Insider Sell: Director Michael Donahue Sells 3,148 Shares of WSFS Financial Corp

Director Michael Donahue has recently made a significant stock transaction in WSFS Financial Corp (NASDAQ:WSFS), selling 3,148 shares on December 1, 2023. This move by a key insider has caught the attention of investors and market analysts, prompting a closer look at the implications of such insider activity.

Who is Michael Donahue of WSFS Financial Corp?

Michael Donahue serves as a Director at WSFS Financial Corp, a position that gives him a unique perspective on the company's operations and strategic direction. Directors like Donahue are responsible for overseeing the company's management and ensuring that it operates in the best interest of shareholders. His decision to sell a portion of his holdings in the company is therefore noteworthy, as it may reflect his personal assessment of the company's valuation or future prospects.

WSFS Financial Corp's Business Description

WSFS Financial Corp is a multi-billion-dollar financial services company headquartered in Wilmington, Delaware. It operates as the bank holding company for WSFS Bank, which provides various banking and financial services to individuals, businesses, and institutions. The company's offerings include personal and commercial banking products, as well as wealth management and trust services. With a strong presence in the Greater Delaware Valley, WSFS Financial Corp has built a reputation for its community-focused banking and commitment to customer service.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

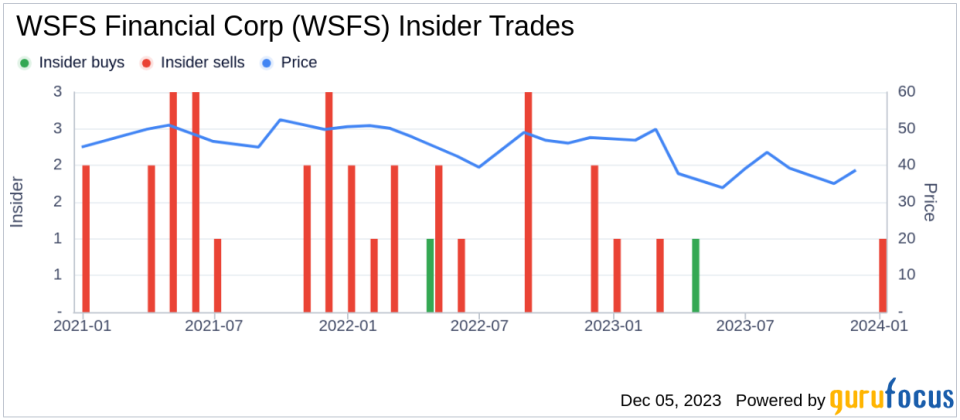

Insider transactions can provide valuable insights into a company's health and future performance. When insiders buy shares, it is often interpreted as a sign of confidence in the company's prospects. Conversely, when insiders sell, it can raise questions about the company's valuation or potential challenges ahead.

According to the data provided, Michael Donahue has sold 3,148 shares over the past year and has not made any purchases. This could suggest that the insider sees the current stock price as a good opportunity to realize gains or that he anticipates a potential downturn in the company's performance or stock price.

However, it is important to consider the broader context of insider activity. Over the past year, there has been only 1 insider buy compared to 3 insider sells at WSFS Financial Corp. This trend might indicate a general sentiment among insiders that the stock is fairly valued or that they are taking profits after a period of appreciation.

On the day of Donahue's recent sell, WSFS Financial Corp shares were trading at $40.3, giving the company a market cap of $2.467 billion. The price-earnings ratio of 8.61 is slightly lower than both the industry median of 8.7 and the company's historical median, suggesting that the stock might be undervalued compared to its peers and its own trading history.

Moreover, with a price of $40.3 and a GuruFocus Value of $57.52, WSFS Financial Corp has a price-to-GF-Value ratio of 0.7. This indicates that the stock is significantly undervalued based on its GF Value, which could mean that the insider's decision to sell does not necessarily reflect a negative outlook on the company's valuation.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. The fact that WSFS Financial Corp's stock is trading below its GF Value could suggest that the market has not fully recognized the company's potential, despite the insider's recent sell.

Conclusion

While insider sells can often be a red flag for investors, the context of the broader market, the company's valuation, and the insider's own trading history must be considered. In the case of Michael Donahue's sale of WSFS Financial Corp shares, the transaction occurs against a backdrop of a stock that appears undervalued according to the GF Value. Investors should weigh this insider activity with other factors such as the company's financial health, market position, and growth prospects before making investment decisions.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock. A comprehensive analysis should include a review of the company's financial statements, competitive position, and macroeconomic conditions, among other factors. Investors are encouraged to conduct their own due diligence and consult with financial advisors before making any investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.