Insider Sell: Director Robert Johnson Sells Shares of Roper Technologies Inc (ROP)

Director Robert Johnson of Roper Technologies Inc (NASDAQ:ROP) has recently made a notable move in the stock market by selling 250 shares of the company on December 1, 2023. This transaction has caught the attention of investors and market analysts, as insider activity, such as sales and purchases, can provide valuable insights into a company's financial health and future prospects.

Who is Robert Johnson of Roper Technologies Inc?

Robert Johnson serves as a Director at Roper Technologies Inc, a diversified technology company that operates businesses that design and develop software (both license and software-as-a-service) and engineered products and solutions for a variety of niche end markets. Johnson's role within the company provides him with a deep understanding of Roper's operations, strategic direction, and financial performance. His decision to sell shares can be interpreted in various ways, but it is essential to consider the context of the transaction and the company's current standing in the market.

Roper Technologies Inc's Business Description

Roper Technologies Inc is a constituent of the S&P 500 index and operates through four main segments: Application Software, Network Software & Systems, Measurement & Analytical Solutions, and Process Technologies. The company's products and services are diverse, ranging from medical and scientific imaging products and software, RFID communication technology, to energy systems and controls. With a focus on high-margin, niche markets, Roper Technologies aims to deliver sustainable growth through strategic acquisitions and organic development, leveraging its robust financial position to invest in technology and innovation.

Analysis of Insider Buy/Sell and the Relationship with the Stock Price

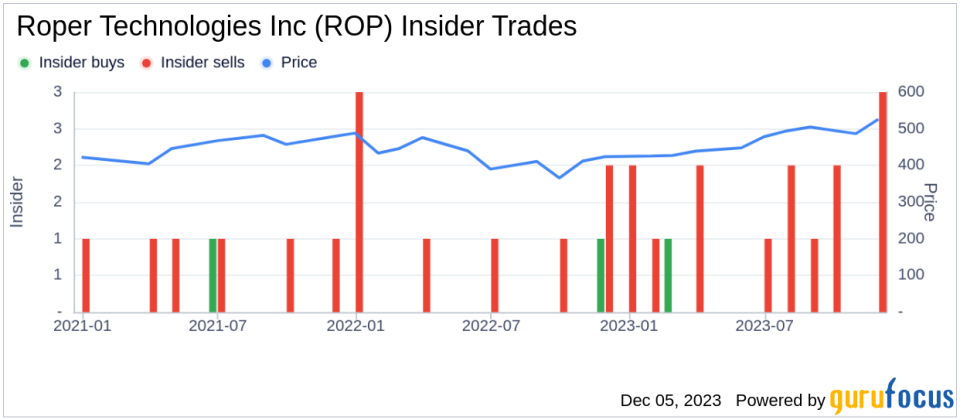

Insider transactions are closely monitored by investors as they can provide clues about a company's internal perspective on its stock's valuation. Over the past year, Robert Johnson has sold a total of 1,650 shares and has not made any purchases. This pattern of selling without corresponding buys could suggest that the insider may perceive the stock's current price as being on the higher end of its value spectrum, or it could be related to personal financial planning.

The insider transaction history for Roper Technologies Inc shows a trend of more insider selling than buying over the past year, with 14 insider sells and only 1 insider buy. This trend could indicate that insiders, on balance, are taking the opportunity to liquidate some of their holdings when the stock price is perceived as favorable.

On the day of Johnson's recent sale, shares of Roper Technologies Inc were trading at $538.25, giving the company a market cap of $57.34 billion. This valuation places the company's price-earnings ratio at 19.63, which is lower than the industry median of 26.87 and also below the company's historical median price-earnings ratio. This could suggest that the stock is undervalued based on earnings, but other factors must be considered.

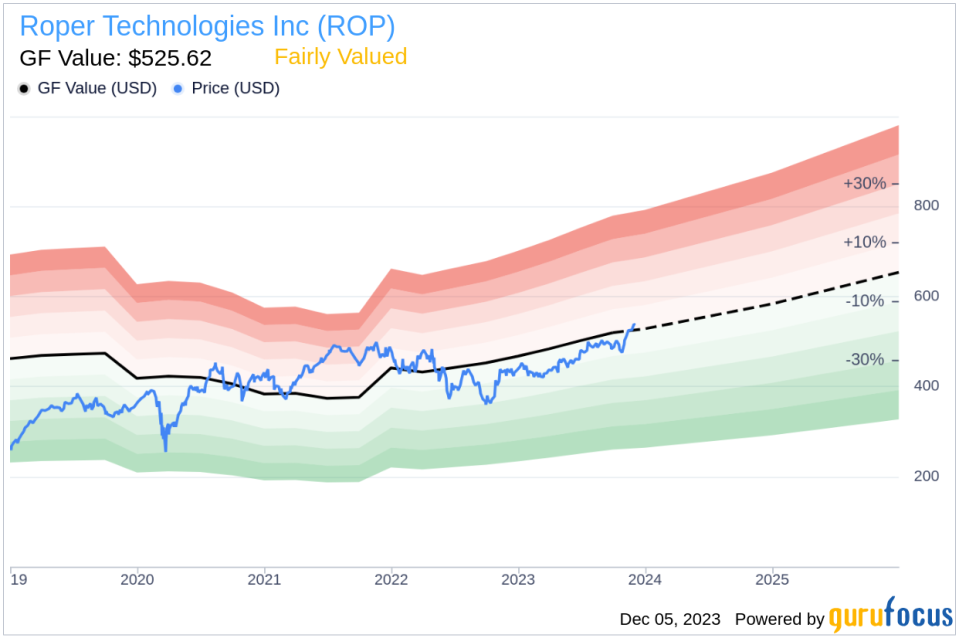

With a price of $538.25 and a GuruFocus Value (GF Value) of $525.62, Roper Technologies Inc has a price-to-GF-Value ratio of 1.02, indicating that the stock is Fairly Valued based on its GF Value. The GF Value is a proprietary intrinsic value estimate developed by GuruFocus, which takes into account historical trading multiples, a GuruFocus adjustment factor based on past returns and growth, and future business performance estimates from analysts.

The insider trend image above provides a visual representation of the selling and buying activities of insiders over time. A consistent pattern of insider selling, especially when the stock is fairly valued or overvalued, can be a signal for investors to proceed with caution.

The GF Value image further illustrates the stock's valuation in relation to its intrinsic value. When the stock trades around or below the GF Value, it is often considered a good buying opportunity, assuming the company's fundamentals are strong. Conversely, when the stock trades significantly above the GF Value, it might be seen as overvalued, and insiders might choose this time to sell.

Conclusion

Director Robert Johnson's recent sale of Roper Technologies Inc shares may raise questions among investors about the stock's valuation and future performance. While the company's lower-than-industry-average price-earnings ratio and fair GF Value rating suggest that the stock is not overpriced, the insider selling trend could be a sign of caution. Investors should consider the broader context of the market, the company's strategic initiatives, and its financial health when interpreting insider transactions. As always, insider activity is just one piece of the puzzle, and a comprehensive analysis should include a review of the company's fundamentals, competitive position, and growth prospects.

It is important to note that insider transactions are subject to various motivations and do not always reflect a clear-cut judgment on the company's future. Therefore, while insider activity can provide valuable insights, it should not be the sole factor in making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.