Insider Sell: Director Richard Parrillo Sells 72,604 Shares of Hudson Technologies Inc (HDSN)

In a notable insider transaction, Director Richard Parrillo of Hudson Technologies Inc (NASDAQ:HDSN) sold 72,604 shares of the company's stock on December 14, 2023. This sale has caught the attention of investors and market analysts, as insider transactions can provide valuable insights into a company's prospects and the confidence level of its top executives and directors.

Who is Richard Parrillo?

Richard Parrillo is a member of the board of directors at Hudson Technologies Inc. Directors play a crucial role in shaping the strategic direction of a company and are privy to detailed information about its operations, financial health, and future plans. Their trading activities are closely monitored as they can reflect the insider's belief in the company's current valuation and its prospects.

About Hudson Technologies Inc

Hudson Technologies Inc is a leading provider of innovative solutions to recurring problems within the refrigeration industry. The company's primary business involves the commercial and industrial refrigeration sector, where it offers a variety of products and services, including refrigerant sales, refrigerant management services comprising reclamation, and RefrigerantSide services, which focus on system decontamination to remove moisture, oils, and other contaminants.

Analysis of Insider Buy/Sell and Relationship with Stock Price

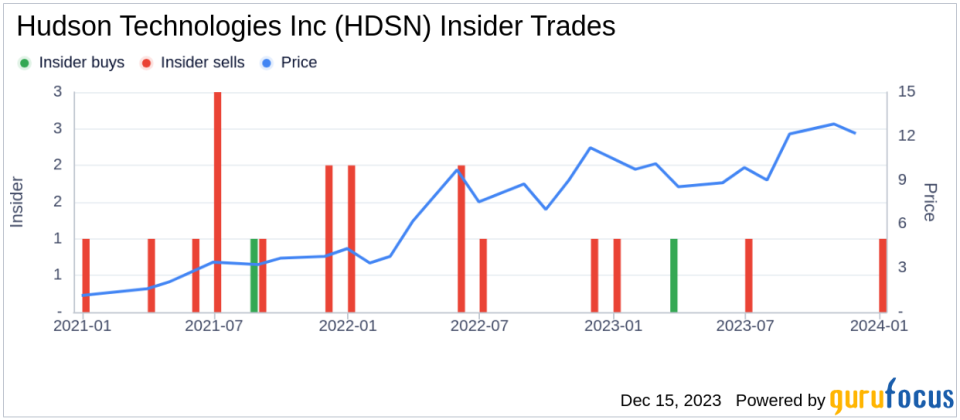

The recent sale by Richard Parrillo is significant due to the volume of shares sold. Over the past year, the insider has sold a total of 72,604 shares and has not made any purchases. This could be interpreted as a lack of confidence in the company's future performance or simply a personal financial decision. It's important to consider the context of these sales and any potential motivations behind them.The insider transaction history for Hudson Technologies Inc shows a trend of more insider selling than buying over the past year, with 2 insider sells and only 1 insider buy. This pattern of insider activity can sometimes lead to concerns among investors about the company's valuation and future growth prospects.

When analyzing the relationship between insider transactions and stock price, it's crucial to consider the timing and market conditions. Insider sales that occur when a stock is perceived as overvalued may suggest that the insiders believe the stock price has reached a peak. Conversely, insider buying during periods when the stock is undervalued could indicate a belief that the stock is poised for a rebound.

Valuation and Market Cap

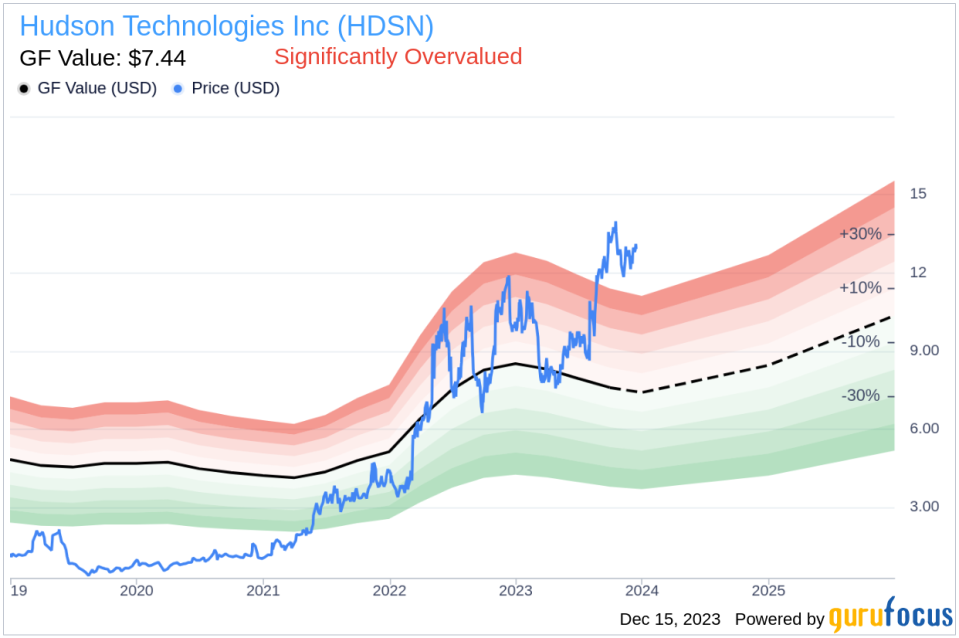

On the day of Richard Parrillo's recent sale, shares of Hudson Technologies Inc were trading at $13, giving the company a market cap of $587.436 million. The price-earnings ratio of 11.33 is lower than both the industry median of 22.515 and the company's historical median price-earnings ratio, suggesting that the stock may be undervalued based on earnings.However, with a price of $13 and a GuruFocus Value of $7.44, Hudson Technologies Inc has a price-to-GF-Value ratio of 1.75, indicating that the stock is Significantly Overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus. It takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts. When the price-to-GF-Value ratio is above 1, it suggests that the stock is overvalued compared to its intrinsic value.

Conclusion

The recent insider sale by Director Richard Parrillo of Hudson Technologies Inc is a transaction that warrants attention from investors. While the company's stock appears undervalued based on its price-earnings ratio, the price-to-GF-Value ratio suggests that it is significantly overvalued. This mixed valuation signal, combined with the insider's decision to sell a substantial number of shares, may lead investors to question the stock's current price level and future growth potential.As always, it's important for investors to conduct their own due diligence and consider the broader market context, the company's financial health, and any other insider transactions when making investment decisions. Insider activity is just one piece of the puzzle, and a comprehensive analysis should take multiple factors into account.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.