Insider Sell: Director Robert Small Sells 2,967 Shares of TransDigm Group Inc

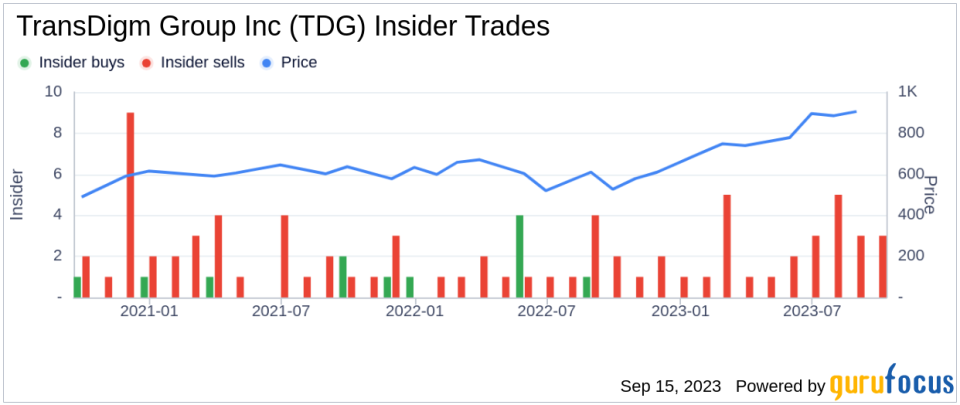

On September 12, 2023, Robert Small, a Director at TransDigm Group Inc (NYSE:TDG), sold 2,967 shares of the company. This move is part of a larger trend for the insider, who over the past year has sold a total of 28,461 shares and made no purchases.

TransDigm Group Inc is a leading global producer, designer, and supplier of highly engineered aerospace components, systems, and subsystems. The company's products are used on nearly all commercial and military aircraft in service today. TransDigm Group's business model is to acquire and, if necessary, restructure businesses in the industry to create value and generate attractive risk-adjusted returns.

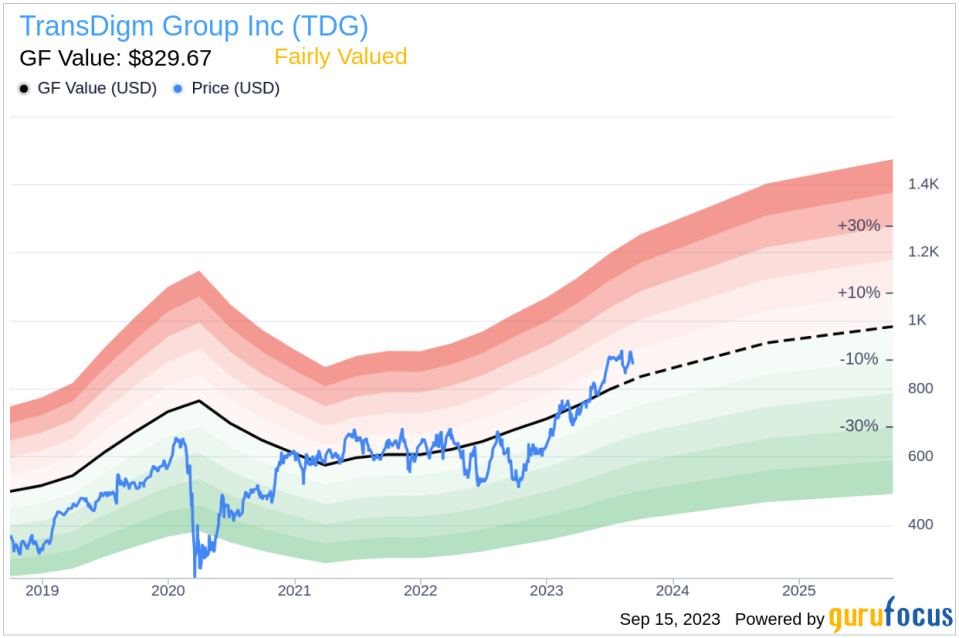

The insider's recent sell comes at a time when the stock is trading at $880.47 per share, giving the company a market cap of $47.82 billion. The price-earnings ratio stands at 46.17, which is higher than both the industry median of 33.88 and the company's historical median price-earnings ratio.

The GuruFocus Value of TransDigm Group Inc is $829.67, resulting in a price-to-GF-Value ratio of 1.06. This suggests that the stock is fairly valued. The GF Value is an intrinsic value estimate developed by GuruFocus, calculated based on historical multiples, a GuruFocus adjustment factor, and future estimates of business performance from Morningstar analysts.

Over the past year, there have been no insider buys at TransDigm Group Inc, while there have been 29 insider sells. This trend could suggest that insiders see the stock as fairly valued or even overvalued at current levels. However, it's important to note that insider selling can occur for a variety of reasons, and it doesn't necessarily indicate a negative outlook for the company.

The insider's recent sell of 2,967 shares represents a small fraction of their total holdings, suggesting that the insider still has confidence in the company's future. Investors should monitor insider activity closely, as it can provide valuable insights into the company's performance and valuation.

As always, it's crucial to conduct thorough research and consider multiple factors before making investment decisions. While insider activity can provide useful insights, it's just one piece of the puzzle.

This article first appeared on GuruFocus.