stock is priced on the higher end compared to its earnings, which may be a contributing factor to the insider's decision to sell shares.

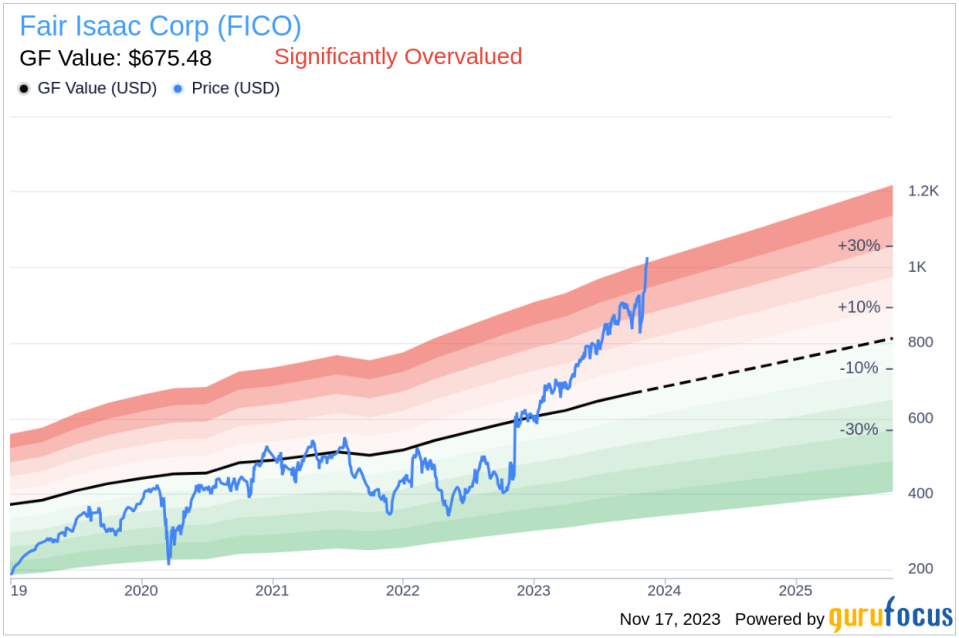

Moreover, when we look at the stock's price relative to the GuruFocus Value (GF Value), we find that Fair Isaac Corp is currently Significantly Overvalued. With a stock price of $1,024.33 and a GF Value of $675.48, the price-to-GF-Value ratio is 1.52. The GF Value is a proprietary intrinsic value estimate from GuruFocus, which takes into account historical trading multiples, an adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above illustrates the recent insider selling activity, which may raise questions among investors. While insider sales do not always indicate a lack of confidence in the company's future, the consistent pattern of sales over purchases could suggest that insiders believe the stock's current price may not be sustainable in the long term.

The GF Value image provides a visual representation of the stock's valuation compared to its intrinsic value estimate. The significant gap between the current stock price and the GF Value reinforces the notion that the stock may be overvalued, which could be a factor influencing the insider's decision to sell.

In conclusion, the recent insider sell by Director Marc McMorris of Fair Isaac Corp is a transaction that warrants attention. The company's high P/E ratio, combined with a price significantly above its GF Value, suggests that the stock may be overvalued. The pattern of insider selling over the past year, with no corresponding insider buys, could indicate that insiders, including McMorris, may have concerns about the stock's current valuation. Investors should consider these factors, along with their own research and investment goals, when making decisions regarding Fair Isaac Corp's stock.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.