Insider Sell: Director Richard Prins Sells 5,000 Shares of Amphastar Pharmaceuticals Inc (AMPH)

Amphastar Pharmaceuticals Inc (NASDAQ:AMPH) has recently witnessed an insider sell that has caught the attention of investors and market analysts. On November 13, 2023, Director Richard Prins sold 5,000 shares of the company, a transaction that prompts a closer look into the insider's activity and the potential implications for the stock's performance.

Who is Richard Prins?

Richard Prins is a notable figure within Amphastar Pharmaceuticals Inc, serving as a Director. His role in the company provides him with a deep understanding of the firm's operations, strategic direction, and financial health. Directors like Prins are often privy to the most current and sensitive information, and their trading activities are closely monitored for insights into their confidence in the company's future prospects.

About Amphastar Pharmaceuticals Inc

Amphastar Pharmaceuticals Inc is a biopharmaceutical company that focuses on the development, manufacturing, and marketing of generic and proprietary injectable, inhalation, and intranasal products. Their portfolio includes a variety of drugs that cater to critical care and other medical needs. Amphastar's commitment to quality and innovation has positioned it as a key player in the pharmaceutical industry.

Analysis of Insider Buy/Sell and Relationship with Stock Price

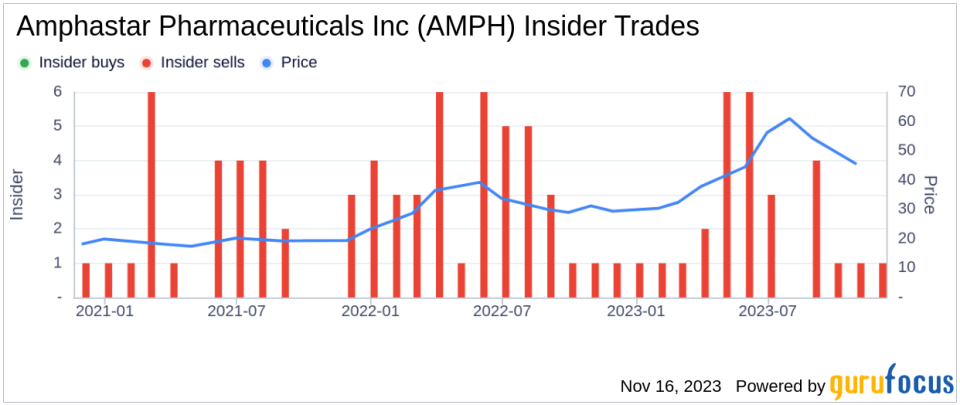

The recent sell by Richard Prins is part of a broader pattern of insider trading activity at Amphastar Pharmaceuticals Inc. Over the past year, Prins has sold a total of 11,163 shares and has not made any purchases. This one-sided activity raises questions about the insider's long-term confidence in the stock, especially when considering that there have been 28 insider sells and no insider buys over the same timeframe.

The relationship between insider trading and stock price is complex. While insider sells do not always indicate a lack of confidence in the company, a consistent pattern of selling, particularly when not balanced by insider buys, can suggest that those with the most intimate knowledge of the company's prospects are choosing to reduce their holdings.

Valuation and Market Response

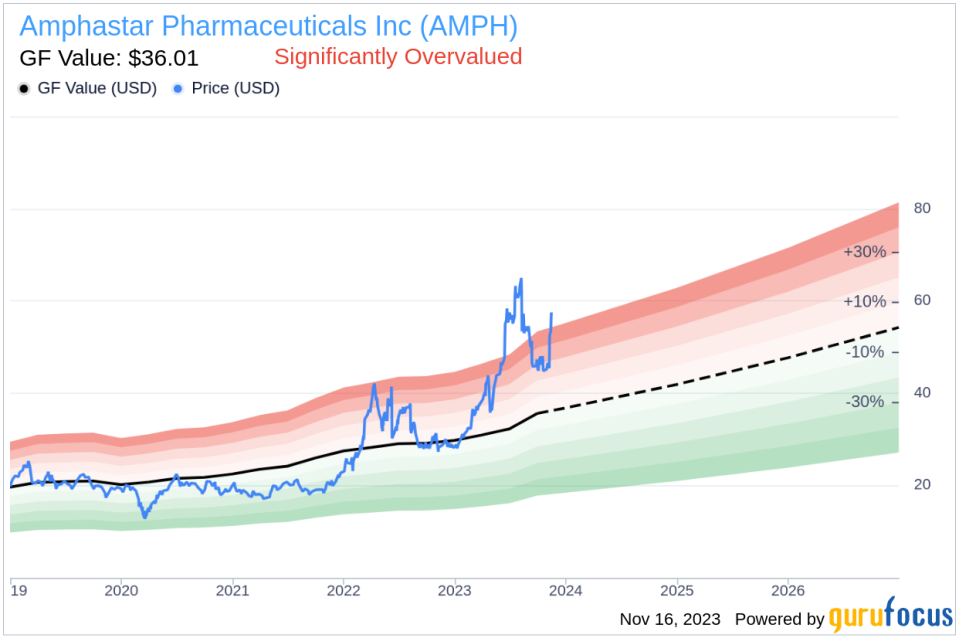

On the day of Prins's sell, Amphastar Pharmaceuticals Inc's shares were trading at $52.5, giving the company a market cap of $2.755 billion. The price-earnings ratio stood at 22.47, slightly lower than the industry median of 22.92 and also below the company's historical median price-earnings ratio. This could indicate that the stock was trading at a reasonable valuation compared to its peers and its own historical standards.However, a different picture emerges when considering the GuruFocus Value. With a stock price of $52.5 and a GuruFocus Value of $36.01, Amphastar Pharmaceuticals Inc has a price-to-GF-Value ratio of 1.46, suggesting that the stock is significantly overvalued based on its GF Value.

The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from Morningstar analysts. The significant overvaluation indicated by the GF Value could be a factor in Prins's decision to sell shares, as it may imply that the stock's current price exceeds its estimated fair value by a considerable margin.

Conclusion

The insider sell by Director Richard Prins at Amphastar Pharmaceuticals Inc is a development that warrants attention from investors. While the company's fundamentals, as reflected in its P/E ratio, appear sound, the GF Value suggests that the stock may be overpriced. Prins's consistent pattern of selling over the past year, coupled with the absence of insider buys, could be interpreted as a cautious signal regarding the stock's future performance.Investors should consider the insider trading trends, valuation metrics, and overall market conditions when making investment decisions. While insider activity is just one piece of the puzzle, it can provide valuable insights into the sentiment of those who know the company best. As always, a diversified approach and thorough due diligence are recommended when navigating the complexities of the stock market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.