Insider Sell: Director Ross Manire Sells 5,000 Shares of Andersons Inc (ANDE)

Recent filings with the SEC have revealed that Ross Manire, a director of Andersons Inc (NASDAQ:ANDE), sold 5,000 shares of the company on November 15, 2023. This transaction has caught the attention of investors and market analysts, as insider activity can often provide valuable insights into a company's financial health and future prospects.

Who is Ross Manire?

Ross Manire is a seasoned executive with extensive experience in the business world. As a director of Andersons Inc, Manire has been involved in guiding the company through its strategic decisions and growth plans. His background and expertise have been assets to the company, helping to shape its direction and success in the competitive market.

About Andersons Inc

Andersons Inc is a diversified company rooted in agriculture that conducts business across North America in the grain, ethanol, plant nutrient, and rail sectors. The company is known for its commitment to providing exceptional service and products to its customers, leveraging its expertise in the agricultural sector to drive growth and profitability. With a market cap of $1.717 billion, Andersons Inc is a significant player in its industry, and its stock performance is closely watched by investors.

Analysis of Insider Buy/Sell and Stock Price Relationship

Insider transactions are often scrutinized for clues about a company's financial health. Over the past year, Ross Manire has sold a total of 5,000 shares and has not made any purchases. This could be interpreted in various ways; however, without additional context, it is challenging to draw definitive conclusions. It is worth noting that there have been 16 insider sells and no insider buys over the same timeframe, which could suggest that insiders are taking profits or have concerns about the company's future valuation.

On the day of the insider's recent sell, shares of Andersons Inc were trading at $51.79. This price point gives the company a price-earnings ratio of 29.76, which is higher than both the industry median of 16.37 and the company's historical median. A higher price-earnings ratio may indicate that the stock is overvalued compared to its peers or its own historical valuation, potentially justifying the insider's decision to sell shares.

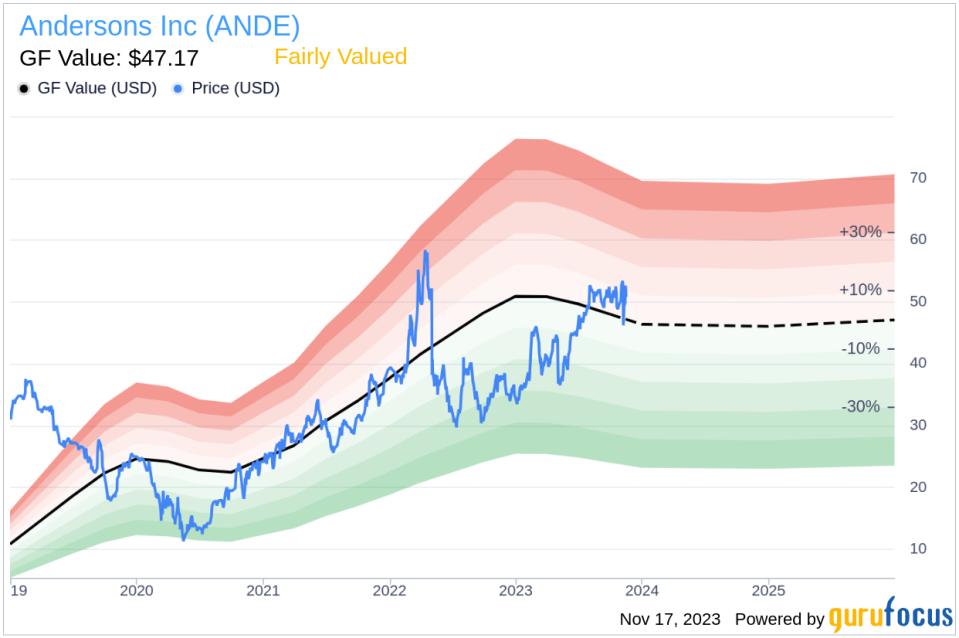

However, when considering the GuruFocus Value (GF Value) of $47.17, Andersons Inc has a price-to-GF-Value ratio of 1.1, suggesting that the stock is Fairly Valued. The GF Value is a proprietary metric that takes into account historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. This valuation measure indicates that the stock price is in line with its intrinsic value, which could mean that the insider's sell transaction does not necessarily reflect a negative outlook on the company's valuation.

The insider trend image above provides a visual representation of the insider buying and selling patterns over the past year. The absence of insider buys and the presence of multiple sells could be a signal to investors to monitor the company's performance and news more closely for potential changes in business conditions or market sentiment.

The GF Value image further illustrates the relationship between the stock's current price and its estimated intrinsic value. With the stock being fairly valued, investors may consider the insider's sell transaction as part of a normal portfolio rebalancing rather than a reaction to overvaluation.

Conclusion

Director Ross Manire's recent sale of 5,000 shares of Andersons Inc has provided an opportunity to delve into the company's stock valuation and insider transaction trends. While the price-earnings ratio is higher than the industry median, the GF Value suggests that the stock is fairly valued. The pattern of insider sells over the past year, with no corresponding buys, could be a point of interest for investors. However, without further context, it is difficult to determine the exact motivation behind the insider's sell. Investors should continue to monitor Andersons Inc for any developments that could affect its stock price and overall valuation.

As always, insider transactions are just one piece of the puzzle when it comes to evaluating a stock. It is important for investors to consider a wide range of factors, including company fundamentals, industry trends, and broader market conditions, before making investment decisions.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.