Insider Sell: Director Naomi Boness Sells 15,000 Shares of Aemetis Inc

On September 12, 2023, Director Naomi Boness sold 15,000 shares of Aemetis Inc (NASDAQ:AMTX). This move comes amidst a year where the insider has sold a total of 15,000 shares and purchased none.

Naomi Boness is a key figure at Aemetis Inc, serving as a Director. Aemetis Inc is an international renewable fuels and biochemicals company focused on the acquisition, development, and commercialization of innovative technologies that replace traditional petroleum-based products. With a market cap of $205.503 million, the company is a significant player in the renewable energy sector.

The insider's recent sell has raised some eyebrows, especially considering the lack of insider buys over the past year. The insider transaction history for Aemetis Inc shows zero insider buys and one insider sell over the past year.

The above image illustrates the trend of insider transactions. The lack of insider buys could be a cause for concern for potential investors. However, it's important to note that insider sells do not necessarily indicate a lack of confidence in the company. The insider may have personal reasons for selling, such as diversifying their portfolio or meeting personal financial obligations.

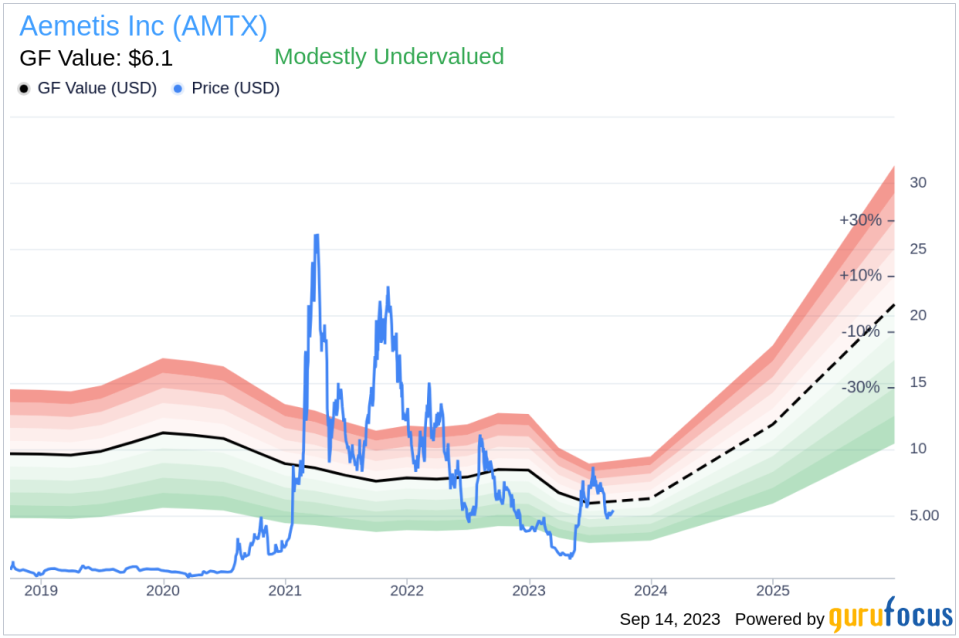

On the day of the insider's recent sell, shares of Aemetis Inc were trading for $5.65 apiece. This gives the stock a price-to-GF-Value ratio of 0.93, indicating that the stock is modestly undervalued based on its GF Value.

The GF Value is an intrinsic value estimate developed by GuruFocus. It is calculated based on historical multiples that the stock has traded at, a GuruFocus adjustment factor based on the companys past returns and growth, and future estimates of business performance from Morningstar analysts. With a GF Value of $6.10, the stock appears to be modestly undervalued.

In conclusion, while the insider's recent sell may raise some concerns, the stock's modest undervaluation and the company's position in the renewable energy sector make it a potential investment to consider. However, potential investors should always conduct their own thorough research and consider multiple factors before making investment decisions.

This article first appeared on GuruFocus.